23-09-2019

23-09-2019

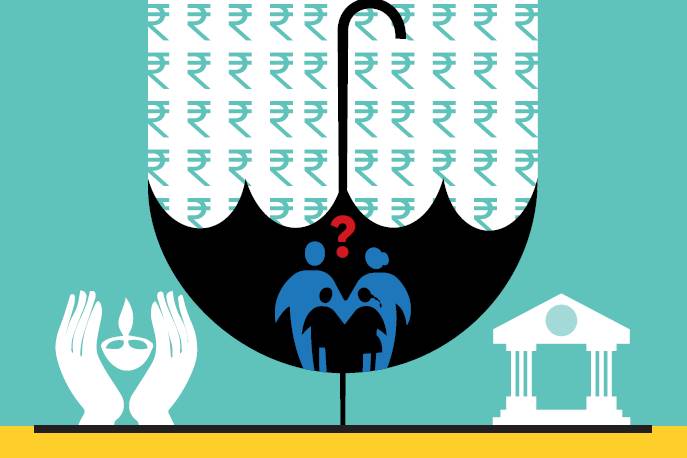

Embedded value: Policyholders can question the LIC-IDBI Bank deal

Insurance Alertss

Insurance AlertssEmbedded value: Policyholders can question the LIC-IDBI Bank deal

Life insurers make money by investing the surplus that they accumulate every year and maintain this in a separate account known as Life Fund. The surplus is the difference between income and expenditure in the revenue account of the company. In life insurance business the surplus is not the profit because every year companies receive premium and also settle both maturity and death claims; but life insurance being a long-term contract the premium is received in instalments over a long period of time against liability undertaken.

The outgo may also occur anytime during that period or when the contract ceases by completion of the term of each contract. The insurers therefore do not treat the difference between income and expenditure during a particular year as profit. They transfer such amount to another account known as Life Fund where every year accumulation happens. But every business must earn profit; hence the actuary, who is especially trained to assess the assets and liabilities of an insurance company, conducts valuation of the liability of an insurer which is spread over various tenures in the coming years.

Life Fund

If the Life Fund is bigger than the net liability of the company the difference is declared as profit of the insurer. For any company to be in sound financial health a well-maintained and well-protected Life Fund is important. The Life Fund acquires exceptional sanctity in the financial world. It needs to be protected and also augmented through prudent investment in financial markets so that the fund not only remains secure but also generates profit for the participating policyholders and the shareholders. The Life Fund, maintained by each insurer, is invested in a very large volume in the bonds and securities market. Life Fund is regulated by the government through legislation and also by the regulators. At any point of time, the Life Fund must be equal or more than the net liability of the insurer.

For maintaining a healthy Life Fund, expenses other than the outgo in respect of claims must be under strict control and investment should be fully secured and capable of yielding a good return so that the company remains financially healthy and attractive in terms of returns to the policyholders and shareholders. In its true spirit, the custodian of the Life Fund is only a trustee and not the owner of the fund. The funds must be invested with a view to provide best possible return. Insurers do not have the privilege of investing the money in any manner that they like. As the liabilities of the insurers keep mounting exponentially everyday with satisfactory growth in their new business the insurers cannot, at any point of time, afford to miss adequate return on investments.

The Irdai monitors investment by insurers and issues guidelines to ensure that the policyholders’ fund is not misused and earns reasonable returns. No life insurer should have more than 15% shareholding in any firm. This is how concentration of risk is sought to be avoided. However, insurers with very large Life Funds sometimes grudge the lack of adequate investment opportunities and seek approval from the regulator to exceed the investment limit as a special dispensation.

LIC investing in IDBI Bank

The decision by the LIC board to buy 51% stake in IDBI Bank and the permission given to LIC by Irdai to hike its investment in the bank raise several questions regarding the motive behind such investments. In this deal, as reported, `13,000 crore is required to be pumped in by LIC. The LIC board is merely a trustee of the policyholders’ money and with all its prudence may not be empowered to take such decisions.

Even a common policyholder may ask the board to justify its decision of investing the money in a bank burdened with 28% NPA and that has a life insurance company of its own. If owning a bank is a business imperative for LIC, in 2001 it had invested in Corporation Bank which was rated the best public sector bank those days. Even now LIC holds around 13% stake in this bank. During all these years LIC board has never deliberated on how to utilise its control on Corporation Bank for strategic advantages. Policyholders may question how a trustee of their fund has taken them for granted. Such decisions may trigger threats to LIC’s very well-groomed image as the most trusted insurer in the country.

Source: Financial Express