24-10-2019

24-10-2019

New rules in place for Ulips, other life insurance products: Know the impact

Insurance Alertss

Insurance AlertssNew rules in place for Ulips, other life insurance products: Know the impact

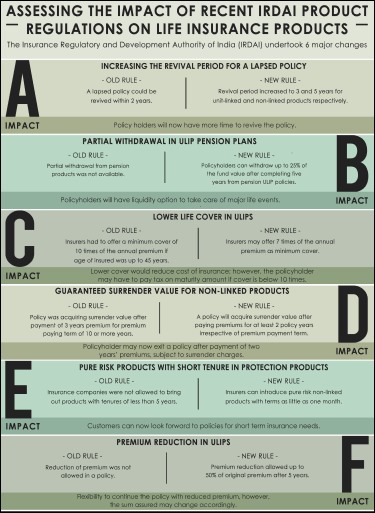

The Insurance Regulatory and Development Authority of India (IRDAI) on July 8, 2019, has brought in significant changes to regulations related to non-linked life insurance products and unit-linked life insurance products (ULIPs). Designed to make life insurance more favourable to customers, the new rules offer substantial benefits and flexibility to policy-holders. In terms of the revival of policies; minimum guarantee on surrender, partial withdrawals from unit-linked pension policies and life cover, among others these rules certainly make it easier for the policyholders.

Let’s look at six major modifications to the rules by IRDAI and its impact on the policy-holders.

1. Increasing the revival period for a lapsed policy:

Old rule: Presently, a lapsed policy can be revived within a period of two years from the date of lapsation by paying arrears of premium with interest and fulfillment of medical requirements, if any.

New rule: The revival period has been increased to three years in case of unit-linked life insurance plans and five years in case of non-linked products from the date of first unpaid premium. A policy lapses or becomes paid-up with reduced benefits when a policyholder fails to pay a premium on time.

Impact: For insurance customers who may find themselves facing a lapsed policy, the new norm offers a bigger window of opportunity to revive the policy during the revival period. Additionally, the move will help insurers spruce up renewal premiums and retain good customers.

2. Partial withdrawal in ULIP pension plans:

Old rule: IRDAI regulations allow for partial withdrawal in ULIP plans. However, partial withdrawal from pension products was kept out of the ambit.

New rule: The regulator has now allowed for withdrawal of up to 25% of the fund value from pension ULIP policies. The withdrawal is allowed only after completing the mandatory lock-in period of five years and is permitted for specified purposes such as higher education and marriage of children or treatment of self or spouse or for the purpose of buying or constructing a residential house. Besides, a policy-holder can withdraw the amount three times during the entire term of the policy.

Moreover, IRDAI has raised the lump sum withdrawal limit on maturity of pension plans to 60% from the existing 33%. In other words, the policyholder can commute up to 60% of the pension fund and utilize the balance amount to purchase an immediate annuity or deferred annuity from the same insurer at the then prevailing annuity rate. Significantly, the policyholder has been given an option to purchase the available annuity from any other insurer using a proportion of the amount available to buy an annuity. This is very much likethe provision under the National Pension System (NPS) wherein the 60% withdrawal is tax-exempted.

Impact: Allowing for premature withdrawal of part of pension funds for critical milestones in life gives policy-holders the much- needed flexibility in deploying funds in case of a liquidity crunch for such events. Moreover, bringing the withdrawal limit at par with NPS, gives the ULIP pension products a competitive edge and makes it much more attractive to potential customers.

3. Lower life cover in ULIPS:

Old rule: Based on the age of the policy-holder, insurers were mandated to offer a minimum cover of 10 times the annual premium to those under 45 and seven times to those over 45.

New rule: The new regulations have discarded the differential minimum life cover based on age. Now the life insurance company has to offer a minimum seven times of life cover for regular premium paying polices and 125% life cover of the premium in case of single premium policy.

Impact: Under the income tax norms, maturity proceeds from a ULIP policy was exempted from taxation provided that the sum assured was at least 10 times the annualized premium. Now that the minimum sum assured has been brought down to 7 times the annual premium, the policyholder will most likely have to pay tax on maturity amount unless the tax laws change appropriately. This may not augur well with customers as well as insurers because ULIPs are popular as tax-saving tool.

4. Guaranteed surrender value for non-linked products:

Old rule: The surrender value, which is the amount received for discontinuing the policy, was based on premium paying terms of the policy.

New rule: Now a policyholder can acquire a surrender value after payment of at least 2 consecutive years premiums. He/she will be entitled to a minimum guaranteed surrender value which shall be 30%of the premiums paid (less survival benefits already paid) if the policy is surrendered during the second year. They will get 35% if surrendered in third year; 50%, if surrendered between 4th and 7th Policy year and 90% if surrendered during the last two policy years.

Impact: The regulation partially streamlines and makes it a less costly affair for a policyholder to exit traditional or outdated non-linked products.

5. High-risk products with short tenure in protection products:

Old rule: So far, IRDAI did not allow insurance companies to bring out products with tenures of less than five years.

New rule: The insurance regulator has now allowed insurers to introduce pure risk non-linked products with terms as small as one month.

Impact: Will widen customer-base for insurance sector by attracting individuals with short term insurance needs. The move also allows insurance companies to bring out innovative products like episodic insurance.

6. Premium reduction in ULIPs

Old rule: IRDA had no provisions to reduce the premium earlier.

New rule: A policyholder now has the option to reduce the premium in ULIPs by up to 50 percent of the original premium, only after 5 years of the policy are complete. However, this option can be availed only if allowed under the product and once the premium is reduced it cannot be increased again in the future.

Impact: While the option to reduce the premium will come in handy for those who may face liquidity crunch, the death benefits and sum assured under the policy among other terms may be revised with change in the amount of premium.

Conclusion

The new guidelines by IRDAI will help pull in more customers towards insurance. Besides, the regulations are likely to give insurance companies the much-needed impetus to launch a new variety of products, which will further boost and deepen the insurance market.

Source: Financial Express