08-11-2019

08-11-2019

Changing Landscape of BI Insurance

Insurance Alertss

Insurance AlertssChanging Landscape of BI Insurance

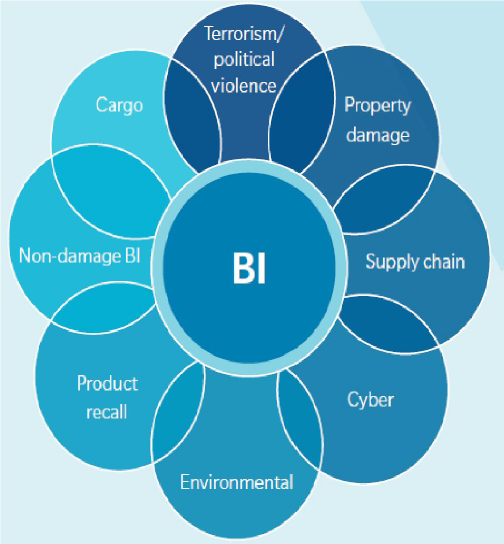

The Business Interruption ( BI ) exposures for corporates are often much larger than the Property Damage . The emerging risks our clients face now a days often fall outside the boundaries of the traditional Property Damage, Business Interruption (PDBI) policies. The businesses are increasingly becoming complex forcing the risk managers to look for coverages beyond the traditional BI . Historically , BI had always focused on financial loss as a result of damage to either assets owned by the clients , to the assets of others on which the business depends / relies on , or to the premises/assets of third parties (such as suppliers or customers). It is therefore very important to understand the changing business scenario and the emerging risks for the Property Insurance .

The businesses now a days are very complex and more and more interconnected. The cascading effect of supply chain disruption can be extremely costly. The perils that could interrupt clients operations and revenue are limitless. As such there are newer & innovative non-physical damage business interruption ( NDBI) solutions to help clients maintain essential cash. These innovative covers / solutions provide the same profit protection as traditional business interruption coverage but are triggered by pre-defined, loss-creating events that don't cause physical damage. We should recognise the importance and complexity of BI risk and the need to keep up with the insurance options available to our clients . We should work very closely with our clients and the insurance markets to address the changing needs of the clients as we recognise that for many companies, BI can be caused by any event that interrupts their business and goes way beyond property damage.

The consideration of non-damage BI (NDBI) has mainly focussed on two key areas – Supply chain and Cyber risk . While supply chain and cyber have been the focus of most development in the market, there have been innovations developed elsewhere such as weather-related parametric options (Swiss Re) whereby payment is triggered by, for example, the recording of a specified volume of rain at an agreed location. There are some industry-specific solutions such as defined perils cover for the Pharma & life science industry (from Munich Re) that expands to the food and beverage industry too, as well as specific NDBI policies for the aviation industry. However, the idea of non-damage triggers has increasingly involved not only standalone programmes, but also extensions of existing

PD/BI policies. We are working with the insurance markets to expand the boundaries of PD / BI policies and develop new solutions and whilst there is

very limited NDBI cover in traditional PD/BI policies.

NDBI policy extensions may now be obtained for non-damage denial of access, the actions of civil and military authorities, loss of attraction, disease, murder and suicide, and the consequences of airborne ash, etc .Before reviewing any insurance solution, we should recommend our clients to consider their BI risk first, including identification, improvement, and measurement of the risk.

There are few common & traditional extensions available very easily in the Indian Insurance markets under the Property (PDBI) policies . The important and notable ones are as under :

-

Additional increase in cost of working

(AICoW)

-

Supplier & Customer ( Named /

Specified )

-

Denial of Access ( Damage)

-

Public Utilities

-

Interdependency

- Claims Preparation, etc

The following is a brief exploration & explanation of the newer extension options for PDBI which the clients are seeking now a days :

Cyber : Loss of revenue because of Cyber events ( Cyber attacks , malware, virus, denial of access, hacking, etc ) . A cyber Contingent BI ( CBI ) loss occurs when an insured suffers lost income as a result of an interruption in service of a shared computer system. These shared computer systems can take on many forms, including cloud services, data storage and other processing functions.

Regulatory :Cover for financial loss due to withdrawal of regulatory approval or license to produce (ie, due to quality problems or safety issues) or closure of production facility by order of an authorized regulatory body.

Denial of Access ( Non Damage) Cover for loss of profit following denial of access to your premises as a result of the actions of public, police, or military authorities.

Supplier & Customer ( Unnamed / Unspecified ) Cover for an interruption to your business as a direct result of physical loss or damage at any of your direct customers or suppliers – limits available are likely far less than for specified suppliers and customers. Ensure territorial limits are appropriate.

Loss of Attraction Cover for loss of gross profit as a result of loss of attraction to your premises following physical loss or damage in the vicinity.

Parametric : Parametric or index-based solutions are not designed to replace but to complement traditional PDBI insurance programmes, usually to fill current protection gaps or exclusions

Pandemic / Disease/murder/suicide Cover for loss of gross profit as a result of murder, suicide, or the outbreak of a notifiable contagious disease .

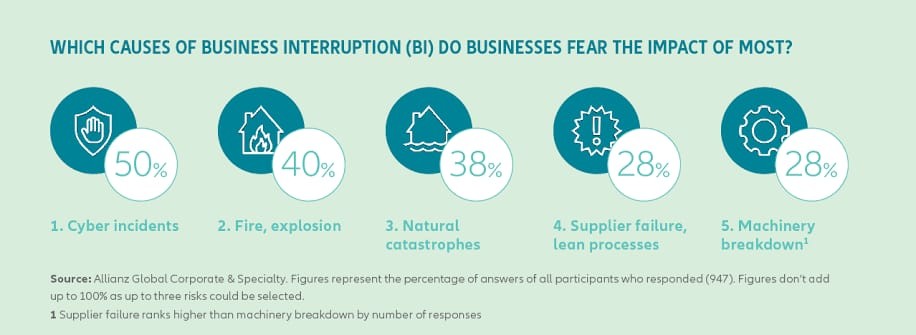

According to the 2019 Allianz Risk Barometer , Impact of business interruption (including supply change disruption) is the major risk for companies for the seventh year in a row with 37% of responses ranking it as one of the three most important risks companies faced in 2019. Further, it has for the first time Cyber Incidents (e.g. cyber crime, IT failure/outage, data breaches, fines and penalties) at the top of the rankings which are increasingly resulting in significant business interruption (BI) losses of their own .

Source: Written by Mr.Sudhish Ramteke, Senior VP from Anand Rathi Insurance Brokers Ltd.