29-11-2019

29-11-2019

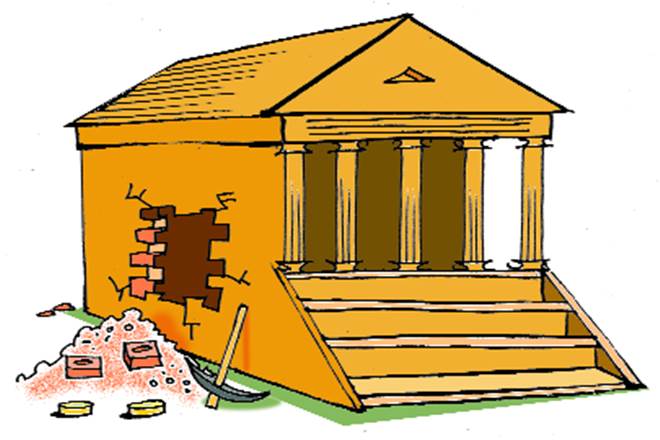

Can an insurance company go bankrupt?

Insurance Alertss

Insurance AlertssCan an insurance company go bankrupt?

Last year, a major scandal regarding financial irregularities involving Rs 13,800 crore by way of issue of fake bank guarantees by the managers of a large public sector bank (PSB) was reported. This affected the reputation of all PSBs in India. The non-performing assets (NPAs) of PSBs together rose to Rs 8.06 lakh crore as on March 2019 from Rs 1.30 lakh crore in March 2014. Banks such as IDBI Bank, Lakshmi Vilas Bank, and in September 2019, Punjab & Maharashtra Co-operative Bank reported frauds in lending big amount to industrialists. All these have shattered the confidence of the public in the banking system of our country.

Many people must be worried about their investments or savings not only in banks but also in life insurance companies. Life insurance is treated as a safe instrument for long to very long term savings. Questions like “what if the insurance company too goes bankrupt? What if the insurer fails to honour a death claim?” haunt them. They are also keeping their fingers crossed regarding the receipt of maturity value in the future. It is necessary to inform the insuring public why they are not likely to face the same kind of predicament. The insurance regulator has prescribed strict norms for setting up an insurance company. One of the norms is to bring in the capital of minimum Rs 100 crore to launch business. During its operation, the insurer must provide for adequate reserve of fund vis-à-vis its liability as calculated by an actuary.

The adequate reserve is defined as 50% more than the required amount for the assessed liability. If the available fund of the company falls short of this amount the promoters will have to infuse the required amount by way of additional capital before the close of the concerned financial year. Each product that the insurers want to sell is approved by the regulator and it monitors the profitability of the products. In case the regulator finds a product unprofitable for the insurers it directs the company to withdraw such products.

Insurers announce a reinsurance programme for every year which is approved by the board and submitted to the regulator. The reinsurance programme is a risk transfer mechanism to the financially very strong international reinsurers. This arrangement protects the insurers from very large and even unexpected losses because the reinsurers provide the fund for settling claims in such cases.

Failing of insurance company

There are instances of quite a good number of insurance companies failing every year even in developed markets. Since 2010, at least 10 insurers in the USA have gone bankrupt.

Like bankers, insurers too invest their fund for reasonable return on the corpus that they own from collection of premium. It is also used for meeting their liabilities as well as giving return to the policyholders. Even though the investment norms as prescribed by Irdai are very strict and the regulator demands regular reporting yet the possibility of mismanagement and fraud cannot be ruled out.

If such malaise affects the insurer there is a high probability of such insurers failing to carry on the business further. For such exigencies the Insurance Act provides merger of the failed insurance company with an on-going strong company. The policyholders will not be left to fend for themselves as it has happened with PMC bank customers who have been deserted to a completely helpless situation.

Source: Financial Express