17-12-2019

17-12-2019

Underwriting losses of non-life insurers jumps 45.5% in FY19

-2019-12-17-14-997.jpg)

Insurance Alertss

Insurance AlertssUnderwriting losses of non-life insurers jumps 45.5% in FY19

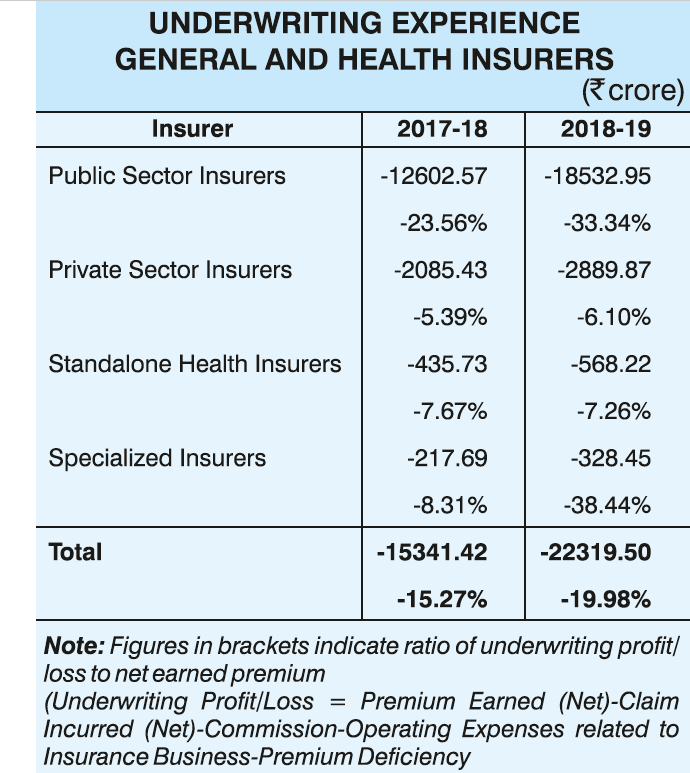

Underwriting losses of general insurance companies rose 45.5 percent year-on-year (YoY) to Rs 22,320 crore in the financial year 2018-19, according to the IRDAI Annual Report.

The widening of underwriting losses means there is an increase in the claims in a particular period. An underwriting loss refers to a situation when the premiums collected are not proportionate to the claims paid. When claims paid are less than premiums collected, an insurance company reports an underwriting profit.

As per the Insurance Regulatory and Development Authority of India (IRDAI) data, underwriting losses of just the public sector general insurers grew nearly 47 percent YoY to Rs 18,533 crore in FY19. For private-sector insurers, the underwriting loss amounted to Rs 2,890 crore in FY19, up from Rs 2,085 crore in the year-ago period.

The standalone health insurers also reported a rise in the underwriting losses. This grew to Rs 568 crore in FY19 compared to Rs 436 crore in FY18.

This was a direct impact of the increase in the claims ratio. IRDAI data showed that the net incurred claims of the general insurers stood at Rs 1.01 lakh crore in FY19, showing an 18 percent YoY increase.

Of this, public sector insurers reported a 14.8 percent increase, private insurers had a 23.8 percent rise while standalone health insurers saw a 40.4 percent increase.

For public sector insurers, the incurred claims ratio (net incurred claims to net earned premium) rose to 103.46 percent in FY19 from 93.73 percent a year ago. Private sector insurers had marginal increase in this ratio from 75.46 percent in FY18 to 76.2 percent in FY19.

India faced a series of cyclones including Titli and Gaja apart from the Kerala Floods in 2018. This caused heavy damage to crops, vehicles and property.

Source: Money Control