19-12-2019

19-12-2019

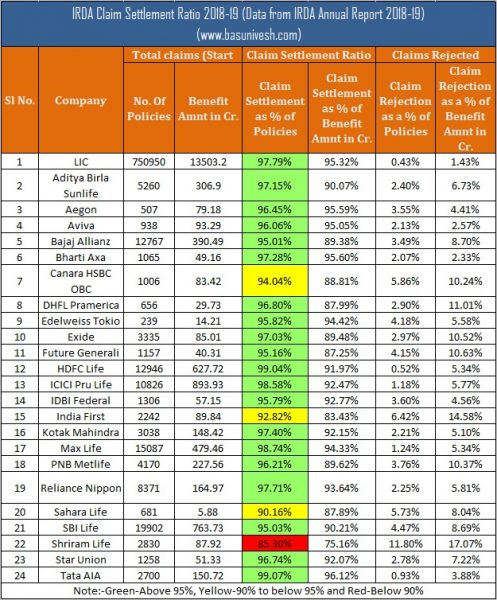

IRDA Claim Settlement Ratio 2018-19 | Best Life Insurance Company in 2020

Insurance Alertss

Insurance AlertssIRDA Claim Settlement Ratio 2018-19 | Best Life Insurance Company in 2020

What is the meaning of Claim Settlement Ratio?

Claim Settlement Ratio is the indicator how much death claims Life Insurance Company settled in any financial year. It is calculated as the total number of claims received against the total number of claims settled. Let us say, Life Insurance Company received 100 claims and among that it settled 98, then claim settlement ratio is said to be 98%. Remaining 2% claims the Life Insurance Company rejected.

Based on this, we can easily assume how much customer friendly they are in dealing with death claims. However, I warn you that this claim settlement ratio is raw data. It will not give you a clear picture of what types of products they settled. They may be Endowment plans, ULIPs or Term Insurance Plans. Hence, this is not a sole criterion in judging the performance of a life insurance company.

IRDA Claim Settlement Ratio 2018-19

Below is the IRDA Claim Settlement Ratio 2018-19 or up to 31st March, 2018. I differentiated the below table with colour code for your better understanding.

You notice that among total 24 Life Insurance Companies, around 20 companies are in GREEN (Claim Settlement Ratio above 95%). Earlier it was 11 companies. Only three companies are in yellow (claim settlement ratio above 90% but below 95%) and one is in red (Less than 90%). As usual, LIC tops the list. But don’t feel happy. Let us see the claim amount settled by individual companies to arrive at best companies.

Average Claim Settlement Amount of Life Insurance Companies in 2018-19

As I said above, the claim settlement ratio will not give you the clear picture about which type of products the insurance companies settled. However, we can assume the types of products they settled by looking at the average claim settlement amount of Life Insurance Companies in 2018-19.

Here come the results !! LIC stands in lowest with red in colour along with Life Insurance Companies like Bajaj Allianz, Exide, Future Genereli, IDBI Federal, India First, Max Life, Reliance, Sahara, SBI Life, Shriram, Star Union. What is it indicating?

It shows that, even though LIC settled the highest number of claims, the majority of such claims are less than Rs.2,00,000 Sum Assured. Hence, it is indicating indirectly that LIC’s claim settlement is mainly in the category of Endowment Plans but not Term Insurance.

Average Claim Rejection Amount of Life Insurers in 2018-19

Now let us go deeper into IRDA Claim Settlement Ratio 2018-19 and try to analyze the how much amount of claims they rejected. Here, I calculated average amount as I don’t have data to check the maximum and minimum amount.

The results are as below.

You notice that Sahara’s claim rejection amount is ZERO. The reason is that IRDA Annual Report itself mentioning it as ZERO. Then comes the LIC. LIC’s claim rejection is less because the quantum of claims it handles is HIGH but value is less. So no need to say that LIC done a great job here along with other players. However, you notice that as usual HDFC and ICICI tops the list.

Top 10 Best Life Insurance companies in India for 2020

Based on the IRDA Claim Settlement Ratio 2018-19, which are the Top and Best Life Insurance Company in 2020? I select only ten based on the above data. You may differ in my view and come up with a different set of ideas. But these are my choices.

- LIC

- HDFC Standard Life

- ICICI Pru Life

- Max Life

- Tata AIA Life

- Aegon

Few important points before jumping into selecting of Life Insurance Companies

# Claim Settlement Ratio is raw data

As I pointed above, claim settlement ratio is just a raw data. It will not give us the specific data. Hence, never rely on this single data alone while shortlisting the insurance company.

# Concentrate on Product rather than company

Choose the product which suits your requirement and premium affordability. Declare the facts properly. Never hide any material facts. If all these you do, then an insurance company will have to accept your claim. Never give a room of suspicious on you to reject the claim.

# Section 45 of Insurance Act will guard YOU

According to Section 45 of Insurance Act “No policy of life insurance shall be called in question on any ground whatsoever after the expiry of three years from the date of the policy, i.e. from the date of issuance of the policy or the date of commencement of risk or the date of revival of the policy or the date of the rider to the policy, whichever is later”.

It says a lot. Even if you shared wrong information or hid some material facts, then also it is purely life insurance Company’s responsibility to dig deep and find out faults WITHIN 3 YEARS ONLY. After 3 years, they cannot question. Note the period of 3 years, it is from the date of issuance of the policy, or the date of commencement of risk or the date of revival of the policy or the date of a rider to the policy, WHICHEVER IS LATER. So let us say if you took the policy today and after a few years, the policy lapsed due to non-payment of premium. However, you thought to renew it again and paid all dues. In such situation, this 3-year period starts from such revival date, but not from the original policy issued date.

Source: Basu Nivesh