30-12-2019

30-12-2019

Life insurers paid Rs 3.3 lakh crore of benefits in FY19, a record high

-2019-12-30-6-541.jpg)

Insurance Alertss

Insurance AlertssLife insurers paid Rs 3.3 lakh crore of benefits in FY19, a record high

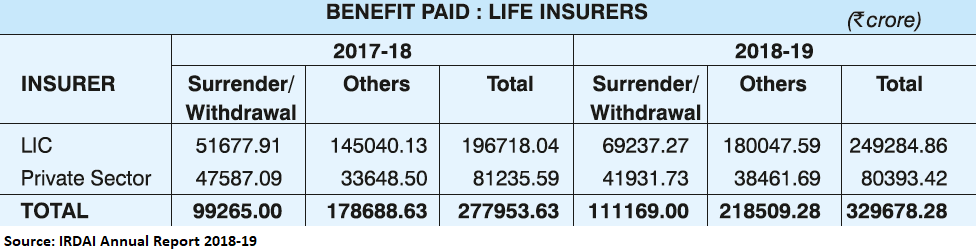

The benefits paid by life insurance companies have touched a record high of Rs 3.3 lakh crore in FY19. Data from the Insurance Regulatory and Development Authority of India (IRDAI) reveals that the benefits paid constitute 64.88 percent of the gross premium underwritten in 2018-19.

The previous high was Rs 2.78 lakh crore of benefits paid in FY18. Benefits are paid when a policy is surrendered or when it attains maturity. If an insurer decides to withdraw a policy, the policyholder gets paid a benefit amount.

Here, private life insurers paid Rs 80,393.4 crore, or 47.12 percent of the premiums underwritten. Life Insurance Corporation of India (LIC) paid Rs 2.49 lakh crore in benefits, which was 73.86 percent of the premium underwritten. With respect to the classification, benefits paid due to surrenders/withdrawals stood at Rs 1.11 lakh crore, of which LIC accounted for Rs 69,237.3 crore.

Overall, there has been a reduction in the surrenders of unit-linked insurance plans (ULIPs). In case of LIC, of the Rs 69,237.3 crore surrender benefit in FY19, ULIP policies accounted for only Rs 4,082.23 crore. This stood at Rs 8,087.82 crore in FY18. Similarly for private insurers, ULIP surrenders accounted for 85.7 percent of the benefit in FY19 as against 88 percent in the previous year.

ULIPs have a lock-in period of five years. If the policy is withdrawn before the five-year period, the premiums paid (fund) gets transferred to a discontinuance fund. This sum is paid to the policyholder after five years after deduction of charges.

Claims settlement sees marginal drop

When it comes to death claims, the life insurance industry settled 8,43,000 individual claims with a pay out of Rs 17,365.3 crore. Here, LIC was leading as far as claims settlement is concerned, though there was a slight drop compared to the previous year. Claims settlement ratio of LIC stood at 97.79 percent compared to 98.04 percent in FY18.

Private insurers had a claims settlement ratio of 96.64 percent in FY19 compared to 95.24 percent in the year ago period. Overall, the industry’s settlement ratio marginally declined to 97.64 percent in FY19 from 97.68 percent in FY18.

Source: Money Control