16-01-2020

16-01-2020

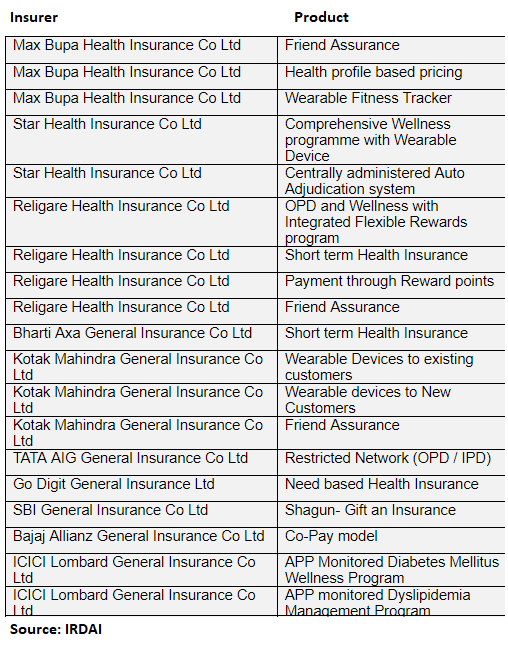

Wearables-led insurance products dominate IRDAI sandbox approvals

Insurance Alertss

Insurance AlertssWearables-led insurance products dominate IRDAI sandbox approvals

Products using fitness trackers for health insurance form a major chunk of those approved by the Insurance Regulatory and Development Authority of India (IRDAI) under the sandbox method.

Under the sandbox method, entities can launch and test a product with a select group of people for a period of six months. Of the 173 total applications submitted for consideration, 33 were approved by IRDAI. These include fitness tracker, app-based diabetes wellness programme, wearable devices for existing customers and new customers and wellness programme using trackers.

In the non-life sector, the pay-as-you-drive and usage-based motor insurance proposals were approved by IRDAI.

In September 2019, IRDAI called for applications from insurers and intermediaries under the sandbox method.

As such, the 33 products approved will be tested between February 1, 2020, and July 31, 2020. Post this, depending on the response received during the pilot, the product could be launched commercially.

The method helps gauge customer interest in an insurance product and reduces failure. At present, about 780 life insurance and over 1,000 general insurance products are being sold in the market for individuals and groups. The sandbox method is expected to help companies better the success rate with their products. According to industry estimates, at present for every 10 new products filed, two fail to make the mark.

IRDAI said the initial permission will be granted for six months but can be extended by another six months. After this, the regulator will look into the proposal and decide whether it can continue in the market or be discontinued. All participants will have to delete the customer data they gather for the testing purposes.

Source: Money Control