27-01-2020

27-01-2020

PM Fasal Bima Yojna back in the slow lane — check premium collected, claims paid

Insurance Alertss

Insurance AlertssPM Fasal Bima Yojna back in the slow lane — check premium collected, claims paid

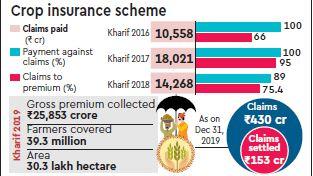

Even as sowing for the winter crop 2019-20 is about to conclude, settlement of crop insurance claims pertaining to the last kharif season is progressing at a tardy pace. Until December 31, the total claims honoured by insurers for kharif 2019 crop damages reported by farmers under PM Fasal Bima Yojana (PMFBY) were just Rs 153 crore, while the previous summer crop saw insurance payouts to the tune of Rs 14,500 crore.

What’s also puzzling is a trend of lower-than-expected claims — Rs 430 crore till December 31 — despite large-scale crop damages in the season, owing to prolonged monsoon showers.

Of course, these are still early days — most insurance claims for kharif season are usually made by March, although the filings could continue for a few more weeks – but analysts observe a delay in endorsement of claims applications by the government and insurers. In September 2018, the government tweaked the PMFBY guidelines to address the issue of delays in claims settlement by making insurers liable to pay 12% interest for payments made after the deadlines set for different crop cycles.

Since insurance companies were complaining that the delays in claims settlement were due to non-payment of premium by the state governments, it was also mandated states too pay 12% interest for the delay in release of their share of premium beyond three months from the cut-off dates. As a result of these steps, a significant improvement was noticed in claims settlements in 2018-19 crop year, that coincided with Parliamentary elections. Previously, farmers had to wait for months – sometimes even a year – to receive the insurance payments.

As reported by FE earlier, four private insurance companies — ICICI Lombard, Tata AIG, Cholamandalam MS, and Shriram General Insurance — have opted out of the government’s flagship corp insurance scheme for both the kharif and rabi seasons of the 2019-20 crop year. Claims ratios in the states where they were operators in the previous year were quite high, leading to losses from the business. Crop damages in Maharashtra, Andhra Pradesh, Haryana and Chhattisgarh in crop year 2018-19 pushed the claims by farmers up against the premium collected by the insures, to over 100%, even as the ratio on a pan-India basis was only 75.4%. Indications were that the claim-to-premium ratio could be very high in many states, including Maharashtra and Karnataka, for kharif 2019, consequent to the prolonged monsoon rains that damaged key crops like pulses, cotton and soyabean.

For the last summer crop, gross premium collected was Rs 25,853 crore. “The data on estimated claims are yet to be finalised and at very preliminary stage,” a source said. The government’s estimates show nearly 64 lakh hectare of kharif areas were inundated by heavy rains during monsoon season last year, while private weather forecaster Skymet had put it at 32 lakh hectares of crops areas in 137 districts of 12 states. The total crop area insured by farmers was 303 lakh hectare during kharif 2019.

Last year, the withdrawal of monsoon commenced from west Rajasthan on October 9 against the normal date of September 1, making it the most delayed withdrawal since 1961. The country had received 110% of the long period average (LPA) rains during June-September monsoon season. Since farmers pay a fixed premium under PMFBY, the subsidy burden on the government increases when premium rates go up. Insurance is taken by farmers before sowing and the premium quoted by the insurance companies is mainly based on monsoon forecast. Under PMFBY, launched in 2016, farmers pay 1.5% of sum insured for rabi crops and 2% for kharif while it is 5% for cash crops. The balance premium is split equally between the Centre and states.

The Centre is under pressure to make necessary changes, including making crop insurance optional for loanee farmers, after Andhra Pradesh, West Bengal and Bihar decided to exit the scheme. Punjab has never rolled out the scheme, saying that the premium should be customised for states on the basis of irrigation infrastructure.

Source: Financial Express