17-04-2020

17-04-2020

Gross direct premium by non-life insurers sees 10.7% dip in March

-2020-4-17-45-534.jpg)

Insurance Alertss

Insurance AlertssGross direct premium by non-life insurers sees 10.7% dip in March

The gross direct premium underwritten by non-life insurance companies declined 10.7% to Rs 15,784.66 crore in March compared to Rs 17,672.89 crore in the corresponding month last year, largely due to the lockdown across India to prevent spread of COVID-19.

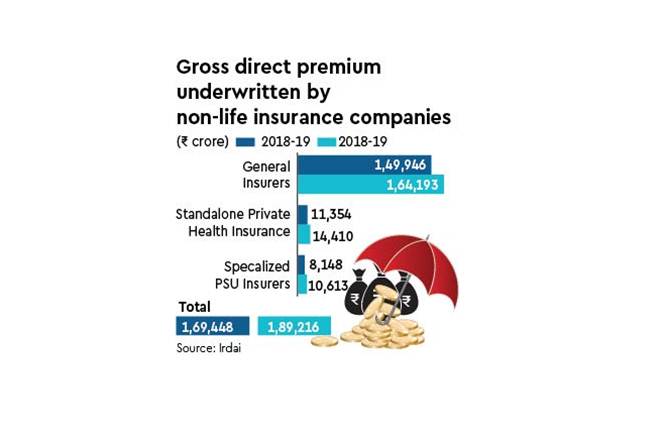

However, for the last fiscal the premiums stood at Rs 1.89 lakh crore compared to Rs 1.69 lakh crore seen in FY19, a growth of 11.7%, shows data from Insurance Regulatory and Development Authority of India (Irdai). But with Indian growth likely to slow down in this financial year, insurers believe that it will be challenging times for the general insurance industry, especially in the motor insurance segment.

Currently motor insurance has a 38-40% of market share of new premiums in non-life industry and weak auto sales number would further impact motor insurance business in the months to come. Mahesh Balasubramanian, MD and CEO at Kotak General Insurance says, “This year looks extremely challenging specially on the motor side of the business. Consumption and consumer spend will go down this year and so business which are largely driven by consumer spending or consumer consumption will probably slow down.” He also added that their focus will remain on health insurance and personal accident (PA) in this financial year.

Among the 25 general insurer players like SBI General Insurance, Bajaj Allianz General Insurance and Bharti AXA General Insurance among other saw strong growth in last financial year. However, ICICI Lombard General Insurance and Tata AIG General Insurance saw negative growth in their gross direct premiums in last financial year shows the data from Irdai. The New India Assurance continued to remain a market leader with market share of 14.11% in the last financial year.

Insurance players are confident that business in health insurance will pick-up going forward as investors will understand the importance of health insurance after recent crises. After motor insurance, health insurance has a market share of around 26-28% in the non-life insurance industry. “The insurance business is expected to witness muted growth in the first quarter of FY21 due to the extended lockdown, however, the segment could witness an increased interest in the health and policies which protect business in the times of shutdown or special perils such as pandemics,” said CARE Ratings in its report.

The standalone private health insurers saw higher growth at 26.92% and premiums at Rs 14,409.98 crore in last fiscal. Even specialised public sector insurers like ECGC and AIC saw growth of 30.24%.

Source: Financial Express