20-04-2020

20-04-2020

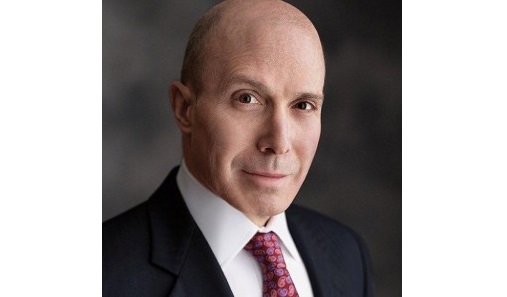

Forced COVID-19 payments could bankrupt industry: Chubb CEO

Insurance Alertss

Insurance AlertssForced COVID-19 payments could “bankrupt” industry: Chubb CEO

Legal efforts to make insurers retroactively pay for business interruption losses related to the coronavirus (COVID-19) pandemic could “bankrupt the industry,” according to Chubb CEO Evan Greenberg.

Speaking in an interview with Bloomberg, Greenberg said that the insurance industry is “a fundamental part of the economic plumbing” of the US, and warned that forcing insurers to pay for claims would do “great damage.” “You can’t just retroactively change a contract. That is plainly unconstitutional,” he said in a separate interview with CNBC.

Greenberg argued that the “infinite financial nature” of the pandemic means that the government is the only body that can reasonably take on the burden. His comments come after lawmakers in several states sought to extend business interruption coverage to COVID-19 related claims, even when such claims had been explicitly excluded by a policy. “I understand the frustration of legislators, I understand they’re looking for a remedy, but this would be a self-inflicted injury and create great uncertainty at a time when we have enough uncertainty and we’re trying to heal the economy,” Greenberg told CNBC.

The Chubb CEO noted that the insurance industry only has $800 billion in capital to support all the normal risks it insures in one year, plus catastrophe events. For comparison, the American Property Casualty Insurance Association has estimated that small businesses alone could incur losses of up to $431 billion per month while lockdown measures are in effect.

Greenberg suggested that a public-private partnership between insurers and the government could be a more effective way to handle pandemic risk, in a similar way to the Terrorism Risk Insurance Act already utilised. His comments echo the risk pooling scheme proposed by AXA CEO Thomas Buberl last week, who similarly said that the industry needs to work with governments to respond to future health crises.

While talking to Bloomberg, Greenberg also urged Congress to consider granting limited immunity from litigation that arises from coronavirus-related issues, except in cases of gross negligence. “There are things that we can and should do to provide a greater degree of certainty, and relieve the economy and business of unnecessary financial burden in the short and medium term,” he went on. “I’m not talking about giving immunity to insurance companies. I’m talking about business and corporate America and nonprofits.”

Source: Reinsurance News