14-05-2020

14-05-2020

Insurance 2.0: Delivering value through digital ecosystems

Insurance Alertss

Insurance AlertssInsurance 2.0: Delivering value through digital ecosystems

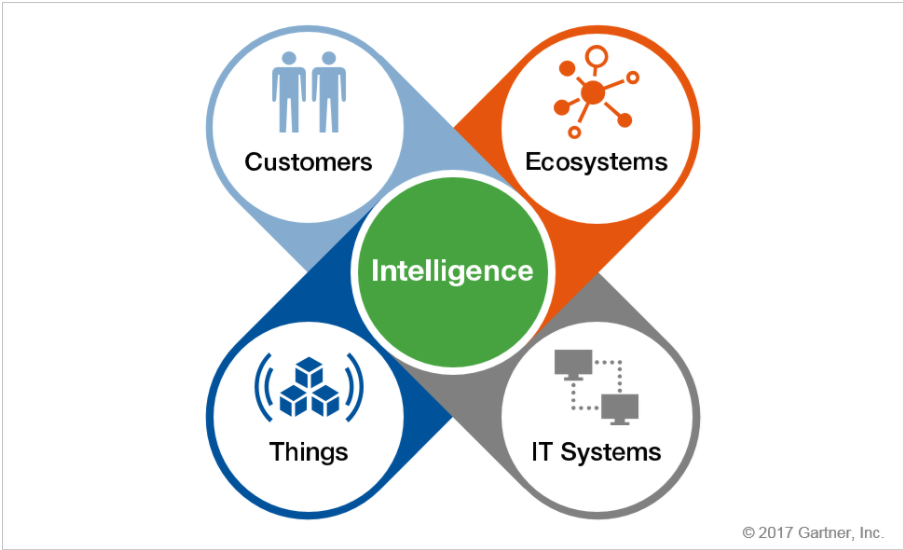

Technology has the potential to become one of the biggest enablers of the 21st century. It has allowed businesses to innovate and explore new frontiers while at the same time birthed entirely new industries. Much like the other industries, the insurance industry is also leveraging technology to communicate with its clients, facilitate ease of transacting and encourage informed decision making. Another important thing that technology has enabled is the creation of interconnected digital ecosystems where companies can co-create and generate shared value. In the insurance sector, digital ecosystems can extend the boundaries of value creation to help insurers better customise their products for customer needs and interact with customers at varying points in their lives.

What are digital ecosystems?

An ecosystem is simply a network of players, both from within and outside the industry that work together to deliver shared value to the customer. A digital ecosystem is one where technology is leveraged by the various players in the ecosystem to deliver viable solutions in a seamless manner. The power of a digital ecosystem lies in the fact that the final value delivered to the customer is greater than the sum of the parts i.e., it is greater than the value added by each player individually.

Creating an interconnected ecosystem by leveraging technology

There are three core areas where tech enabled ecosystems are contributing to enhancing the value proposition of insurers. These arecustomer journeys, health and auto.

Seamless omnichannel customer journey

Today, the customer is at the centre of every solution. Not only have clients come to demand customised solutions they also expect companies to provide them with a seamless and interactive journey. For this, it is imperative that the various moving parts in the customer’s journey are woven together. Technology is enabling this by creating interconnected systems that can not only recognise the customers’ requirements but also enable precise delivery and cater to customer queries and complaints across multiple channels in a seamless manner. For example, there is an app development platform headquartered in South Africa that offers insurers a self-service customer portal solution with rich UI experience.

With this, customers can access/update their account information, create and track support requests, view all historical cases as well as insurance renewal options. During app development, insurers can also weave in options for product trials, comparisons, signup, support, claims processing, etc. Another example would be a mobile app created by us with the aim of empowering the advisors and ensuring that information and advice from distinct sources is available to the customer in a quick and efficient manner. The app can assist advisors in selling multiple insurance products of multiple insurers with the help of algorithms which make recommendations based on customer needs, coupled with a simplified, paperless online issuance process.

Health

In an interconnected health ecosystem, the insurer can provide a comprehensive 360-degree service to customers by leveraging technology to connect with other players in the healthcare ecosystem. Today, wearables and personal medical monitoring devices can track an individual’s health information like weight, heart rate, blood pressure, blood sugar, exercise activity etc. When these devices are connected through an app it becomes easy to transfer all this relevant data about a person’s health to a medical practitioner for timely interventions and ongoing monitoring. An integrated ecosystem could provide further support in the form of healthy meal plan recommendations, discounted gym memberships and also incentivise through a discount on premiums.

For example, a leading consulting firm recently worked with a Singapore insurer to develop a connected health diabetes management program, which allows the insurer to provide affordable health insurance to early stage diabetes patients, who would otherwise not be able to avail themselves to any medical coverage once the diabetes is detected.

Auto

The use of telematics in the auto insurance space is fast gaining traction as its myriad benefits come to the fore. Telematics devices can enable an insurer to track the behavioural driving patterns of the driver and reward the driver, perhaps through lower premiums, for positive driving habits. Once this data is available, insurers can create a repository of drivers and their driving habits that can be accessed by an ecosystem of service providers like petrol pumps or even auto companies who can then reward drivers for good driving habits by offering free products or discounted services.

The rise of the gig economy has precipitated a shift from asset purchase to asset usage. In such an environment, insurers will need to find ways to connect with users at multiple points in their lives and add value that goes beyond the value of the product. A digitally connected ecosystem can allow insurers to foster partnerships with trusted providers who can help the insurer not just provide emergency assistance but also ongoing and seamless support.

Source: The Economic Times