21-05-2020

21-05-2020

Don’t use your car daily? Edelweiss will now let you switch on your motor insurance only when needed

Insurance Alertss

Insurance AlertssDon’t use your car daily? Edelweiss will now let you switch on your motor insurance only when needed

Private non-life insurer Edelweiss General Insurance has launched a motor insurance own damage product under the sandbox method where customers will be able to switch the policy cover on or off depending on when the vehicle is used.

In an interaction with Moneycontrol, Shanai Ghosh, Executive Director & CEO, Edelweiss General Insurance said this will benefit individuals who don’t use their vehicles on a daily basis. Motor own damage protects the vehicle from damages due to accidents or other instances like fire and theft.

“We were looking at the customer need. The concept of using cars every day was fading away especially for new owners. Globally as well, there was a clamour for usage-based insurance,” she added.

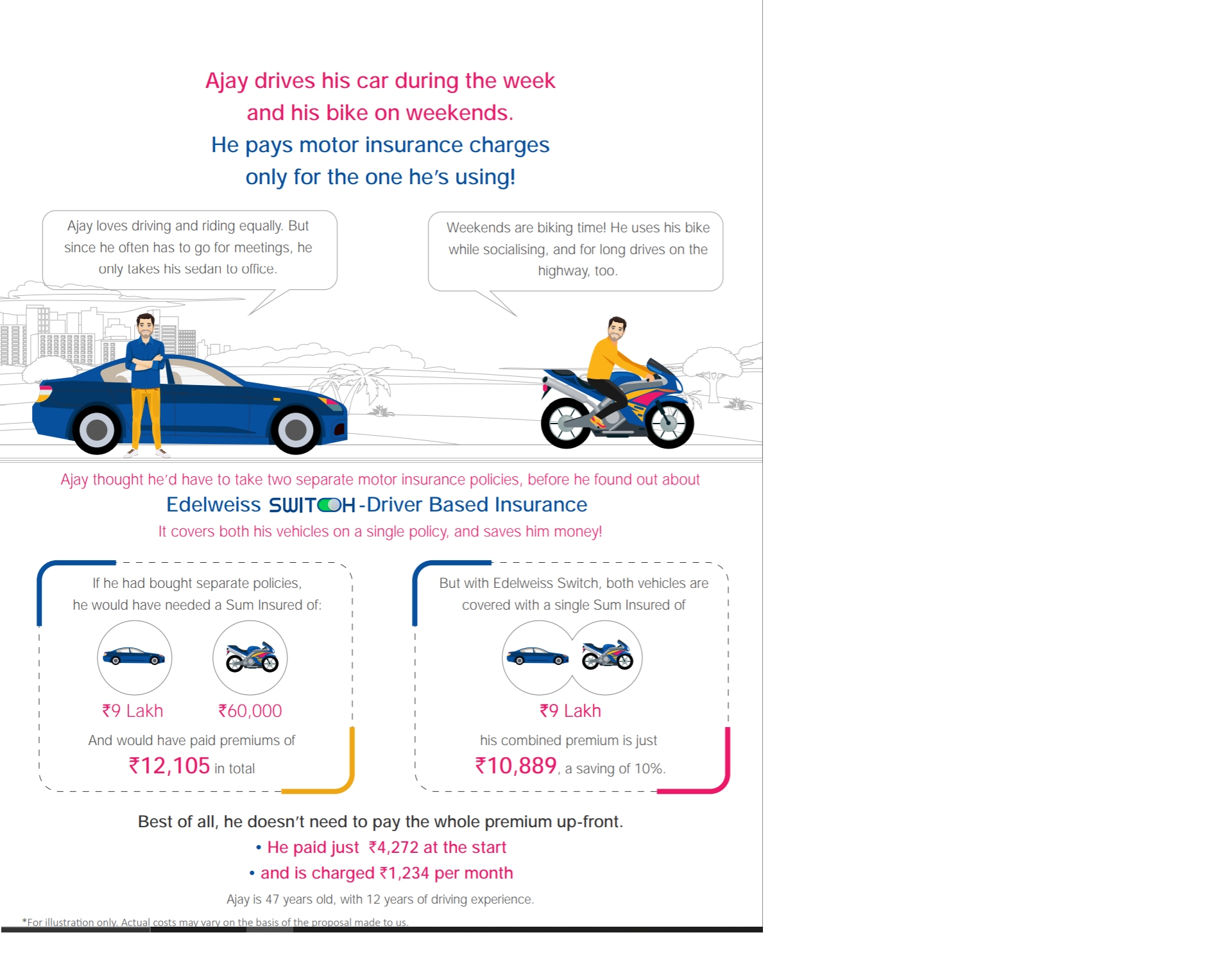

In that context, she said the company has launched the product called ‘Edelweiss Switch’ that lets the vehicle owner switch the cover on only in case he/she is using the car/bike on that particular day.

The premium is calculated depending on the driver profile, including the age and number of years of driving experience. This is a floater policy and up to three vehicles can be insured under one policy. Basic protections under the motor OD cover including fire and theft would continue 24/7, and it is only accident damage component, that is switched on or off “After COVID-19, this product has become more relevant. Safer the driver, lower is the premium. People need to conserve liquidity and improve cash position in this economic situation and this product could help save costs,” said Ghosh.

Benefit Illustration of 'Edelweiss Switch'

Here the premium would vary depending on the number of drivers, vehicle type and age as well as the number of years of driving experience.

For instance, a 40-year-old individual with 10 years of driving experience with an SUV will pay a premium of Rs 650 per month depending on usage. This individual has to pay an upfront amount of Rs 4,278. Whatever amount is saved in the first month is adjusted in the next month premium amount based on vehicle usage.

Sandbox products are approved by the regulator for a six-month period. After that, the regulator gives the nod to the product based on its success rate.

Going forward, Ghosh said usage-based insurance could also be relevant for segments like home insurance. As far as the business is concerned, Edelweiss General Insurance saw a 58.2 percent year-year growth in the gross written premium for FY20 at Rs 146.39 crore. Ghosh said the company has seen minimal disruption in business continuity because it is a cloud-based insurer.

“For motor claims, we have been able to service them through a self-service application downloaded by customers. Similarly, health claims are also being handled digitally. We also waived off the 30-day period for COVID-19 claims in health insurance,” she said.

The insurance regulator has asked companies to settle COVID-19 claims under regular health insurance products that cover hospitalisation.