27-05-2020

27-05-2020

Decoding climate change - what does it mean for the underwriter?

Insurance Alertss

Insurance AlertssDecoding climate change - what does it mean for the underwriter?

Swiss Re Institute's latest sigma publication on Natural Catastrophes and Man-made Disasters focuses on climate change and other macro risk drivers for growing natural catastrophe losses. This report demystifies complex climate change and sheds light on its implications for the insurance industry.

What is climate change and variability?

A range of natural factors contribute to short and long-term variability in climate patterns. This variability is primarily due to large-scale atmospheric and ocean circulation patterns around the globe. For example, a well-known variability is El Nino Southern Oscillation (ENSO), which results in changing temperature and precipitation conditions worldwide.

In the background of this natural variability, the earth's climate is further subjected to change due to global warming. While natural variability will play a larger role on climate perils in the short-term, the impact from climate change trends over the longer term will grow. Since the pre-industrialisation period, global temperature has warmed up by about 1℃ and it has been forecasted to continue to rise by another 1.5℃ to 4℃ by the end of the century.

Scientific research suggests that it is not easy to correlate extreme weather perils with global warming. The global warming phenomenon is complex with many feedback loops and tipping points that challenges accurate future projections. More importantly, the genesis of many extreme perils (e.g., tropical cyclones) is not well-understood and thus it becomes difficult to anticipate how these perils will respond to a warming planet with high certainty.

Nevertheless, observations of recent events such as Typhoon Hagibis, which registered record precipitation levels, and the Australia Bushfire, which is the longest-running catastrophic event in 2019, point to the likely presence of climate change impact. In general, it suggests that global warming does lead to increased volatility and greater intensity of natural perils in the environment.

Why hasn't climate change been a part of mainstream underwriting?

While climate change has been known topic in the insurance industry for many decades, applications of climate change knowledge in mainstream underwriting have been limited. Insurance studies which were mainly focused on stress scenarios with long-term horizons of 30-to-100 years have not been particularly useful for underwriting where the primary focus is on events that may happen in the next year. Industry catastrophe models have also yet to include climate models to integrate climate science into mainstream underwriting and risk assessment.

The complexities and uncertainties about climate change have hindered its integration into mainstream underwriting. Many climate change studies have suggested an increase in risks of between 20-to-50% over a 50-to-100 year period – a hypothesis that remains highly uncertain. Even an annual change averaging 1% or less can be misleading as the actual volatility of risk exposure can be much higher. In addition, the insurance industry holds a wealth of historical data which it readily relies on, providing a basis for insurers to react quickly and make underwriting adjustments to annual property contracts after catastrophes.

While these factors hinder motivation to integrate new climate science into underwriting practices, there is a growing risk that certain perils will gradually become uninsurable in future (e.g., flood, wildfires) unless we act now.

Dimensions of climate change: perils, time horizon, and confidence level

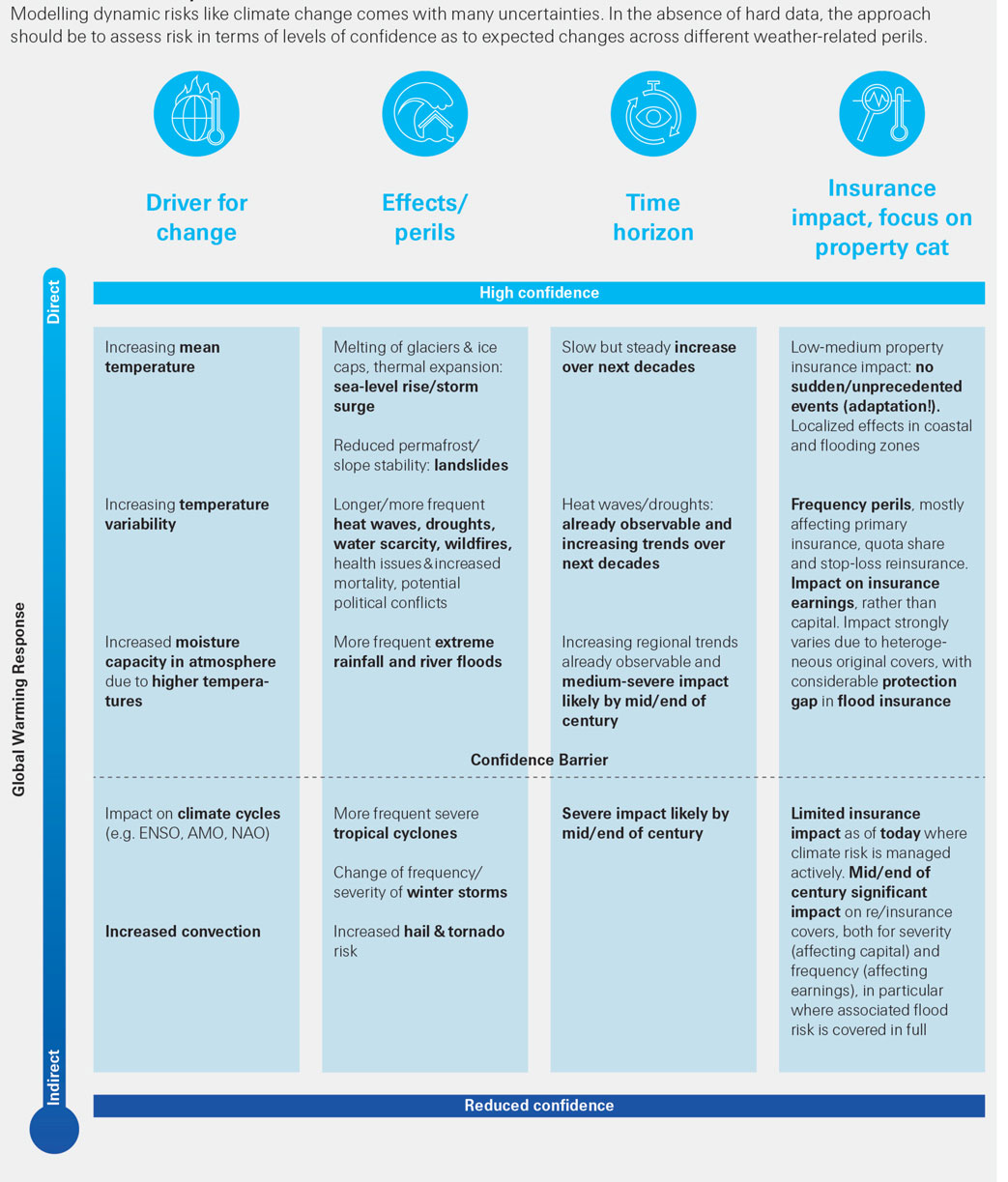

The sigma highlights that analysing climate change impact through three main dimensions brings it closer to underwriting. Specifically, climate change impact for different perils need to be analysed in context with time horizon and the degree of confidence as to expected outcomes across various weather-related perils (Figure Here are 3 key takeaways:

- Confidence levels are highest for risks directly related to the increase in global temperatures such as melting of glaciers and expansion of oceans resulting in a rise in sea levels, more frequent and prolonged heat waves and extreme rainfall. Confidence levels are less evident in understanding atmospheric changes that fuel the frequency and intensity of phenomena such as tropical cyclones and winter storms. The complex interplay of different factors plays a role in these events, often with counteracting effects.

- In terms of time horizon, evidence of climate change impact on directly-affected perils are already present and will grow more robust in the next few decades. However, it would probably take many more decades to realise and understand its impact on complex perils such as tropical cyclones.

- In the short term, natural variability in the climate system remains a dominant driver in weather perils and the nature of most non-life re/insurance business allows for continuous risk view adjustments that reflect observed changes in climate, exposures and vulnerability.

Figure 1: How confident are you?

So, what does it mean for underwriting?

While climate change is an important risk to be understood, it should be considered alongside other macro risk trends such as urbanization and social inflation, that are impacting the insurance industry at a much faster rate than climate change.

An underwriter can start integrating climate change findings with pricing and accumulation control based on a few overarching considerations. These considerations can become part of underwriting guidelines for climate-sensitive portfolios.

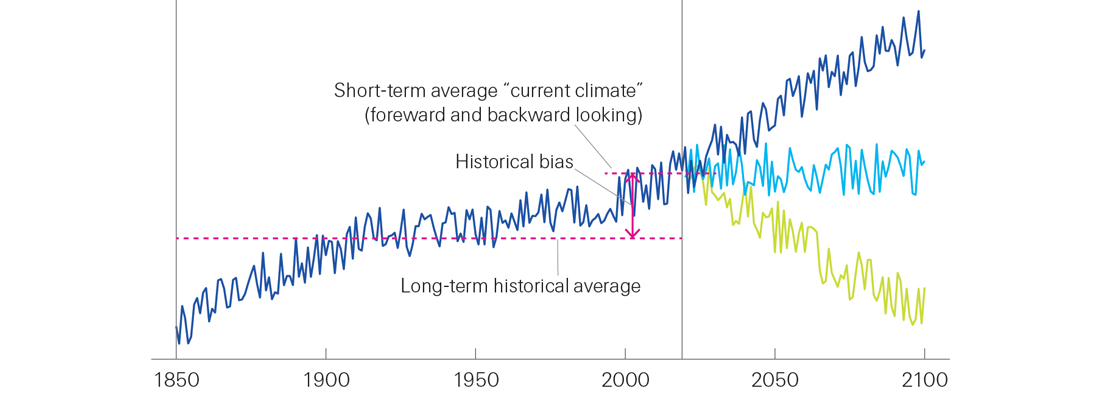

Forward and backward looking: Most of the industry’s catastrophe models are built on the same founding principles and exploit decades of loss experience for calibration. This approach has yet to include a close look at the dynamically changing risk landscape as a standard component to modelling and risk views. This results in outdated risk views, typically leading to an underestimation of expected loss cost (Figure 2). While historical data is essential for developing a robust risk view of rare catastrophe events, it must be considered along with macro risk drivers in a region. A risk view that accurately represents today's landscape and that of the next underwriting year is paramount to ensure the sustainability of insurance risk taking.

For example, high levels of secondary peril activity in Australia during the last decade requires underwriters to align costing with recent loss experience to reflect today's risk view. In another instance, a forward looking perspective is also important for developing a long-term business strategy in managing a coastal flood exposure portfolio under the threat of gradual sea-level rise.

Figure 2: Historical modeling bias, forward and backward looking

- Adequacy, not accuracy: Looking into past data and climate change impact, many possibilities with similar scientific credibility will emerge. Challenging scientific and underwriting judgments are thus unavoidable. For example, data may indicate typhoon occurrences are cyclical, with more typhoons approaching Japan in recent years. However, it rarely tells if the cycle is of 10 or 20 years. Depending on selected assumptions, it may mean 10 or 20% increase in typhoon frequency adjustments. The 'right answer' may not exist, but it is important to make an informed judgment and move forward. As new science and data emerge over time, risk views can be adapted, just as how underwriters have been doing it for all types of uncertain risks, cyber or terrorism risks just to name a few.

- Evolved insurance products: Besides adopting an adequate pricing, re/insurers will need to adapt insurance solutions across the value chain to limit unsustainable losses. This means adapting re/insurance policy terms and conditions with the changing character of climate events (e.g., bushfire for 2 months). With increasing risk for secondary perils such as bushfire and floods, both reinsurance (e.g., aggregate structures) and primary insurance policies need to adapt with relevant and sustainable features. Shared learning on underlying macro risk trends including climate change affecting local perils and changed claims behaviour thus becomes essential for sustainable risk transfer.

- No gaping holes in well-known risks: "Those who do not learn history are doomed to repeat it" – a quote that is most applicable in catastrophe underwriting. Time and again, despite historical proof, secondary effects such as tropical cyclone-induced flooding are still lacking in many well-known models. Forward looking views or any other complex analysis will add little value if large gaps in capturing well-known risks persist.

The above guidelines are neither exhaustive nor a replacement for a climate change-integrated catastrophe models but suggest a tangible approach towards bringing climate change into renewal underwriting.

Call to action

As advancement in climate research continues, the time is ripe to bring climate science into underwriting. In the absence of robust risk tools, forward-looking perspective is a valuable approach to bring macro risk trends including climate change into mainstream underwriting. Shared learning on underlying risk trends across the insurance value chain is important to enable this integration. An adequate risk view is critical to maintain long-term insurability of risks and to continue providing growth opportunities for the industry.

Source: Swiss Re