22-06-2020

22-06-2020

Centre fast-tracks LIC listing plan

Insurance Alertss

Insurance AlertssCentre fast-tracks LIC listing plan

With its fiscal deficit seen bulging to 7% of the GDP or thereabouts in FY21 against the budget estimate (BE) of 3.5% even to maintain the budgeted level of expenditure, the revenue-hungry government on Friday kick-started the process for the mega initial public offering (IPO) of state-run insurer behemoth Life Insurance Corporation of India (LIC). It invited consultants to work as pre-transaction advisors for the IPO and set an early July 13 deadline for them to submit the proposals, showing its intent to sell a stake in the insurer in the current fiscal year itself.

Although precise valuation estimates of the insurer –which often plays White Knight to the government and salvages its disinvestment plans – aren’t available, it is believed to be worth Rs 8-11.5 lakh crore, meaning a 10% IPO could fetch the government, its sole owner, Rs 80,000-110,000 crore. Private valuation firm RBSA Advisors recently estimated LIC’s worth to be between Rs 9.9-11.5 lakh crore.

However, it is unclear at this stage if 10% stake will be offloaded this fiscal or only half that quantum, as market’s absorptive capacity will be decisive in this regard. The Centre was apparently banking on the LIC IPO to meet its ambitious disinvestment target of Rs 2.1 lakh crore in FY21. However, since the market conditions have become volatile after outbreak Covid-19, doubts have arisen in some quarters if the IPO could indeed be concluded in FY21.

In a recent commentary, S&P said that it considered the proposed float of shares of LIC to be crucial for the government to consolidate its fiscal position following the spike in the deficit this year. The rating agency S&P has estimated India’s general government (Centre and states) fiscal deficit to rise to 11% of GDP in FY21 from 7.8% in FY20.

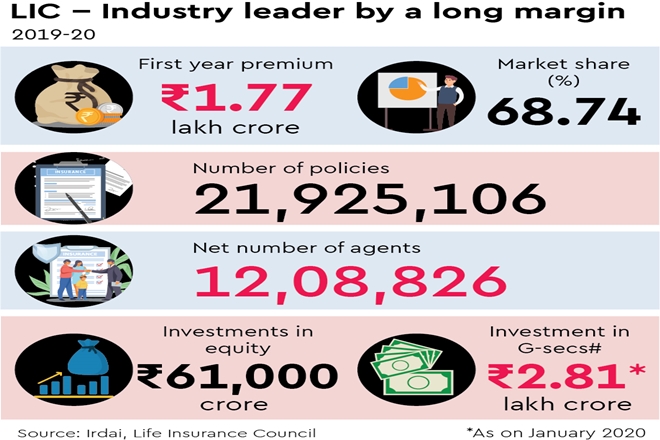

LIC has a lion’s share in India’s insurance business with close to 70% first-year life insurance premia fetched by it, thanks partly to the comfort of sovereign guarantee. It also holds huge equity investments, which are close to 95% of its total investment portfolio, which also includes bonds and money market investments. LIC’s paid-up equity capital, sticking to the relevant law, is just Rs 100 crore, which may require to be bolstered to facilitate the stake sale.

Also, while the current Sebi rule mandates that at least 10% of the promoter’s stake be offloaded upon listing, the government will seek an exemption from this rule to dilute less in LIC, should it discover that it would be too big for the market to absorb in one go. Although it is expected the listing of LIC might help unlock the insurer’s true potential and ensure its greater accountability, it is now bleeding from a string of bad corporate investments. Gross bad loans in the corporate portfolio of LIC jumped almost five times in eight years through FY19 to as high as 6.15%.

Its non-performing assets (NPAs) are seen to have inched up further in FY20, as bonds of companies — including DHFL, Reliance Capital and Reliance Home Finance — in which it had exposure of around Rs 11,000 crore, were junked by rating agencies in the first half of FY20. Its acquisition of a controlling stake in IDBI Bank in FY19 was unremunerative, as the debt-laden bank continues to be under stress.

Elevated gross NPAs (corporate portfolio) of Rs 24,777 crore in FY19 forced LIC to set aside as much as Rs 23,761 crore to bring down net NPA ratio to just 0.27%. Similar high provisions in FY20 might have weighed on LIC’s profits in FY20.

In FY21 budget speech on February 1, finance minister Nirmala Sitharaman said: “Listing of companies on stock exchanges disciplines the company and provides access to financial markets and unlocks its value. It also gives an opportunity for retail investors to participate in the wealth so created. The government now proposes to sell a part of its holding in LIC by way of IPO.” The IPO may also attract foreign capital in a big way. According to the department of investment and public asset management (Dipam), the transaction advisers would guide the process of preparation of LIC for the listing, by undertaking tasks related to all preparatory aspects including advising and assisting the government on modalities of IPO and the timing. They would also recommend the need for other intermediaries required for the process and also help in identification and selection of them.

Usually, the IPO preparation and processes take 6 to 9 months before the offer hits the market. With analysts estimating tax revenue shortfall against budgeted level to be in the range of Rs 3-4 lakh crore in FY21, the LIC IPO could help narrow the overall revenue shortfall. Among the strategic deals, the Centre is banking on sale of its entire 53.3% stake in oil retailer-cum-marketer BPCL to raise Rs 70,000-80,000 crore in this fiscal.

Source: Financial Express

.png)