26-06-2020

26-06-2020

Insurance companies are pushing Rs 1-crore health covers. Do you really need them?

-2020-6-26-59-299.jpg)

Insurance Alertss

Insurance AlertssInsurance companies are pushing Rs 1-crore health covers. Do you really need them?

COVID-19 has taught us the importance of buying health insurance. As per global reinsurer Swiss Re’s consumer survey conducted in May 2020, Indian consumers are the second most active in the Asia-pacific region in searching for – and purchasing – new insurance policies. But such studies should not make you go overboard and panic.

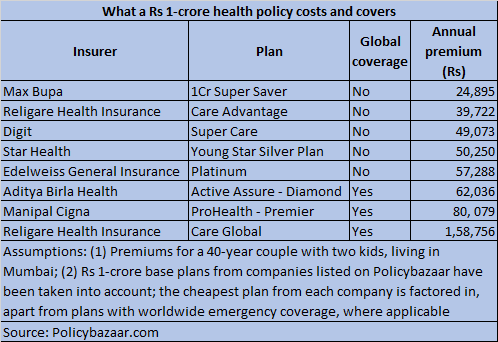

Health insurers such as Aditya Birla Health, Religare Health, Max Bupa and online aggregator Policybazaar are actively promoting the idea of buying a Rs 1-crore health cover. “Earlier, high-value covers constituted 4-5 per cent of enquiries, today, the share has gone up to over 50 per cent. There is a realisation that a Rs 1-crore cover can take care of everything – from big COVID-19 claim to advanced cancer treatment,” adds Amit Chhabra, Business Head, Health Insurance, Policybazaar.com. These policies are promoted on television as well as through online modes. As per Policybazaar.com, a 40-year-old couple with two kids will be able to obtain this sum insured by paying Rs 23,000 to Rs 2 lakh a year, depending on the product, features and health insurer.

The anxiety among people is not surprising given the pandemic’s rapid spread and the hefty hospitalisation bills, with some patients having had to pay up to Rs 18 lakh for the COVID-19 treatment. “There is a growing realisation that a Rs 5 lakh cover, particularly a family floater may just not be enough given that multiple members are being hospitalised simultaneously,” says Mahavir Chopra, Founder, Beshak.org, an independent research platform for individual insurance buyers.

But do you really a healthy policy of Rs one crore? Put it in another way, do you foresee your hospital bill to be as high as Rs 1 crore to get the full benefit here?

Feature rich…

A top-of-the-end health policy comes with a lot of features. “You can get global coverage, maternity expenses reimbursement of up to Rs 2 lakh and expensive health check-ups such as 2D Echo,” says Ashutosh Shrotiya, Head, Products, Religare Health Insurance.

The key benefit for such large health insurance covers is their worldwide coverage. Given the increasing cost of advanced medical treatment abroad, a sum assured of Rs 1 crore is justified. “If you are looking to cover the possibility of undergoing treatment abroad, and can afford a high-value plan, these covers will make sense. They ensure complete peace of mind even if you need to be treated in, say, the US or Singapore,” explains Parag Ved, Executive Vice President and Head-Consumer Lines, Tata-AIG General Insurance. Young couples who look to buy a health insurance policy early can also benefit from the maternity benefits that such policies cover. But do go through clauses carefully. A large cover, such as this Rs 1 crore policy, does not necessarily cover international healthcare expenses. For example, only a few plans offer global coverage (see table) even if your sum insured is Rs 1 crore. And, the premiums are four to six times those of their plain vanilla counterparts.

…but is the high premium justified?

A Rs 1 crore health policy sounds exhaustive, but can you afford the gigantic premiums? “If you are in the age-group of 35-40, you do not need such a large cover to start with, since you are likely to be free from lifestyle ailments such as diabetes or hypertension at that stage,” says Tejal Gandhi, Founder, Money Matters, a Mumbai-based financial planning firm. A COVID-19-like pandemic is a rare event and even here, the average claim size across insurers has hovered around Rs 1.25-2 lakh since April.

She recommends an individual cover of Rs 10-lakh – the new bare minimum – or Rs 20 lakh as family floater. You can review and enhance this cover every five years to account for healthcare inflation and change in your requirements. If you are over 50, buy a cover as large as your budget permits as premiums are likely to be sharply higher at this stage due to age and lifestyle diseases. The chances of being hospitalised and running a huge bill will be higher too.

Health insurance premiums are linked to age and can shoot up drastically when you move to the older age-brackets. Take, for instance, New India’s Premier Mediclaim with a sum insured of Rs 1 crore. If you were buy this policy when you are 40, you would start with an annual premium of close to Rs 63,000. The moment you turn 46, however, your premium will shoot up over 52 per cent to nearly Rs 96,000 a year! Therefore, know that what seems affordable today, may balloon beyond your budget a few years down the line. “Insurers can always find these unviable a few years down the line and hike premiums. If you have to get into these at a younger age, do so knowing that they will get costlier in future,” cautions Chopra.

Top-up policy: A cheaper alternative

If a non-fanciful high-value cover at an affordable rate is your goal, go with a combination of a base policy of Rs 10 lakh, plus a top-up of another Rs 10-15 lakh. It will be lighter on your wallet, with similar coverage in terms of the sum insured, barring global treatment. Ensure that you buy a base policy free of room rent sub-limits and co-pay clauses and a super top-up – which takes into account aggregate claims during the year and not just a single claim – instead of simple top-up plan.

Certain expenses, such as maternity benefits and annual check-ups that are covered in a typical Rs 1 crore can be planned ahead.

Critical illness cover, a useful addition

In-built restrictions in some policies including co-pay, room rent sub-limits and exclusions can drag down the actual claim paid under an indemnity-based policy, leaving policyholders in a lurch. This is where critical illness policies, which pay out the pre-agreed lump-sum upon diagnosis, can come in handy. You can file a claim even if your regular, indemnity-based policy has already settled the bills. This amount can also help cover loss of income or cost of recuperation. While COVID-related bills have been the talk of the town, the fact is that it is usually critical ailments such as cancer, heart diseases and renal failure that cause the maximum dent in savings.

Should you buy a Rs 1 crore health policy?

The short answer is no, because these policies are expensive. A combination of a base policy and a top-up or a critical illness cover would serve you well.

However, if you cannot take your mind off COVID-19 for now, you can consider buying dedicated fixed benefit policies offered by the likes of ICICI Lombard, Religare Health, Royal Sundaram and Star Health. The sum insured under these products ranges from Rs 21,000-Rs 5 lakh, with premiums starting at Rs 149, depending on the insurer. Alternatively, you can wait till the IRDAI finalises norms for the standard COVID-19 covers that all insurers have to offer by July 15.These cheaper fixes would work better than buying a high-value cover out of sheer panic and eye on presently-lower premiums, disregarding the potentially exponential rise over your lifetime.

Source: Money Control