30-06-2020

30-06-2020

Covid-19 non-life industry loss $100bn+, say 40% of survey respondents

Insurance Alertss

Insurance AlertssCovid-19 non-life industry loss $100bn+, say 40% of survey respondents

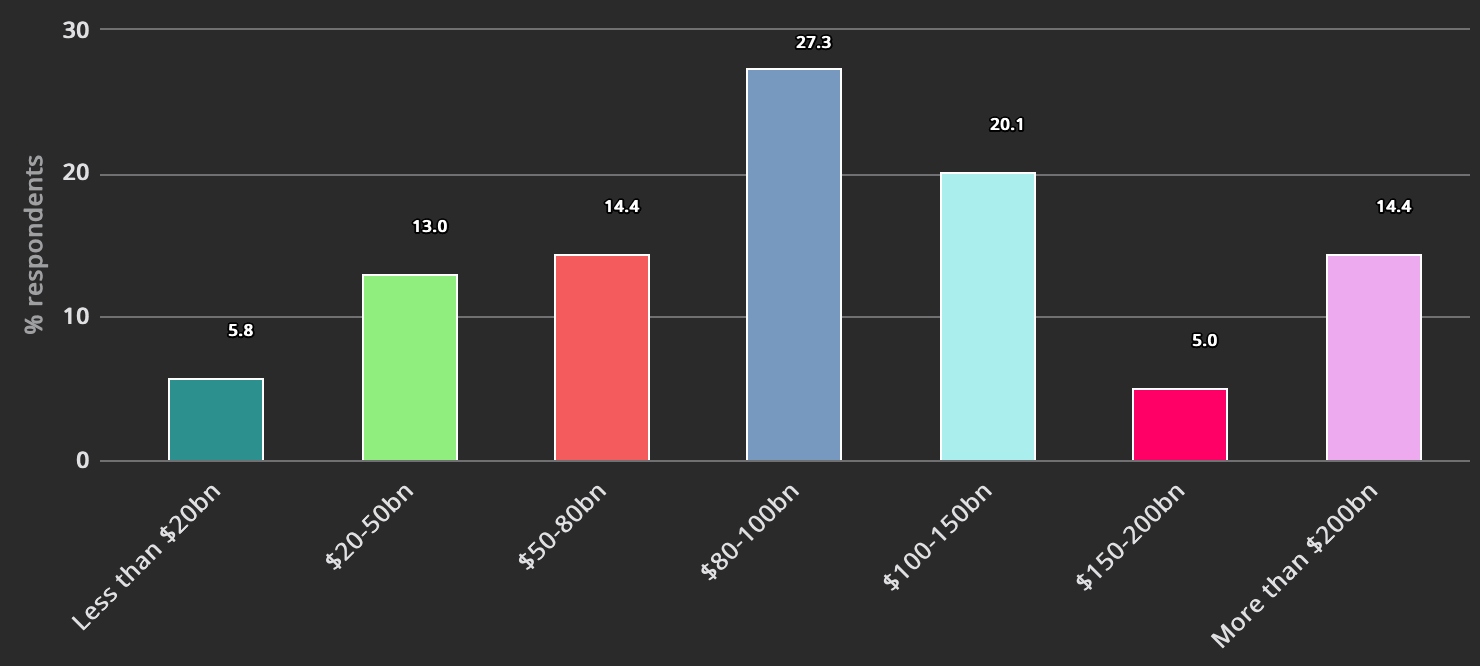

The non-life insurance and reinsurance industry is deemed most likely to face between $80 billion and $100 billion of underwriting losses due to the Covid-19 coronavirus pandemic, according to the respondents to our latest market survey.

Nearly 67% of respondents to our latest market survey said that they believe the non-life industry loss from Covid-19 will be above $80 billion, but almost 40% of those responding said it would be above $100 billion, nearly 20% said above $150 billion and over 14% opted for an enormous $200 billion plus claims burden from the pandemic.

We reached out to our readership community again in the last few weeks alongside sister publication Reinsurance News to get an updated view of how the sector is feeling about the implications of the Covid-19 coronavirus pandemic for the insurance and reinsurance industry. Hundreds responded again, giving us another strong sample of data on opinions among senior industry executives.

When it comes to estimating industry losses, the coronavirus pandemic is particularly challenging to assess given the significant uncertainty that exists over how significant the initial losses will be, how much in the way of future liability claims insurance and reinsurance market participants will face and how long the tail of claims associated with Covid-19 will run for.

The results of our survey show that many people are expecting the eventual claims bill for the insurance and reinsurance industry will rise above $100 billion, but responses also show that it could be some years before the final quantum of the loss from Covid-19 is fully understood. The chart below shows where our hundreds of survey respondents believe the non-life insurance and reinsurance market loss from Covid-19 will settle, with almost half of respondents believing the bill will be between $80 billion and $150 billion.

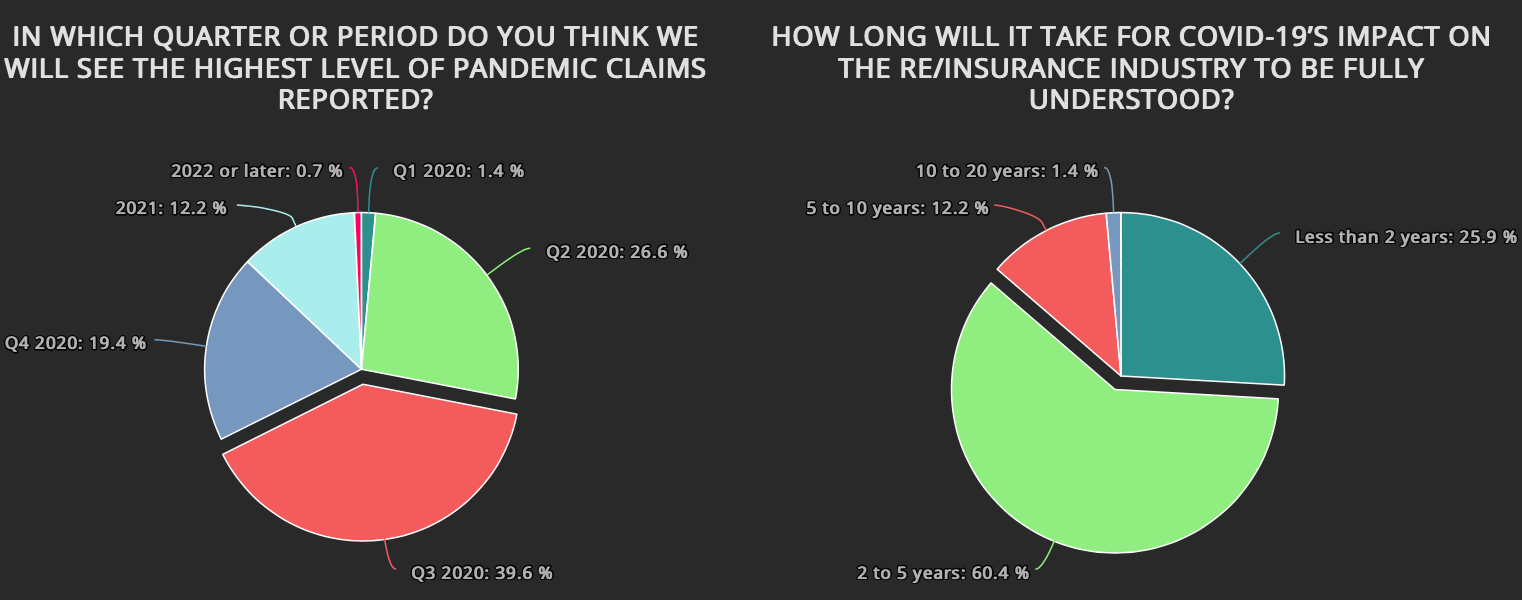

In terms of the tail of claims set to flow from the pandemic, almost 40% of our survey respondents identified the third-quarter of 2020 as the period most likely to see the highest level of pandemic claims reported by re/insurers. But, demonstrating how long the insurance and reinsurance industry is going to have to live with the impacts of the pandemic, just over 60% of our survey respondents said that it will take between two and five years for the full industry impact to become clear.

Our survey respondents clearly feel that the insurance and reinsurance industry will face ongoing uncertainty over a number of years, with Covid-19 pandemic claims continuing to flow.

Adding to the uncertainty is the potential for further waves, a second outbreak, or fresh lockdowns of regions and economies, with that only like to prolong the tail of the pandemic industry loss event and continue to drive further costs through the insurance and reinsurance market chain. The estimates from our survey compare well with others from analysts and companies in the sector.

Our Covid-19 reinsurance market survey update features responses from hundreds of identifiable senior insurance and reinsurance industry executives, including 16 CEO’s, 15 CUO’s, 12 COO’s, 27 senior Board members, reinsurance buyers, senior underwriting executives, ILS managers, brokers and a range of other service providers.

Source: Artemis