07-07-2020

07-07-2020

COVID-19 treatment: Know what your health insurer will not pay for

Insurance Alertss

Insurance AlertssCOVID-19 treatment: Know what your health insurer will not pay for

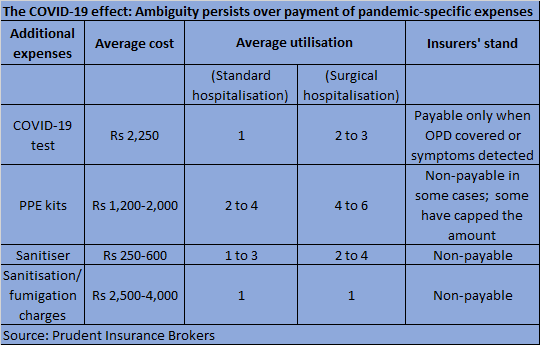

Disputes between hospitals and insurers over the reimbursement of the cost of PPE kits, masks, as also sanitisation and fumigation charges billed to novel COVID-19 patients have been widely publicised. As a result, policyholders are seeing their claims being only partially settled by insurers.

Moneycontrol had first reported in May about how insurers are seeking standardisation in charges, particularly related to personal protection equipment (PPE) kits. Even now, it’s largely down to negotiations between individual insurers and the hospitals. “We take care to walk the fine line when issues of overbilling for these items come up. Our networking team holds discussions with hospitals. The attempt is to reduce the burden on patients when we are compelled to cap the amount we can allow under this head,” says Girish Radhakrishnan, MD and CEO of United India Insurance.

While the government, regulator, insurers and hospitals are said to be in talks to resolve the disputes, you must understand the reasons why your claim payout can be lower than your hospitalisation bill.

Cloud over PPE kit expenses

Ambiguity and lack of uniformity on billing and claims settled continue to date. “We usually bill two PPE kits per day to a patient. Some hospitals charge the actual cost of PPE kits used divided by the number of beds occupied. Nurses, resident medical officers, ward boys – all have to wear PPEs. In our experience, insurers do not reimburse these expenses. They need to be practical as patients cannot be treated without this equipment,” complained the chairman of a hospital chain in central Mumbai, speaking on the condition of anonymity.

As per industry data collated by Prudent Insurance Brokers, the average claim size as on June 26 was close to Rs 1.79 lakh, but the average settlement amount was much lower at around Rs 1.35 lakh. Also, expenses are far higher for those with co-morbid conditions. “The average claim size is Rs 2-2.5 lakh in urban areas, but the amount is much higher at Rs 6-8 lakh in the case of intensive care unit (ICU) admissions and co-morbid conditions. COVID-19 diagnostic tests are being billed at Rs 2,250 and personal protective equipment (PPE) expenses are in the range of Rs 1,200-2,000,” says Surinder Bhagat, National Head, Large Account Practice, Employee Benefits, Prudent Insurance Brokers.

PPE, masks and gloves remain the key causes of lower claim payouts vis-à-vis actual hospitalisation bills. “It is broadly 70 per cent in the case of insurers who refuse to pay for PPE kits. It goes up to 80 per cent where insurers pay for these charges. Hospitals usually bill each patient 2-4 such kits per day,” says Bhagat.

With some insurers taking the call to either not pay or partially settle these expenses, policyholders have had to make good the shortfall from their own funds. “Insurers need to find a middle ground and pay market rates instead. PPE costs are coming down due to increase in supply. Some NGOs, in fact, are supplying PPE kits to some hospitals at around Rs 600 per unit,” says Gaurang Damani, a civic activist whose petition in the Bombay High Court had resulted in the IRDAI framing health insurance guidelines in 2012.

Diagnostic tests reimbursed only if treatment is related

Deductions from the claim amount – that is amount that insurers will not pay for – start with COVID-19 tests. “If a policyholder visits a hospital, tests positive and is admitted, the expense is payable as part of the hospitalisation claim,” says Bhagat. However, this might not be the case if you take the test before undergoing non-COVID-19 treatment, for instance, dialysis or a surgical procedure, on the hospital’s insistence despite showing no symptoms. “Here, some insurers are refusing to pay for the tests as they argue that the basic purpose of hospitalisation is not COVID-19,” he adds.

Hospital room rent-linked proportionate deduction

A common yet less-understood clause pertains to room rent sub-limit, which is typically 1-2 per cent per day of the sum insured, and proportionate deduction of expenses is linked to this limit. Policies that do not come with such limits are costlier. Here, if you have a cover of Rs 5 lakh, your daily limit on the hospital room rent can be capped at, say, Rs 5,000 per day (one per cent of the sum insured). Now, let’s assume you choose a room that costs Rs 6,000 per day – 20 per cent higher than the limit – and spend five days in the hospital. Due to the clause, your overall claim approved will be reduced by 20 per cent, as other expenses – doctor’s fees, operation theatre charges and so on – are linked to the room category.

The clause has added to policyholders’ woes in the current situation. “Hospitals have inflated their rates citing isolation, sanitation, hygiene and disposable charges, which exceed the allowed room rent limit as per patients’ health policies. Due to the proportionate deduction clause, their out-of-pocket outgo is higher,” says Abhisek Tiwari, CEO, iAssure, an online insurance aggregator. If housekeeping charges are levied separately, insurers will not pay for the same, as IRDAI’s standardised list of exclusions issued in 2013 designates these as part of room rent charges.

Thanks to a recent IRDAI amendment, claim settlement amounts are likely to go up. It has asked insurers to not treat costs of pharmacy, consumables, implants, medical devices, diagnostics as ‘associate medical expenses’, thus leaving them out of the room rent sub-limit ambit. The actual expenses incurred under these heads will have to be reimbursed by insurers. This will mean significant relief for policyholders, particularly in the current situation when they have had to deal with higher rates.

Policy restrictions and standardised exclusions

Did your hospital levy a registration or admission charge at the time of admission? Your insurer will not foot the bill for this expense. Laundry charges, toiletries, hearing and walking aids are also excluded. “Ailment caps, sub-limits, co-pay and non-medical deductions are among the key reasons for a claim payout being lower than the hospitalisation bill,” says Sanjay Kedia, Country Head and CEO, Marsh India Brokers. For instance, cataract cost could be capped at Rs 25,000 even if the hospital charges are far higher. Similarly, the co-pay clause can take you by surprise at the time of settlement of bills. Under the clause, the insured has to chip in with 10-30 per cent of the claim amount before the insurer settles the balance.

New policies issued after October 1, 2019 adhere to IRDAI’s new standardised exclusions norms, but insurers have time till October 1 to make these revisions in existing health insurance contracts. Some insurers have already modified their retail health policies in line with these guidelines. “Once the guideline comes fully into effect, policyholders can expect average claims settled to go up from 90 per cent (of the claim filed) to 93-94 per claims as the new list is more policyholder-friendly,” says Bhagat.

Source: Money Control

http://www.insurancealertss.