09-07-2020

09-07-2020

General Insurance Council’s tariff card explained

Insurance Alertss

Insurance AlertssGeneral Insurance Council’s tariff card explained

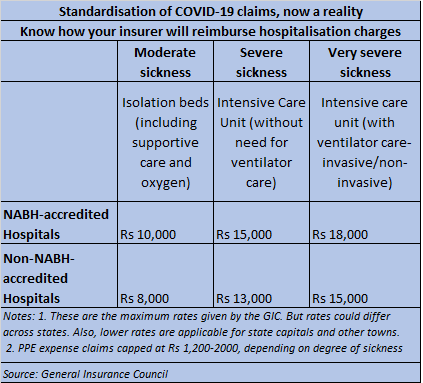

The General Insurance Council (GI Council), the non-life insurance industry association, has come out with an indicative rate chart for COVID-19 hospitalisation claims. The tariff has been devised after discussion with the medical professionals employed with insurance companies, the council said. The rates will be applicable to both cashless and reimbursement claims. However, in case a government authority has prescribed treatment charges in a state or city, those charges will apply. The Council-devised charge structure will be reviewed every month. Here is what the development means for policyholders (who may be patients).

What is the rationale behind devising this rate chart?

Since the beginning of the COVID outbreak, insurers and hospitals have often been locked in disputes over expenses payable. The objective is to bring about some clarity on what is payable, and the expenses that will not be reimbursed. “COVID-19 is a new illness with no established protocols and standardised treatment costs. This may, at times, result in an insurance company raising questions on the amounts spent,” the industry body’s statement noted. Due to such disputes, patients suffer a loss. As per the GI Council, the rate chart is an attempt at allaying policyholders’ fears and bringing clarity to the treatment of COVID-19 claims.

For insurers, this will act as a reference guide for approving treatment expenses. “Earlier, hospitals were charging rates with wide variations. Insurers were confused as to what is payable and what is not. As per policy terms, personal protection equipment (PPE) kits are actually not payable. However, we later took a call to pay for these expenses. However, there was no uniformity across insurers,” says Bhaskar Nerukar, Head, Health Claims, Bajaj Allianz General Insurance. Now, a consensus has emerged that PPE expenses should be settled, given how critical they are to the treatment procedures.

How does the chart deal with various charge heads related to COVID-19 treatment?

The rate chart categorises patients’ ailment condition into three segments: moderate sickness, severe sickness and very severe sickness. The admissible cost in case of moderately sick patients being treated at National Accreditation Board for Hospitals & Healthcare Providers-accredited (NABH) hospitals will be Rs 10,000 per day, including PPE cost of Rs 1,200. In the case of non-NABH hospitals, this will be Rs 8,000 per day. For severely sick patients, who need intensive care unit (ICU) with ventilator care, hospital rates per day will be Rs 18,000 (Rs 15,000 at non-NABH hospitals), including PPE cost of Rs 2,000. In metros, while 100 per cent of this rate structure will be paid out, the settlement will be lower, at 90 per cent in state capitals and 75 per cent in the rest of the country. Likewise, the proportion will vary as per the type of healthcare facility too: tertiary hospitals (100 per cent of the rate ceiling), nursing homes (80 per cent) and standalone hospitals (65 per cent).

What are the other associated expenses that will be covered or excluded?

The document mentions consultation, nursing charges, room stay, meals, COVID-19 testing, drugs and medical consumables, urinary tract catherisation, biochemical waste management and other protective gear as inclusions. Most importantly, PPE will be covered, though sub-limits (Rs 1,200-2,000 per day) are specified. If the hospital bills a higher amount, the policyholder will have to pay it from her pocket.

Certain charges related to interventional procedures such as bronchoscopic procedures, biopsies, ascitic or pleural tapping and so on will be reimbursed as per the hospital’s rack rates as on December 31, 2019. Likewise, high-end investigation expenses including MRI and PET scan will be settled at the rack rates as on December 31, 2019.

Do insurers have to mandatorily adhere to this structure?

Not necessarily. In cases where insurers have negotiated tariffs and agreements with their network hospitals in place already, they could stick to those too. But it is unlikely that the payable charges will now exceed the caps mentioned in the GI Council’s rate chart.

“These are indicative rates, not binding on insurers. However, it is in the interest of insurers to follow the tariff chart, so that hospitals bring about some standardisation in their charges,” says Nikhil Apte, Chief Product Officer, Royal Sundaram General Insurance.

How will it help policyholders?

Policyholders will have a better idea of hospitalisation expenses that their insurer will pay for. “Now, there is some standardardisation across the industry available transparently for the hospitals and customers. Policyholders will know the expenses their insurers will bear, beyond which, they will go from their pockets. They can ask questions to hospitals as well as their insurers, as rate chart is transparently available. So, it is in everybody’s interests,” says Nerurkar. Greater transparency will also reduce customer complaints, most of which pertained to non-payment of PPE kit and other consumables’ expenses that constituted up to 55-60 per cent of the hospital bill. “This was being disallowed by some insurers. Now, insurers will pay for these expenses if managed within the limits specified.”