16-07-2020

16-07-2020

Corona Kavach policy premiums across insurance companies compared

Insurance Alertss

Insurance AlertssCorona Kavach policy premiums across insurance companies compared

New Delhi: The Insurance Regulatory and Development Authority of India (IRDAI) recently issued final guidelines containing the standard features of the Covid-19 specific health insurance plan 'Corona Kavach'. The regulator allowed 29 General and Health Insurance companies to market the Policy.

In its statement, the Authority said, "In view of the COVID-19 pandemic, the Authority has designed a standard COVID specific product addressing basic health insurance needs of insuring public with common policy wordings across the industry. The Authority has mandated general and health insurers to offer this indemnity based Individual COVID Standard Health Policy called “Corona Kavach”."

Here are the key features of “Corona Kavach” policy:

1. Product Type: Available on Individual and Family Floater Basis

2. Type of Cover:

Base Cover on Indemnity Basis- Covid Hospitalization cover

Optional Cover on Benefit Basis- Hospital Daily Cash

3. Sum insured: Rs 50,000 to 5,00,000 (in the multiples of fifty thousand)

4. Waiting Period: 15 days

5. Policy Period: Three and half months (3.5 months), Six and half months(6.5 months), Nine and half months (9 ½ months) including waiting period.

6. Eligibility:

Policy can be availed by persons between the age of 18 to 65 years.

Policy can be availed for Self, spouse, Parents, Parents-in-law and Dependent Children up to 25 years of age.

7. Hospitalization Expenses: Medical Expenses of Hospitalization on diagnosis of Covid shall be admissible.

8: Pre Hospitalization Expenses: 15 days

9. Post Hospitalization Expenses: 30 days

10. Sub-limits:

Home care treatment: Maximum up to 14 days per incident.

Ambulance Charges: Rs 2000 per hospitalization.

Optional Cover of Hospital Daily Cash: 0.5% of Sum Insured per day subject to maximum of 15 days in a policy period for every insured member.

11. Home Care Treatment Expenses:

Cost of treatment incurred by the Insured person on availing treatment at home for Covid on positive diagnosis up to 14 days per incident, which in the normal course would require care and treatment at a hospital but is actually taken while confined at home.

12. Premium payment: Single Premium

13. Hospital: For the purpose of this policy any set-up designated by the government as hospital for the treatment of Covid shall also be also considered as hospital.

14. Co-morbidities: Any co-morbid condition triggered due to Covid-19 shall be covered during the period of hospitalization.

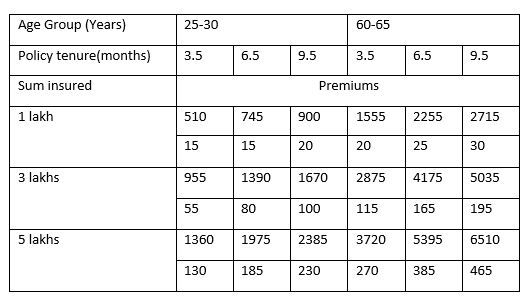

Corona Kavach Insurance premium Compared:

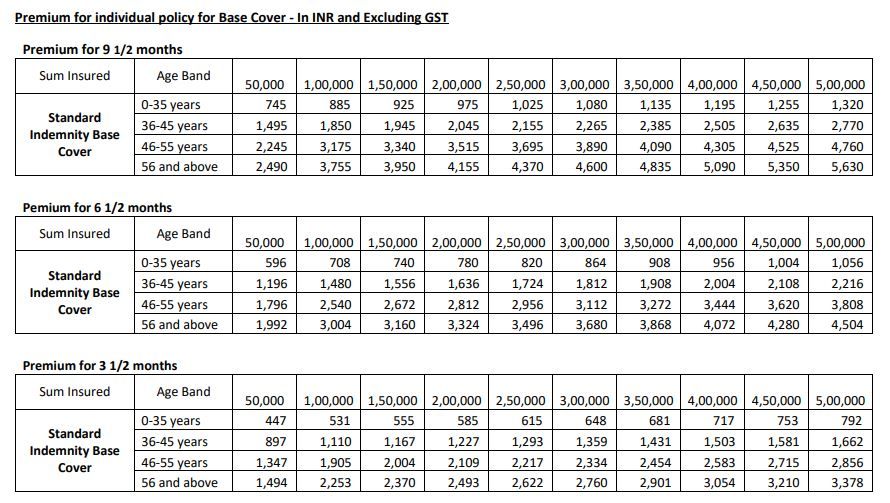

1. ICICI Lombard: In the case of a policy tenure of 6.5 months, for Sum Insured 3Lakhs, for an individual between 36-45 years the premium would be 1734 exclusive of taxes. Additionally, a premium for Rs. 2 Lakhs Sum Insured would be approximately Rs 1,300 and Rs 2,500 for Rs 5 Lakhs sum insured for individuals in the age group of 36-45 Years and the policy term of 9 months, 15 Days.

The figures are illustrative in nature and the policy premium depends on a lot of factors such as Sum Insured, insurance period, individual health of the person insured and number of people covered under the policy.

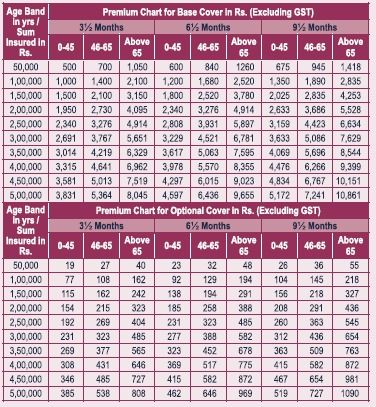

2. Bajaj Allianz:

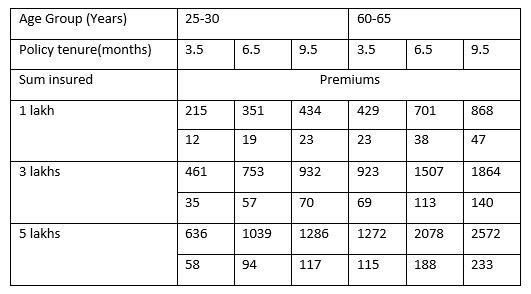

3. Star Health:

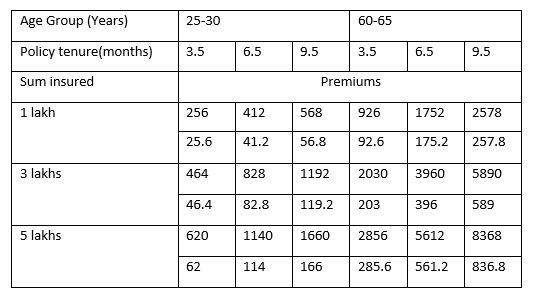

4. Oriental Insurance:

5. United India Insurance:

6. National Insurance:

Should you buy Corona Kavach?

Naval Goel, CEO & Founder of PolicyX.com said, "If you already have an adequate health insurance plan that covers pandemic as well then you don’t have to invest in corona specific health insurance plans. However, a person can consider investing in corona specific plans for fixed benefits. Such corona specific plans help you to get additional coverage against PPE kits and other consumable required during the treatment."

Source: Times Now News