24-07-2020

24-07-2020

Weekly market view by Hemant Kanawala, Head - Equity, Kotak Mahindra Life Insurance Co. Ltd

-2020-7-24-3-709.png)

Insurance Alertss

Insurance AlertssWeekly market view by Hemant Kanawala, Head - Equity, Kotak Mahindra Life Insurance Co. Ltd

Improved sentiments and supportive flows pull markets up

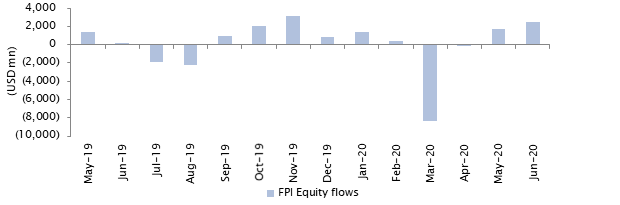

Shrugging of the weakness seen last week, markets rallied sharply with Nifty returning 4 .8% and Midcap index rising 2.6% on the back of 1) far stronger than anticipated results in Q1FY21 from banks; 2) return of foreign flows (~USD 442 million over the last week) 3) news relating progress in government disinvestment (BPCL) and foreign investment commitments (Jio platforms, Google announcement).

On macro front, European Union countries agreed on a USD 857 bn stimulus package sending strong signal of solidarity. The deal was notable because for the first time European countries agreed to raise large sums by selling bonds collectively, rather than individually. The announcement of the package has considerably eased risk of a deep recession in Eurozone. This deal and the uncertainty regarding the extension of the Relief Package is adding to the pressure on the US Dollar. Dollar Index has declined by 7.7% since its recent peak in March-20.

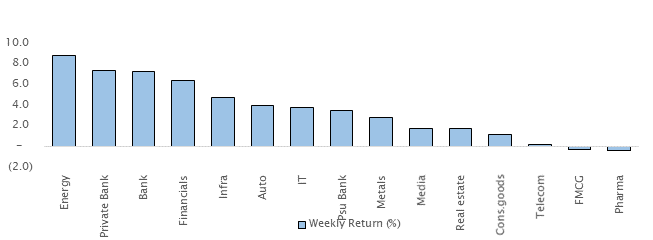

Energy and Banks perform; pharma and FMCG lag

Energy (8.8%) and banks (7.2%) have seen strong performance over the last week. News relating to progress in BPCL disinvestment and continuing investor interest for JIO platforms (subsidiary of Reliance Industries, classified under Energy) has pulled energy sector performance strongly. Banks, especially private banks, that have declared results so far have indicated much lower impact due to loan moratorium provisions, infusing positivity into the sector. Pharma (-0.3) and FMCG (-0.3) having had a strong run up until now have had a breather last week, remaining flat.

Exhibit 1: FPI flows have returned strongly over the last week

Exhibit 2: Energy and banks have led the recent leg of market rally