06-08-2020

06-08-2020

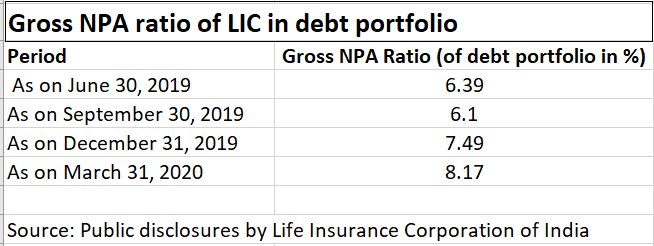

LIC’s gross NPA ratio in debt portfolio at record high of 8.17% at end of FY20

Insurance Alertss

Insurance AlertssLIC’s gross NPA ratio in debt portfolio at record high of 8.17% at end of FY20

The gross non-performing assets (NPA) ratio of the debt portfolio of Life Insurance Corporation of India (LIC) rose to an all-time high of 8.17 percent at the end of FY20, a data point that will come under the spotlight in a year when the life insurer readies itself for an initial public offering.

The gross NPA was 6.15 percent at the end of FY19. Sources said the coronavirus outbreak and the volatility in the economy were the causes for the downgrade of certain investments leading to the rise in gross NPA.

Peers like ICICI Prudential Life Insurance, HDFC Life Insurance and SBI Life Insurance had no gross NPA ratio as of March 31, 2020.

While LIC had a Rs 31.2 lakh crore balance sheet at the end of FY20, there will be closer scrutiny of its finances as it nears listing on the stock exchanges. The total investments of LIC under policyholder book stood at Rs 28.4 lakh crore at the end of FY20, a growth of 3.4 percent year-on-year.

The net NPA ratio (of the debt portfolio stood at 0.79 percent at the end of FY20. In the year-ago period, the net NPA ratio of debt portfolio was at 0.27 percent.

LIC did not respond to a query sent by Moneycontrol. MR Kumar, chairman of LIC had said in February 2020 that the gross NPA ratio of LIC should not be compared to that of the banking sector. He had said the stress threshold for banks is different from that for insurers. For LIC, he said most investments comprise government securities, equity and a small portion of corporate debt.

ICICI Bank’s gross NPA stood at 5.53 percent at the end of March quarter while that of State Bank of India stood at 6.15 percent. Though LIC discloses the list of downgraded investments after every quarter, the life insurer has not made a public disclosure on such investments for the period ended March 30.

At the end of December 31, 2019, LIC had given detailed disclosures about the downgrade of investments across life fund, unit-linked fund and pension fund.

There was a downgrade of investment in LIC’s life fund. Between October and December 2019, a slew of instruments in companies like IFCI, Yes Bank, Dewan Housing Finance and Indiabulls Housing Finance witnessed ratings downgrade. The insurers' exposure to these instruments stood at Rs 5,753.48 crore as per its balance sheet as of December 31, 2019.

Does LIC have adequate capital?

LIC has adequate assets and investments to cover up for any gross NPA in its debt portfolio. Unlike state-owned general insurers like United India and National Insurance, LIC’s solvency or minimum capital is above regulatory requirements.

At the end of March 31, 2020, LIC’s solvency ratio stood at 1.55 against the regulatory requirement of 1.5. Solvency is a crucial aspect because LIC’s future valuation will depend on its capital strength and balance sheet position. The proposed merger of National Insurance, United India and Oriental Insurance and subsequent listing of the combined entity were called off in July 2020 for the very same reasons.

The government had announced divestment of its stake in LIC through an initial public offer in FY21. The government is likely to sell up to 10 percent stake in the insurer.

Though the government had given H2FY21 deadline for LIC's IPO, it is likely that this process will be completed only in FY22.