The coronavirus (COVID-19) pandemic has brought about a big shift in the insurance preference for customers, especially individuals. While the pandemic has made corporates take up the responsibility of providing insurance coverage to their employees by subscribing to group insurance plans, the financial uncertainty that the pandemic created has pushed back individuals from buying insurance, reveals data from the insurance regulator.

As per data shared by Insurance Regulatory and Development Authority of India (IRDAI) on new business of life insurers for end July 2020, during the month, group annualised premium equivalent (APE) has reported a strong performance, with 50.3% growth.

APE is the sum of annualised first-year premiums on regular premium policies and 10% of single premiums on the new business written during any period.

According to a research report by Emkay Global Financial Services, the share of private players on the APE basis continued its sequential improvement at 49.2% (44.2% in June 2020) in July against the peak of 60.2% in February 2020. The share of retail APE stood at 55.2% against 61.6% in February before the impact of Covid-19.

"Private players finally managed to bring back their APE growth momentum after reporting a steep decline in the last four months. However, growth is mainly contributed by group businesses, whereas the retail individual business is still lagging, with a 7.1% decline, similar to a 7.0% fall in June 2020," the report said. The data clearly shows the path that insurance business is taking as new premiums are coming from group side while retail subscription still remains slow.

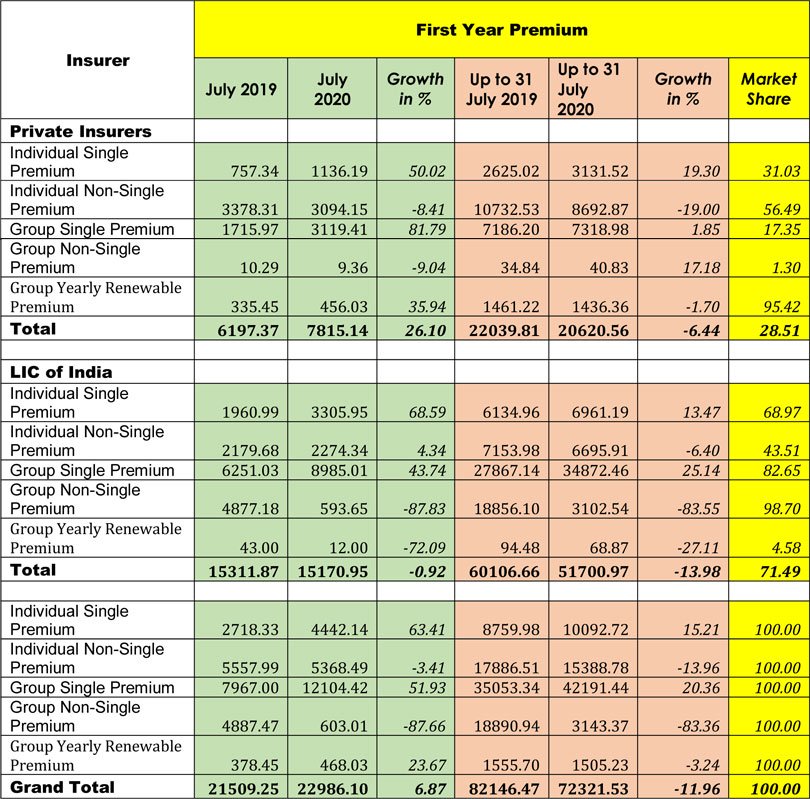

During the month, new business premium (NBP) of life insurers grew 6.87% to Rs22,986.10 crore, compared with Rs21,509.25 crore same month a year ago. The growth in July was mainly driven by private insurers with an increase of 26.10% in their NBP to Rs7,815.14 crore. LIC has reported relatively weak numbers, with APE falling 48%. However, its retail APE has grown by 9.6% to Rs2,600 crore. LIC's new business premium (NBP) decreased by 0.9% to Rs15,171 crore. Policy sales dipped by 25.1%, while the ticket size witnessed growth of 39.3% during the same period.

Among listed players, HDFC Life reported positive trend with growth of 12.5% in APE in July 2020 to Rs710 crore with a sharp sequential recovery after de-growing for four straight months. Growth was majorly contributed by group single premiums, which grew by 106% on a month-on-month basis or 63% on year-on-year (y-o-y) basis. Max Life witnessed modest decline of 2.9% to Rs350 crore while SBI Life witnessed decline of 3% to Rs890 crore. SBI Life's retail APE de-grew by 14.4% to Rs720 crore.

On the other hand, IPRU Life reported APE de-growth of 10.8% to Rs610 crore on a received premium basis in July 2020. Its retail APE at Rs380 crore decreased by 36.5% and group APE at Rs230 crore jumped by 175.9%.

Source: Moneylife News & Views

11-08-2020

11-08-2020

Insurance Alertss

Insurance Alertss