02-09-2020

02-09-2020

New India Assurance Settles Insider Trading Violation by Paying Rs62.68 lakh from Shareholders’ Fund; No Action Against Any Official, Reveals RTI

Insurance Alertss

Insurance AlertssNew India Assurance Settles Insider Trading Violation by Paying Rs.62.68 lakh from Shareholders’ Fund; No Action Against Any Official, Reveals RTI

State owned New India Assurance Co Ltd has paid Rs.62.68 lakh as settlement for violating insider trading norms of market regulator Securities and Exchange Board of India (SEBI) and this amount was paid from the shareholders’ fund by the insurer, reveals a reply received under the Right to Information (RTI) Act.

Interestingly, New India Assurance paid the settlement amount from its shareholders’ fund but refused to divulge any information on whether or not this matter was discussed and approved by its board.

Replying to other question, the insurer accepted that it did not inform the Insurance Regulatory and Development Authority (IRDAI) or the government of India about the Rs.62.68 lakh settlement it made for violating insider trading norms. No wonder, there was not even an enquiry either by the IRDAI or the government about this violation and settlement.

What is more shocking is, that despite paying Rs.62.68 lakh as settlement for the violation of insider trading norms, New India Assurance neither carried out any internal inquiry or investigation to fix accountability and responsibly for this lapse, nor was there any action against any official, the RTI reply reveals.

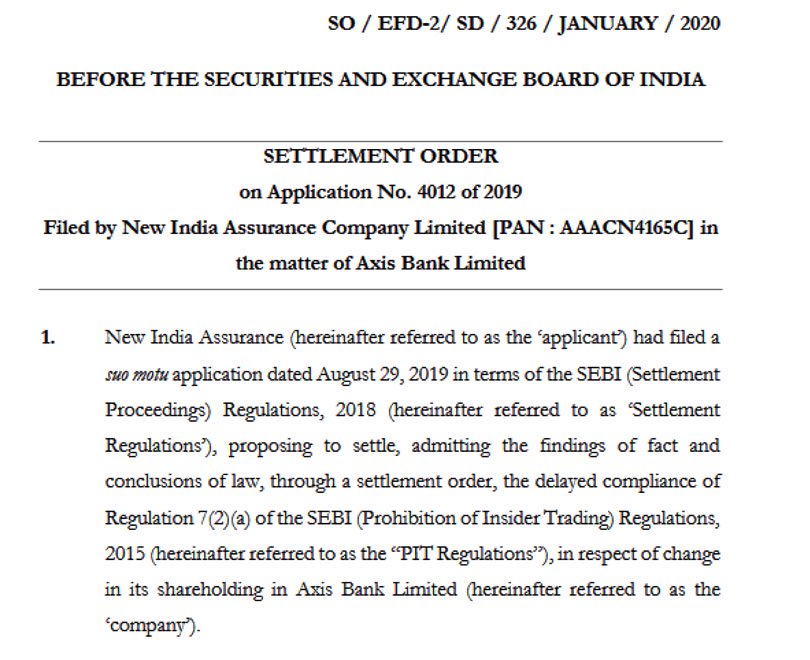

In a settlement order passed on 23 January 2020, SEBI says, "...it is hereby ordered that the proceedings that may be initiated for the default....are settled qua the applicants....SEBI shall not initiate any enforcement action against the applicant for the said defaults...this order disposes of the proceedings that may be initiated for the default as mentioned....and passing this order is without prejudice to the right of SEBI to take enforcement action including commencing proceedings against the applicant..."

The matter is related with New India Assurance and Axis Bank Ltd, in which the insurer is promoter. During 28 May 2018 and 30 September 2018, the state-owned insurer traded in shares of Axis Bank, sometimes in excess of Rs10 lakh. As per the regulatory norms, New India Assurance was expected to report within two days from the date of transaction, the change in its shareholding in Axis Bank. However, New India Assurance only disclosed it on 10 June 2019, violating regulation 7(2)(a) of the Prohibition of Insider Trading (PIT) regulations.

On 29 August 2019, New India Assurance filed a suo motu application proposing to settle the delayed compliance of regulation under the PIT Regulations.

On 17 December 2019, New India Assurance appeared before the internal committee of SEBI and was offered the facility of preferring the application through summary settlement procedure by paying Rs62,68,600 within 10 days. On 23 December 2019, the insurer paid the amount to settle the matter.

Here are the questions asked for seeking information from New India Assurance under RTI…

1. Confirm that NIACL had paid Rs62.68 lakh towards settlement charges to SEBI for alleged violation of insider trading norms.

New India Assurance (NIA): Yes. Paid the said amount.

2. Did SEBI issue any letter or correspondence to NIACL in this regard? If yes, copy of the same be furnished.

NIA: No Notice Received.

3. Did NIACL submit any reply to it? If yes, copy of the same be furnished.

NIA: Applied for settlement proceedings on suo motu basis.

4. Furnish the copy of the final settlement order passed by SEBI in this regard.

NIA: Enclosed.

5. Confirm that this payment of Rs62.68 lakh towards settlement charges was discussed and approved by the board of NIACL. If yes, a copy of the same be submitted.

NIA: The information is confidential in nature and hence can’t be furnished under sect 8(1)(d) of the RTI Act.

6. Did the NIACL bring the issue of payment of Rs62.68 lakhs towards Settlement Charges to SEBI for alleged violation of Insider Trading norms to the notice of IRDAI and Government of India. If yes, copy of the same be furnished.

NIA: No

7. Did IRDAI or Govt. of India seek any explanation/comments from NIACL on this issue? If yes, copies of the same be furnished.

NIA: No.

8. From which account was this Rs62.68 lakh paid by NIACL (i) from Its shareholders’ account or (ii) policyholders account.

NIA: Out of the shareholder fund.

9. Did NIACL carry out any internal inquiry or investigations to fix accountability and responsibility for this lapse? If yes, a copy of the report be submitted....

NIA: No.

10. Did NIACL take any action against any of its officials for this lapse. If yes, their names and designations be submitted.

NIA: No.

11. Provide me with documentary evidence as to what are the steps taken by NIACL to avoid reoccurrence of such incidents in future.

NIA: 12-31 enclosed as annexure.