21-09-2020

21-09-2020

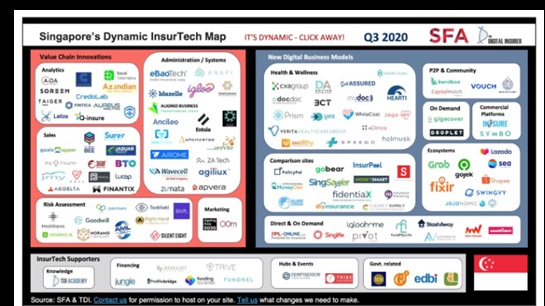

Singapore:FinTech Association launches first-of-its-kind interactive Singapore InsurTech Map

Insurance Alertss

Insurance AlertssSingapore:FinTech Association launches first-of-its-kind interactive Singapore InsurTech Map

The InsurTech sub-committee of the Singapore FinTech Association (SFA) yesterday announced the launch of Singapore's first interactive InsurTech map, capturing Singapore's vibrant InsurTech ecosystem on the SFA's website.

The map will be regularly updated to reflect Singapore’s rapidly evolving InsurTech landscape. It is intended to help users of InsurTech services such as insurers to source for solution providers, while enabling InsurTech firms to easily promote their businesses locally and globally.

The map is powered by The Digital Insurer’s (TDI) InsurTech Directory platform (ITD), which categorises InsurTechs and dynamically links readers to further information on each firm. ITD is positioned as The World’s InsurTech Database and, whilst still in its formative stage, already manages the largest freely accessible listing of InsurTechs around the world.

Commenting on the launch of the Singapore InsurTech Map, Tomasz Kurczyk, chairman of SFA’s InsurTech sub-committee, said, “The sub-committee was recently formed and aims to foster collaboration within the InsurTech ecosystem. We believe this interactive map is a great platform to enable people and organisations to bridge and make connections. The InsurTech map will also be updated every quarter to reflect the growing InsurTech community.”

Chia Hock Lai, president of SFA, commented, “SFA is proud to be launching the first interactive Singapore InsurTech Map and remains committed to build a thriving ecosystem for InsurTechs. Initiatives like this will help place InsurTechs in Singapore on the global map and enable insurers to tap on opportunities that already exist as they transform and grow.”

Hugh Terry, founder of TDI, added, “Our purpose at TDI is “working together to accelerate the digital transformation of insurance” and we are delighted to have partnered with SFA to launch a practical yet interactive and visually engaging tool that will help InsurTechs to get connected to potential customers, both locally and globally, and vice versa.”

For more information on the Singapore InsurTech Map, please visit: https://singaporefintech.org/insurtech-subcommittee/#insurtechmap

The SFA is a cross-industry and non-profit organisation. Its purpose is to support the development of the FinTech industry in Singapore, and to facilitate collaboration among the participants and stakeholders of the FinTech ecosystem in Singapore. The SFA is a member-based organisation with over 700+ members. It represents the full range of stakeholders in the FinTech industry, from early-stage innovative companies to large financial players and service providers.

To further its goals, the SFA also partners with institutions and associations from Singapore and globally to cooperate on initiatives relating to the FinTech industry. The SFA has signed over 50 international Memorandum of Understanding (MoU) and are the first U Associate organisation to be affiliated with National Trades Union Congress (NTUC). Through their FinTech Talent (FT) Programme, launched in 2017, over 300 professionals have been trained in FinTech, including blockchain & cryptocurrency, cybersecurity and regulation.

The SFA InsurTech Sub-Committee was formed to promote the adoption of technology and new digital business models as well as foster collaboration between start-ups, ecosystem participants, insurance industry and regulators. The sub-committee represents the interests and acts as the voice of the InsurTech ecosystem in Singapore, in addition to representing local InsurTechs beyond the city state.

The Digital Insurer is the world’s largest knowledge platform on digital insurance and has a community of more than 40,000 professionals around the world who align around the common purpose of “working together to accelerate the digital transformation of insurance”.

Source: Asia Insurance Review