06-10-2020

06-10-2020

Here’s how scores will be calculated in the new colour-coded health insurance plans

Insurance Alertss

Insurance AlertssHere’s how scores will be calculated in the new colour-coded health insurance plans

Health insurance policies will soon have a colour-coding system of green, orange or red to show whether a product is simple, moderate or complex.

Insurance Regulatory and Development Authority of India (IRDAI) has said that a score will be assigned to each product, depending on the product features and the type of covers. For customers, this is meant to reflect whether the product is simple or complicate to understand.

Green is a colour which all health insurers will desire to get as this means that the product is simple.

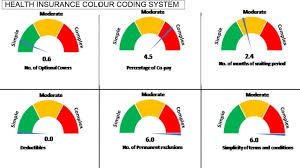

Factors like number of optional covers, percentage of co-pay, waiting period, permanent exclusions, number of treatments included, and simplicity of terms will be considered for deciding on a score for the product. Moneycontrol gives you a glimpse of how the colour code will work.

Scores and their relation to colour coding

Products with a score of 2 or less will be classified green, more than 2 and less than 4 will be orange, while those above 4 and up to 6 will be red.

Seven parameters will be considered. They include the number of optional covers offered, waiting period, percentage of co-pay, number of treatments where sub-limits are applicable, deductibles, number of permanent exclusions and simplicity of terms. All the seven parameters will be given an equal weightage of 14.28 percent.

Optional covers and co-pay

A score of 0.6 will be given for every one optional cover in the product. If a health insurance product has 5 optional covers, the score of the product on this parameter will be 3.

When it comes to co-pay, a score of 0.3 is given for every 1 percent rise beyond the 5 percent co-pay. If a health product has two options -- of 10 percent and 20 percent co-pay -- the average co-pay will be 15 percent. Co-pay in health Insurance refers to the percentage of the claim amount that has to be borne by the policyholder. If the co-pay is 10 percent, the insurance company will pay 90 percent of the claim.

Waiting period and sub-limit

A score of 0.15 is given for every one month of waiting period. For example, if the maximum waiting period in a health product is 18 months, the score will be 2.7. Waiting period is the period where claims for pre-existing diseases will not be paid.

A score of 0.6 is given for every one disease placed under the sub-limit. In case of multiple options, the maximum co-pay offered will be considered. For example, if a health product has 6 diseases under sub-limits, the score will be 3.6.

Deductibles

Deductible is the amount a policy holder has to pay before the insurance company starts paying up. For example, if the deductible in a health insurance policy is Rs 20,000 and the mediclaim is Rs 40,000, the insurance company is liable to pay only Rs 20,000.

IRDAI has said that a score of 0.3 is given for every 1 percent of deductible in the policy. If a health policy has a deductible of 10 percent, the score will be 3.

Similarly, when it comes to permanent exclusions or diseases/treatments for which insurers won’t pay, a score of 0.6 will be given for every permanent exclusion. If a health policy has 5 permanent exclusions, the score for this parameter will be 3.

Standard terms and definitions

IRDAI had already notified the standard definitions, general terms, and exclusions in health insurance policies. A score of 0.1 is given for every definition, general clause and exclusion, which differ from standard definitions.

For example, if there are 20 definitions, 20 clauses and 5 exclusions in the product, which are other than standard ones, the score will be 4.5. The weighted average scores of all the seven parameters are then added together to get the final score of the product.

IRDAI has asked stakeholders to present their views on this colour-coding system by October 15.

Source: Money Control

http://www.insurancealertss.