19-10-2020

19-10-2020

Rains trigger flood of car insurance claims

Insurance Alertss

Insurance AlertssRains trigger flood of car insurance claims

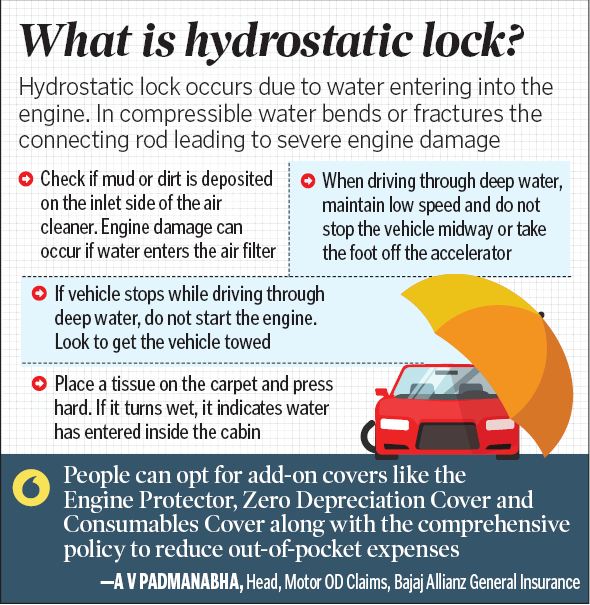

Hyderabad: The incessant rains have battered the city and in the process many cars have been immobilised due to the hydrostatic lock, where electricals and wiring of the car are damaged due to the water getting in. In some cases, engines might also be at risk. This is resulting in people filing for a claim

AV Padmanabha, Head – Motor OD Claims, Bajaj Allianz General Insurance, said the company has received a few motor claim intimations and these are mainly related to vehicle submerging and vehicle breakdowns. More claims are likely in days to come once water levels recede and power supply is restored in more places.

Engine cover

Only those who have a comprehensive cover including engine protection will see some relief coming from insurance companies. Others with no engine protection or with only a third party cover will have to spend from their pockets for the repairs.

“People can opt for add-on covers like the Engine Protector, Zero Depreciation Cover and Consumables Cover along with the comprehensive policy to reduce out-of-pocket expenses,” Padmanabha said. In words of Vinya Ramdayal Saboo, CMD, RKS Motors, flood affected vehicles can be categorised minor, major and high risk types. The company has seen 30 cases coming so far and high numbers are expected in days to come, he said.

In minor cases, the water enters upto the carpet level and needs only cleaning and checking the consumables. The costs can range from Rs 10,000 to Rs 15,000. Instances of major type, where water level is upto the dashboard, may require repairs and/or replacement of some electronic components. The repairs may cost from Rs 40,000 to Rs 50,000. The high risk ones, where the vehicle has submerged for long period, the electronic parts and engine along with interior components including seats will see the impact. These kind of repairs cost Rs 1.2 lakh to Rs 2 lakh.

Petrol engine repairs cost would be lesser than the diesel as the component cost and the number of components for the diesel car is higher. Praveen Chowdary Sajja, Motor Business Head, Policybazaar.com, said most policies routinely honour damages caused by an accident. An add-on cover, which ranges from Rs 1,000 to Rs 10,000- varying with the age and model of the car- will come handy. This apart, customers should also look to have an invoice-protection cover. This will bridge the gap between the insured’s declared value (IDV) and the value on the invoice. This will allow the customers to buy a new car,” he said.

Word play

“What some call a bumper-to-bumper cover actually may not cover all aspects. Some may use the terms like platinum, gold, silver and the like to sell a policy. It is important to buy a policy based after knowing what is covered,” he said.

Source: Telangana Today