19-10-2020

19-10-2020

The changing face of HDFC life & the Insurance industry

Insurance Alertss

Insurance AlertssThe changing face of HDFC life & the Insurance industry

Life insurance products have been synonymous with LIC since time immemorial. But ever since the government opened up the industry to private players, a lot of companies have been making considerable headway. And perhaps one of the leading players in the recent past has been HDFC Life — a company that’s focused on selling long-term life insurance products. So today we thought we’ll look at how the industry is shaping up and HDFC Life’s place in the ecosystem.

Understanding the fundamentals

Insurance works because of risk pooling. It is one of the fundamental building blocks of the industry. A risk pool involves a group of people coming together (prompted by an insurer) to pool small amounts of money to cover those who might need money in the event of a catastrophe. Think — Death or a debilitating disease. And as more people enter the risk pool, insurance companies try to cover high-risk individuals by sharing costs and potential exposure more evenly across the board.

However, insurers still have to make sure that the fee they collect from each customer will allow them to honour their obligations. This is a function of the insurer’s underwriting capabilities i.e. their ability to gauge risk and price their policies accurately. If they get this bit right, then they can go about pursuing more customers in a bid to keep expanding that risk pool.

And this begets the distribution challenge. How do you convince people they need insurance? Specifically, term insurance. The product doesn’t protect you per se. But it does protect those around in the event of your untimely death — By way of making a large payout so that your family can deal with the added financial burden despite your absence.

Unfortunately, for most people thinking about death and insurance can be extremely challenging. In fact, most people in India buy insurance products because they have a pushy uncle who happens to be an agent or they’re trying to save on taxes. So, if you’re a company trying to create and sell insurance products, your biggest challenge is to market it.

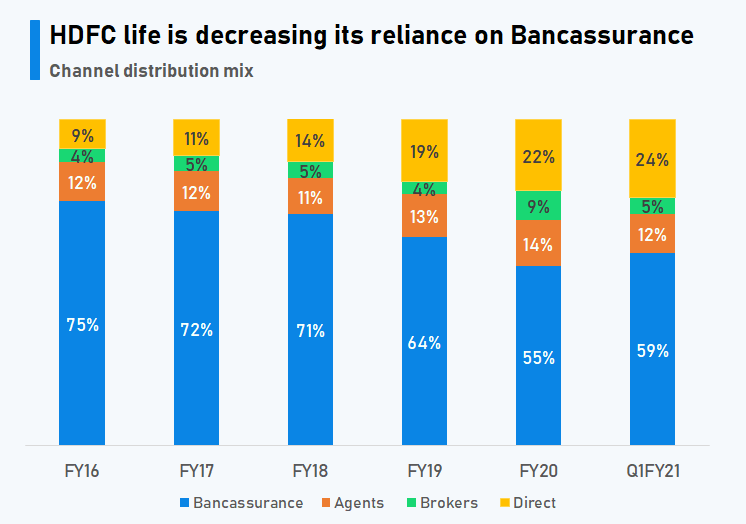

Now HDFC Life has traditionally skirted around this problem by leveraging the large network of HDFC bank in this country. They have been able to cross-sell their insurance products in these banking channels (also called bancassurance) and this avenue has been the primary driver of growth for the company — contributing almost 75% of the sales in FY16. And although they are no longer as reliant on these channels anymore (with the growing influence of direct sales and online partners), it’s still the biggest distribution channel for the company contributing about 55% of the sales in FY20.

But then, insurance companies found another workaround. They changed the composition of the insurance product in a bid to make it more enticing. And the most infamous product within the lot is a ULIP (Unit Linked Insurance Product). Think of ULIPs as part insurance, part investment products. A small chunk of the premium is allocated towards providing you with an insurance cover (decent payout in case you do die). And the remaining funds are invested in stocks and bonds. Eventually, at the end of the payment cycle i.e. maturity (say 10 years), you will be paid the final investment corpus so long as you are alive at the time. Meaning, you don’t have to die to gain from your insurance policy making it very appealing to the average Joe.

Now most prudent financial planners will tell you ULIPs aren’t particularly useful. The cover is insufficient to really help your family in case catastrophe strikes and the investment bit won’t yield outsized returns considering that a sizeable part of your premium is deducted before they’re invested. For instance, there is the premium allocation charge, the fund management fee, some random commission, admin fees and eventually once everyone’s taken their cut, the insurance company will park the remaining funds in a mix of stocks and bonds. But despite this sub-optimal allocation, customers always seem to think they’re getting a bargain. And the agents selling these products make sure of it.

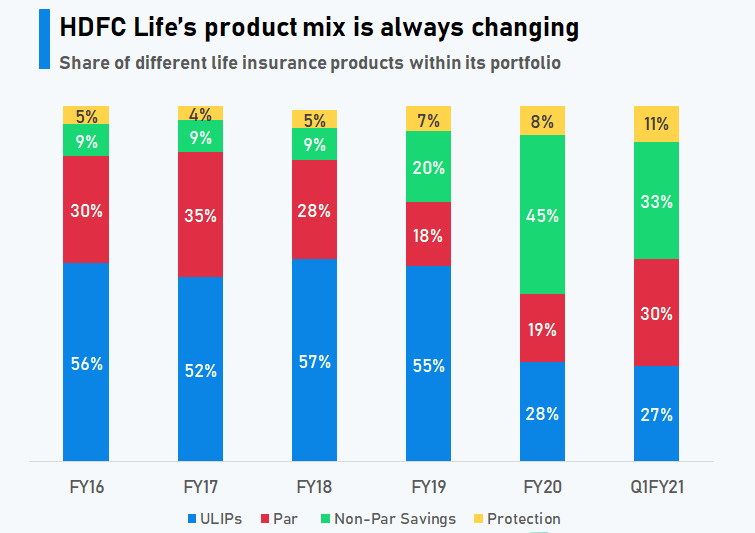

But here’s the funny thing. Despite their popularity, ULIPs aren’t high margin products. In the long run, insurance companies are likely to make better margins via stand-alone life insurance products. So technically, HDFC Life has every reason to keep selling those pure protection policies, even if they are hard to sell. And while the company did focus on ULIPs at one point in time, there is a discernible shift in strategy. Share of ULIPs in the new business has dropped from 56% in FY16 to just 28% in FY20, whereas term insurance plans have increased from 5% in FY16 to 11% in FY20.

And guess what — The pandemic might only further reinforce this conviction.

Now bear in mind, it’s not been very rosy for insurance companies since coronavirus made landfall. After all, insurance is a push product and the lockdown impacted the movement of agents and customer walk-ins. Ultimately premiums earned from selling new policies fell by 25–30% for the entire industry. Meanwhile, insurers were also having to deal with falling persistency levels i.e. the number of people persisting with their premium payments beyond a certain time frame. There’s an obvious decline here considering the threat of job loss and income depression. However, on the bright side, protection plans have been the least affected. In fact, there’s an increasing demand for term insurance policies presumably since more people finally seem to understand the utility of a pure protection product.

And therefore optimists argue that HDFC Life is best poised to leverage this opportunity considering they’ve been focusing on pure-play products for a while now. In fact, new business premium growth for the company in August and September tallied up to 44% and 55% respectively — highest among its public competitors. So could all this explain why the company commands a premium (in the stock market) compared to their listed peers?

What do you think?

Do you think there’s a clear frontrunner in the industry or is insurance just too complicated to figure out?

Source: Finshots