21-10-2020

21-10-2020

Indians invest primarily in life insurance, FDs for retirement

Insurance Alertss

Insurance AlertssIndians invest primarily in life insurance, FDs for retirement

The notion of India as a country of savers may be outdated as Indians are focusing more on current expenses rather than saving and planning for the future, reveals a survey by PGIM India Mutual Fund.

The survey, titled ‘Retirement Readiness Survey 2020’, states that retirement planning rates low on people’s priorities, while children and spousal security and even fitness and lifestyle rank higher.

So far as saving for retirement is concerned, Indians invest primarily in life insurance and fixed deposits. In fact, during the survey, 41% of respondents said they had focused their retirement investments on life insurance, while 37% preferred fixed deposits. This underlines the essential conservatism of most retirement planning, and the preference for solid investments that minimise risk. Other popular retirement investments include health insurance (favoured by 15% of respondents), gold (15%), recurring deposits (14%), POSS (14%), NSC/ NSS (9%) and property (9%).

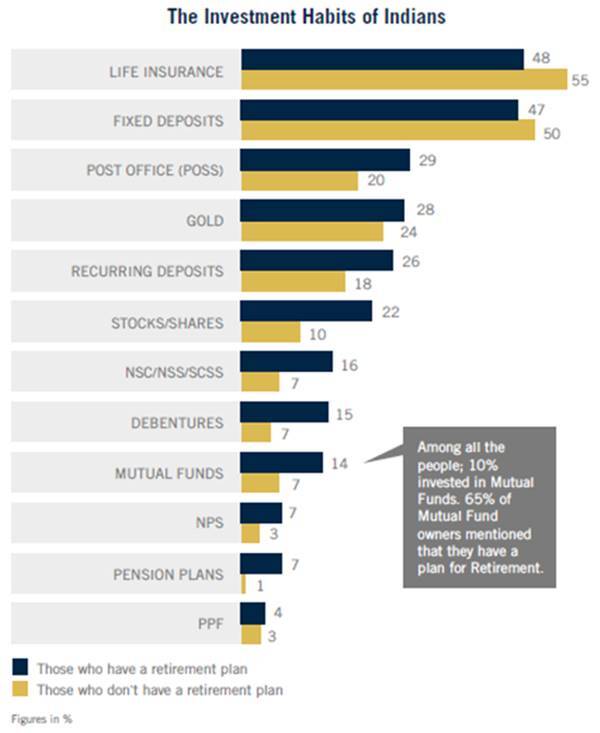

Indians with retirement plans invest relatively more in POSS (Post Office) and stocks, among other investments, compared to those without retirement plans. 29% of those who have retirement plans also happened to invest in POSS, compared to 20% for those without a plan, while stocks were favoured by 22% of those with a plan, compared to 10% of those without one. The other investments more favoured by those with a plan (compared to those without one) were stocks (22% to 10%), NSC/ NSS/ SCSS (16% to 7%) and debentures (15% to 5%).

On the other hand, life insurance, fixed deposits and property proved more popular with those who didn’t have a retirement plan, than with those who did. Life insurance was favoured by 55% of respondents without a plan, compared to 48% of those with one. Fixed deposits were favoured by 50% of those without a plan, compared to 47% of those with one, while property was favoured by 11% of those without a plan, compared to just 8% of those who had one.

The percentage of people investing in mutual funds is twice among those who have a retirement plan v/s those who don’t have a retirement plan. This indicates that those who engage in retirement planning are more likely to recognize mutual funds as good investment vehicles.

Another interesting finding of the survey was that retirement planning is linked to surplus income, not age. The incidence of retirement planning, therefore, increases as incomes rise. 62% of those earning Rs 50,000-75,000 have retirement plans mapped out, whereas only 44% of those earning Rs 20,000-50,000 have a retirement plan. This underlines how Indians may be willing to fund their retirement corpus from surplus income, but are less likely to do so by sacrificing current expenses.

Source: Financial Express

http://www.insurancealertss.