27-10-2020

27-10-2020

AIG Names Next CEO as It Splits Off Life Insurance Unit

Insurance Alertss

Insurance AlertssAIG Names Next CEO as It Splits Off Life Insurance Unit

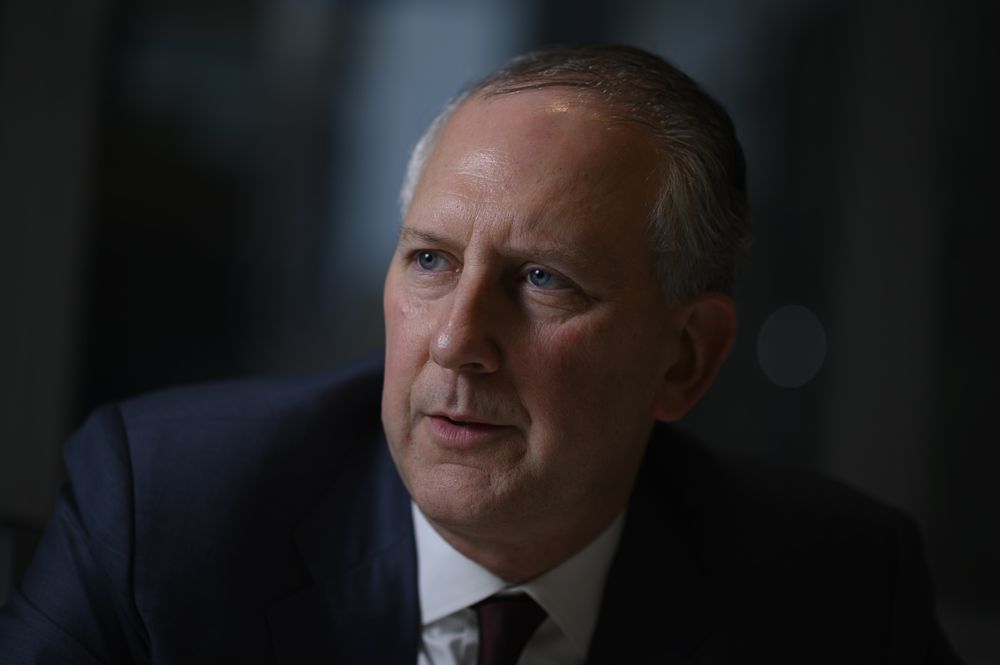

American International Group Inc. named Peter Zaffino as its next chief executive officer and indicated he’ll run a smaller and simpler company as the firm splits off its life-insurance business.

Zaffino, currently AIG’s president, will take over the top job on March 1, when current CEO Brian Duperreault becomes executive chairman, the company said in a statement Monday. AIG will also look to separate its life and retirement business, which accounted for about one-third of revenue last year. Duperreault, 73, recruited Zaffino to join him at AIG shortly after returning in 2017 to try to turn around the troubled insurer. Zaffino initially joined as chief operating officer but quickly took on a role helping fix the sprawling property-casualty business. His promotion to president at the end of last year stoked speculation that he would one day succeed Duperreault, and the decision to ditch life insurance serves as a capstone of the pair’s effort to simplify the company.

“AIG’s executive management and board believe a simplified corporate structure will unlock significant value for shareholders and other stakeholders,” the company said of the life-insurance divestment. It said no decision has been made on how to separate the unit. AIG is a rare U.S. insurer that has both a sizable life and retirement operation and a large presence in the property-casualty market. The company has rebuffed calls to break up the insurer before, most notably through its battle with activist investor Carl Icahn starting in 2015. Icahn, at the time, urged AIG to split up into three companies: one for its property-casualty units, another offering life insurance and one backing mortgages. AIG eventually sold the mortgage-insurance business.

Former CEO Peter Hancock argued that keeping the businesses together, at least in the short term, was important for tax and diversity reasons. But Chief Financial Officer Mark Lyons said in August that tax reform lessened that part of the argument, and that it was an issue management would routinely think about strategically.

Shares of the insurer climbed 6.6% to $33.33 at 5:48 p.m. in extended New York trading in New York. The stock had slumped 39% this year through Monday’s close. Life-insurer stocks have taken a beating this year as low interest rates pressure returns. MetLife Inc. has plunged 23% year-to-date while Prudential Financial Inc. shares are down 29%.

“After years of being poked, prodded and questioned, AIG is finally ready to pull the trigger and step back from its multiline strategy,” David Havens, a credit analyst at Imperial Capital LLC, said Monday in a note to clients. “While bondholders would lose the diversity benefit of a multiline platform, the market shows a clear preference for well-positioned P&C insurers over life/annuity insurers.”

What Bloomberg Intelligence Says

“We view Peter Zaffino as a solid choice for AIG’s next CEO. Given his success in the considerable effort of reshaping P&C underwriting and reinsurance, we have confidence in his ability to unlock value by successfully separating the life insurance unit. The P&C business may have a higher multiple as a stand-alone entity.”

--Matthew Palazola, senior industry analyst, and Derek Han, associate analyst

Duperreault’s arrival in 2017 led Icahn to ease his demands. The CEO has focused on fixing underlying issues that led to frequent charges as the firm was burned by old policies. That included shoring up underwriting at its property-casualty business and rejiggering its reinsurance use. “We are grateful to Brian for his leadership and expertise in guiding the strategic repositioning of AIG’s businesses as market leaders,” Douglas Steenland, independent chairman of the board, said in a statement Monday. “We are extremely fortunate to have an executive of Peter’s caliber and have great confidence about the future of the company under his leadership.”

Zaffino will be the latest leader to try and tackle AIG’s turnaround efforts. He’s held a range of jobs, including a stint at a General Electric Co. venture, leading Guy Carpenter and even helming Marsh & McLennan Cos.’ large-insurance brokerage business. Zaffino was most recently tasked with an effort called AIG 200, a series of initiatives for the firm to improve its operations and efficiency.

The company also said in a separate release Monday that it estimates it will take a third-quarter catastrophe loss of $790 million before taxes and net of reinsurance, with about $185 million of those costs related to Covid-19. An annual review of assumptions at its life and retirement and legacy businesses will produce a charge of $7 million after taxes in the third quarter, the insurer said. The company is set to report third-quarter results next week.

Source: Bloomberg