29-10-2020

29-10-2020

How life insurance policies invest your premiums

-2020-10-29-41-401.jpg)

Insurance Alertss

Insurance AlertssHow life insurance policies invest your premiums

Many life insurance policyholders often buy covers after looking at returns promised by insurance agents. Rarely do they delve deeper to find out how their premiums will be deployed. This is especially the case with endowment policies. These are relatively opaque as they do not disclose their portfolios or their NAVs (net asset values) daily unlike unit-linked insurance policies (ULIPs) or mutual funds. The reality is, insurance covers such as moneyback or endowment policies also invest the premiums that they collect from you.

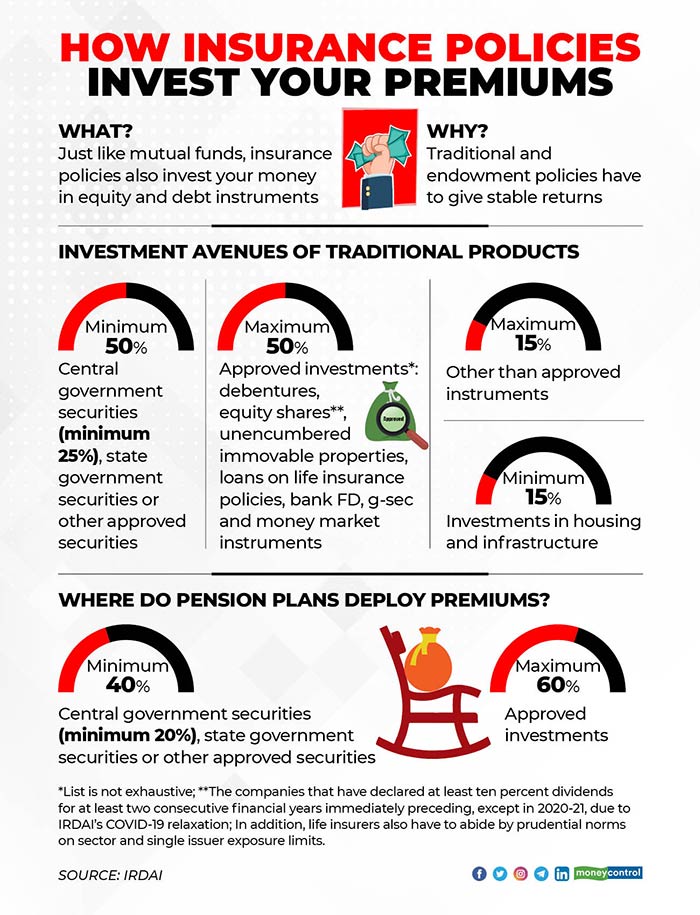

The Insurance Regulatory and Development Authority of India (IRDAI) has put in place regulations on how your money can be invested by life insurers.

In what kind of instruments do life insurers invest my premiums?

In the case of investment-cum-insurance products, it would depend on the type of product you choose. With Ulips, which offer market-linked returns, you have the freedom to take calls on how and where to invest – in equities, debt or a mix of both. “So, a large-cap or a mid-cap equity fund would have asset allocations in line with their filings in different categories of equity. Similarly, a debt fund would invest in government securities, corporate bonds and the money market as per its approved asset allocation. A balanced or hybrid fund would invest in debt and equity,” says Sandeep Nanda, Chief Investment Officer, Bharti AXA Life Insurance.

Traditional endowment policies can be participating and non-participating. In the case of the former, the insurer announces annual bonuses out of profits earned by its participating fund, besides terminal bonus at maturity. Non-participating plans offer guaranteed maturity corpus and returns. Traditional policies invest in government securities, corporate bonds and also equity.

Does IRDAI prescribe rules about the quality of underlying investments?

The insurance regulator has a detailed set of conservative investment guidelines specifying the type of instruments and allocations to these. “The regulations try to ensure that both Ulip and traditional funds are managed in a prudent manner without too much risk. To avoid too much concentration, there are issuer limits (no more than 10 percent investment in a single issuer) and sector limits (15 percent cap on investment in a sector, with the exception of banking and financial services where it is 25 percent),” says Nanda. To contain credit risk – which has taken its toll on debt mutual funds in the last two years – insurers can only invest in corporate debt with rating of AA and above. Even here, securities with AA rating cannot exceed more than 25 per cent of the portfolio, with the rest having to be AAA-rated.

“In the case of traditional funds, insurers are required to invest at least 50 percent in government securities and 15 percent in infrastructure and housing. This is to ensure that assets are in line with the long-term nature of the policy liabilities. This helps ensure that apart from concentration and credit risk, interest rate risk is also managed properly,” says Nanda.

Can insurance policies invest in equity? And do they have any restrictions?

Even in the case of equity funds, in the ‘approved investments’ basket, insurers are required to invest in companies that have declared dividends in two consecutive financial years immediately preceding the year of investment. According to this parameter, a company ought to have declared at least 10 per cent dividend in the preceding two financial years for it to be classified as an ‘approved investment.’

The IRDAI has, however, relaxed this requirement for making investments in the current financial year, factoring in the adverse impact of COVID-19 into account. “It has allowed insurers to buy and hold securities of companies that had declared dividends in at least two of the three immediately preceding financial years,” says Shyamsunder Bhatt, CIO, Exide Life. This was done after taking into account the extraordinary situation post the COVID-19 outbreak and the ensuing lockdown.” The RBI and IRDAI asked insurance companies to not declare any dividend last financial year. So, many blue-chip companies, particularly in the banking and insurance sectors, were not able to declare dividends for the financial year 2019-20,” says Bhatt. In other words, even if an underlying company did not declare dividend last year, it will not be classified as ‘other than approved’ security, as long as it has declared dividends in at least two of the three immediately preceding financial years. This means insurance companies can continue to hold them.

Else, stocks of several such blue-chip companies would have had to be re-classified as ‘other than approved’ securities as per the IRDAI’s criteria. “If it skips dividend payment in one out of these two financial years, it will be classified as ‘Other than approved.’ There are regulatory caps for investing in the latter category – 15 percent of assets under management in the case of traditional policies and 25 per cent for Ulips,” adds Bhatt.

Moreover, insurance pension funds are not allowed to hold any securities at all in the ‘Other than approved’ basket. The COVID-19-related relaxation helps such funds. “They can invest only in approved securities. So, they would not have been able to buy or hold securities of many blue-chip companies that might have had the ability to declare dividends, but got stalled by the regulatory diktat,” says Bhatt. If this leeway – valid for financial year 2020-21 – had not been granted, pension funds would not have had many leading Nifty blue-chip companies, especially from banking and finance sectors, in their portfolios. “They would have had to change their investment strategies to look for alternatives that might not have been as good. IRDAI’s move is in favour of policyholders too. Otherwise, their returns might have been adversely affected as insurers would not have been able to invest in several blue-chip companies,” Bhatt explains.

What is the rationale behind these regulatory caps?

Investment regulations’ objective is to protect policyholders’ interest by curtailing the risks that insurers can take. While Ulips are market-linked, policyholders expect a degree of assurance in terms of returns from traditional products. “Life insurance companies face greater stringency of investment regulations as they have shareholder funds (largely balance sheet surplus, and term and non-participating policy funds), policyholder funds (which are entrusted by policyholders as savings with returns to be added or given) and unit-linked funds,” says Joydeep K Roy, Global Health Insurance Leader and Leader, Insurance Practice, India, PWC India. In addition, they are also the custodians of any unclaimed funds of policyholders. The stringent regulatory oversight is aimed at ensuring prudent risk-taking so that the stakeholders of these funds do not suffer.