24-11-2020

24-11-2020

Lives covered under group schemes fall sharply this fiscal

Insurance Alertss

Insurance AlertssLives covered under group schemes fall sharply this fiscal

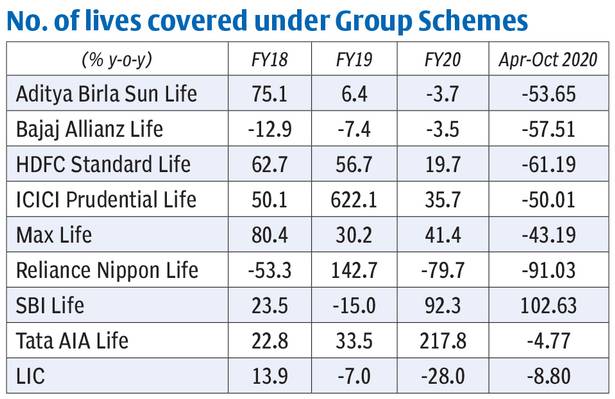

After a robust growth in recent years, lives covered under group schemes saw a sharp decline this fiscal for most players, according to data put out by IRDAI. In the April-Oct period, the total number of lives covered under group schemes for all life insurance players declined by 40.6 per cent to 6.8 crore lives from about 11.5 crore in the same period last year.

While the largest life insurer LIC saw 8.8 per cent y-o-y decline, leading private insurers such as HDFC Life, ICICI Prudential Life and Bajaj Allianz Life saw a steeper 50-60 per cent decline in the April-Oct period. Absence of lives covered under Pradhan Mantri Jan Dhan Yojana (PMJDY) this fiscal appears to have impacted LIC. On the other hand, for private players muted credit life business on the back of slower loan disbursements has led to a sharp fall in lives covered under group schemes.

Muted credit life

Credit life policies are essentially group policies issued by life insurance companies to financial institutions. They ensure that in case of death of the borrower, the amount of loan outstanding (or the chosen sum assured) is paid out by the insurer. The premium is determined based on the original loan repayment schedule (or opted sum assured), duration of the cover, and age of the borrower, among others. These policies are essentially single premium policies, and the premium is usually taken upfront by the insurerat the time of availing the loan.

Pandemic-led disruption saw muted loan disbursements across lending institutions in the initial months of the current fiscal, impacting the credit life business of insurance players.

According to Vibha Padalkar, MD and CEO, HDFC Life: “A large proportion of the lives under the group scheme are covered under Credit Protect ( term insurance attached along with a loan by a lender). HDFC Life is among the pioneers in this segment and also among the market leaders. There has been de-growth in the current year primarily on account of the slowdown in the loan disbursements.”

According to IRDAI data, the number of lives covered under group schemes fell by 61 per cent y-o-y in the April-Oct period for HDFC Life. However, the private insurer is witnessing a gradual recovery. “There has been a gradual pick-up in the credit protect segment with Q2 de-growth being lower at 36 per cent compared to 74 per cent de-growth in Q1. If the current trend sustains, we expect the credit protect business and, hence, lives covered to normalise to previous year levels by Q4 of the current financial year,” added Vibha Padalkar.

According to the post-September results management call, ICICI Prudential Life also saw its credit life being impacted in the first quarter of the fiscal due to lower retail credit off-take. But Q2 saw a strong recovery in the business. NS Kannan, MD and CEO of ICICI Prudential Life, had stated that the credit life business had declined by about 30 per cent for the half year compared to the last half year. But in he second quarter specifically, the business had seen a strong recovery ending at similar levels as last year. Otherwise, leaving credit life aside, group term business had seen very sharp growth, as severalwanted to take new policies for their employees or enhance the life cover owing to the pandemic.

For SBI Life, too, while the first quarter saw a fall in credit life business, in the second quarter, it was back to last year levels. Unlike HDFC Life or ICICI Pru Life, however, SBI Life has seen number of lives covered under group schemes more than double in the April-Oct period from last year, possibly due to a much smaller base and its relatively recent focus on the credit life business.

LIC’s marginal decline

Unlike private players, LIC’s group business mainly comprises conventional group term and social security schemes (rather than credit life). LIC has witnessed a much lower 8.8 per cent decline in lives covered under group schemes in the April-Oct period this year.

One of the key reasons for this decline could be the absence of lives covered under PMJDY this year. The PMJDY scheme intended to open a basic savings account for every unbanked person was launched in 2014-15. It included ₹30,000 life cover for a period of five years till the close of financial year 2019-20. Last year, LIC covered 94 lakh lives under social security schemes. It needs to be seen if the life cover under PMJDY is reviewed and continued this year.

Source: The Hindu Business Line

http://insurancealerts.in/