01-12-2020

01-12-2020

Fasal Bima profits of private insurers jump, as state govts, state-run firms falter

Insurance Alertss

Insurance AlertssFasal Bima profits of private insurers jump, as state govts, state-run firms falter

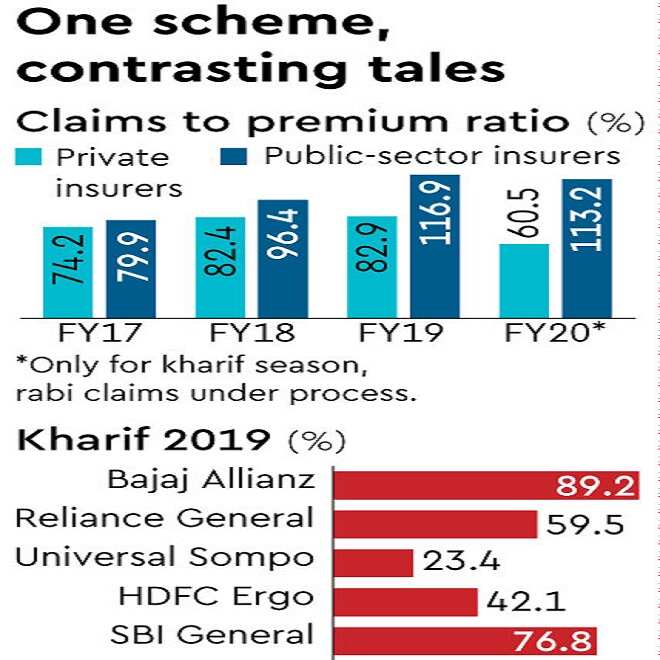

Some of the private insurers seem to have cut against the grain and found a lucrative business model under the Pradhan Mantri Fasal Bima Yojana (PMFBY), the government-supported crop insurance scheme. Claims to premium (CP) ratio of private insurers in kharif 2019 season stood at just 60%, and was as low as 23% in the case of one firm, implying their high profitability.

This is even as many public-sector insurers made losses under PMFBY – their aggregate CP ratio was 113% in the last summer crop season (see chart on Pg 1). While public-sector insurance companies have been nudged by the government to stay with PMFBY and even cover crops and areas that are highly vulnerable to the vagaries of nature, private insurers limit their PMFBY portfolio to the crops less likely to suffer damage. Also, private firms have had a less creditable record in admitting claims of farmers.

In three years since its 2016 launch , PMFBY became the third largest line of non-life insurance business in India. The private sector insurers are estimated to have made a surplus of Rs 12,500 crore in the last four kharif seasons (data as of November 16, 2020). But their profit could be around Rs 7,500 crore only after netting out 10% (of the gross premium) expenditure on reinsurance and other administrative expenses. On the other hand, the claims ratio of the public sector insurance companies was 102% (against Rs 48,000 crore collected as premium) during the last four summer seasons.

Currently, private and public-sector insurers have roughly equal share in the crop insurance business. The improved profitability of private insurers during kharif 2019 season, curiously, coincides with a trend among state governments to quit the PMFBY, citing rising premium bill. Andhra Pradesh, Telangana and Jharkhand wrote early this year to the Centre, communicating their decisions to exit the scheme. Gujarat also did not implement the scheme for kharif 2020 crop, while Madhya Pradesh took the plunge after some initial dithering. Under PMFBY, farmers’ premium is fixed at 1.5% of sum insured for rabi crops and 2% for kharif crops, while it is 5% for cash crops. The balance premium is split equally between the Centre and states.

Effective Kharif 2020, the Centre has decided that it will foot the PMFBY subsidy bill to the extent of its formulaic share so long as gross premium level is up to 30% of the sum assured in non-irrigated areas and 25% in irrigated areas. The onus is on the states if they want to implement the scheme even if insurers quote any premium above 25-30%. Meanwhile, the payout ratio (actual payment against claims made) for kharif 2019 improved to 85% till mid-November, as against only 61% till mid-June. The gross premium was Rs 23,930 crore while reported claims were Rs 20,764 crore for kharif last year.

Four private insurance companies — ICICI Lombard, Tata AIG, Cholamandalam MS, and Shriram General Insurance — had opted out of PMFBY for both the kharif and rabi seasons of the 2019-20 crop year, as the claims ratio in the states where they were operated in the previous year were quite high, leading to losses. During kharif 2019, among the six major private insurers (over Rs 1,000 crore premium collected by each) only IFFCO Tokio has claims ratio over 100%, while – Bajaj Allianz, HDFC Ergo, Reliance General, SBI General and Universal Sompo have reported much lower ratios.

“Selection of clusters during the bidding process is crucial in the crop insurance business as perennially drought or flood-prone districts increase the risk. Normally, it is seen that the public sector companies, particularly the Agriculture Insurance Company (AIC) win the bids in high risk districts,” an analyst said. Out of about Rs 12,000 crore premium collected by public insurers AIC had a share of nearly 85% during kharif 2019. In the crop insurance business, PMFBY has about 90% share while the other scheme, RWBCIS, has the remaining 10%.

Source: Financial Express