08-12-2020

08-12-2020

Tech innovations that can transform the Insurance sector by 2021

-2020-12-8-49-0.jpg)

Insurance Alertss

Insurance AlertssTech innovations that can transform the Insurance sector by 2021

Despite the many economic impacts of the COVID virus around the globe, the current pandemic has largely been a health problem. Among the severely impacted, India now ranks among the top 3 countries in the total number of cases and deaths.

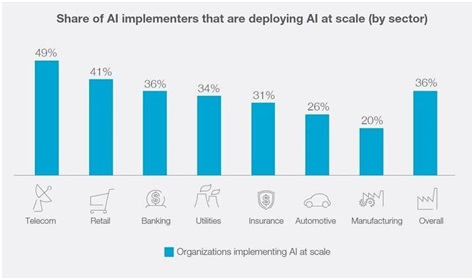

In this age of global pandemics and health crises, is the insurance sector responding to the changing global scenarios through more customer-centric life and health insurance plans? When it comes to technological innovations, no industry sector – including insurance – can now hope to survive (or scale to the next level) without adopting the latest cutting-edge technology.

Going forward, here are the top 5 technological innovations that are set to transform the insurance industry in 2021:

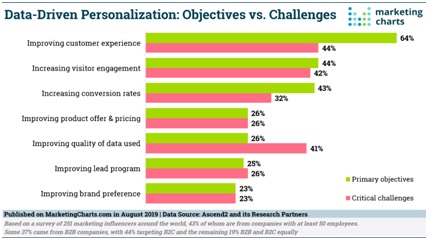

1. Data-driven innovations

Data is driving most of the technological innovations across various industries – and it is no different for the insurance sector. With the majority of insurance users wanting services that are customized to their personal needs, insurance providers are now leveraging Big Data to rope in more customers.

An example of this is a U.K-based insurance company that is offering lower health insurance premiums to fit and healthy individuals (with a higher score on their fitness trackers).

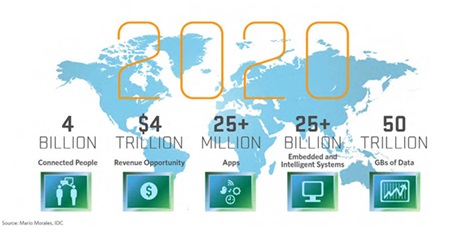

With the ever-increasing improvement in IoT, this digital technology holds great potential to transform the insurance sector with faster and accurate results.

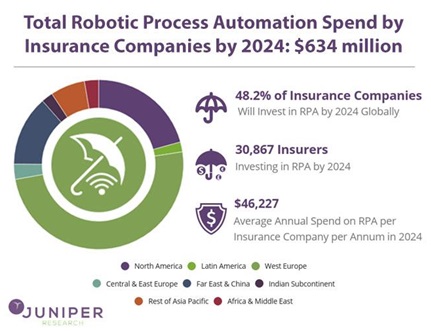

5. Robotic Process Automation (or RPA)

Like it or not, every insurance company must deal with loads of repetitive administrative tasks like underwriting, claims processing, and addressing customer queries. One technology that can automate these tasks is Robotic Process Automation (or RPA) – which can drastically reduce operational costs and the workload.

Going by a Capgemini report, RPA can improve productivity in insurance companies by 50%. In another recent use case, a global consultation firm could save annual work time of 54,000 hours with 85% accuracy – after adopting RPA.

Conclusion

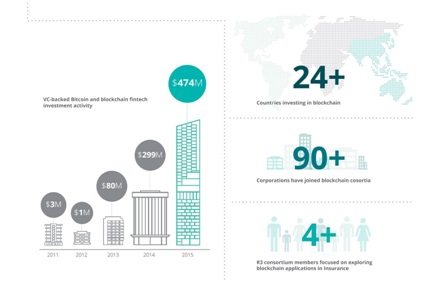

Technology innovations have caused major disruptions in global industries including the insurance sector – while creating new opportunities for insurance players to tap into. Through this article, we have only outlined a few ways in which technologies like AI, Blockchain, and IoT are transforming the way insurance companies operate in today’s dynamic environment.

Does this mean that you should go ahead and adopt each of these technologies into your insurance company? Not necessarily. Choose the technology that offers the most value to the insurance domain that you are operating in – before diving in.