21-12-2020

21-12-2020

Telangana floods: Insurance cos get paltry Rs 290 crore claims

Insurance Alertss

Insurance AlertssTelangana floods: Insurance cos get paltry Rs 290 crore claims

HYDERABAD: Despite Telangana suffering extensive damage due to the incessant rains and subsequent floods in October, insurance companies have received claims of a meagre Rs 290 crore so far. Companies say that this is an indication of low insurance penetration in the region amid a rise in the number of extreme weather conditions in recent years.

Data procured from the General Insurance Council (GIC) shows that insurance companies have received about 6,400 claims so far. Of these, about 5,500 pertain to motor insurance and the rest are for property and goods-related damages

While the number of motor claims are high, their total value is just Rs 80 crore. By contrast the number of property insurance claims is just 400 but the value is around Rs 130 crore. Insurers pointed out that most of the property-related claims were made by small and medium enterprises (SMEs). Insurers had earlier indicated the overall loss in Hyderabad floods could be much lower than those filed for the 2015-16 Chennai floods where over 50,000 claims worth over Rs 5,000 crore had poured in.

Sanjay Datta, chief (underwriting, claims and reinsurance), ICICI Lombard General Insurance, said overall claims were lower in Hyderabad because the extent of damages was also much lesser as compared to Chennai. Besides, the flood had impacted not just the city of Hyderabad but adjoining areas as well, as a result of which loss was not concentrated in the urban region but beyond, where the penetration of insurance is low, Datta added.

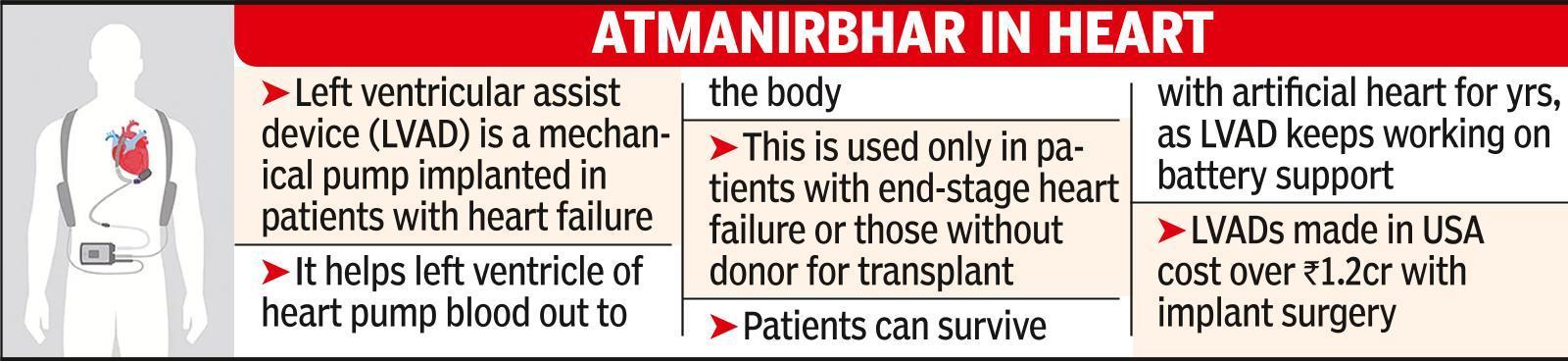

In Hyderabad, many citizens were left with damaged vehicles and properties, but lack of comprehensive motor insurance and home insurance covers saw many people having to spend from their own pockets for repairs. While motor insurance is mandatory and vehicle owners are expected to have at least a `third party liability’ motor cover, the issue with this cover is that it does not offer protection against damages caused by natural calamities.

Kshitish Kumar Mohanty, head – corporate planning and product development, Universal Sompo General Insurance pointed out that home insurance accounts for only about 2% of the total premium collected by general insurance companies in India. Most of the home insurance policies are home loan-linked and they generally cover flood-related damages, he said.

“India is among the most disaster-prone countries in the world. Additionally, unplanned urbanisation, development within high-risk zones, changing demographics, environmental degradation, and climate change are adding to the risk. Hence, all home owners without exception should opt for home insurance since the rates are not prohibitive,” he added.

In October, the state had estimated crop loss at Rs 8,633 crore, loss to roads at Rs 222 crore and loss to GHMC at Rs 567 crore. However, it has not come up with any estimates of total loss to private property.

Source: The Times of India