14-01-2021

14-01-2021

Insurance purchases in India shifting rapidly to online modes: Swiss Re

Insurance Alertss

Insurance AlertssInsurance purchases in India shifting rapidly to online modes: Swiss Re

The coronavirus pandemic is accelerating the use of digital platforms in India, offering insurance companies a vital new pathway to connect with and serve customers. Consumer surveys and sales data this year show that the pandemic has rapidly raised public awareness about both health risk and insurance in India – and insurance purchases are shifting rapidly to online modes, reveals the latest Swiss Re study.

According to the study, supportive government policies and a COVID-enforced spike in digital activity are pushing consumers – and their insurance needs – online. The growing presence of e-commerce and digital wallet apps presents opportunities for innovative partnerships between insurers and digital platforms to bridge the $369-billion health protection gap in India.

The survey results underline Indian consumers’ extensive use of digital platforms and their preference to purchase insurance through them. Around 65% of Indian respondents are likely to use digital channels such as e-wallets, bank or insurance websites and e-commerce platforms to purchase insurance in the future, indicating there is potential for primary insurers to move their offerings online and engage new digital consumers.

The Swiss Re Institute study, titled “Going Digital – Insights to Optimise Consumer Appetite for Online Insurance”, surveyed 1,800 consumers in India, Indonesia and Malaysia in June 2020 to understand their attitudes toward digital platforms and perceptions of buying insurance online. The survey also tested their acceptance of selecting and purchasing six life and health insurance products tailored to fit digital platforms. The three Asian economies represent a combined population of over 1.5 billion people, with a burgeoning middle class increasingly dependent on technology and connectivity to drive their decision making.

Survey respondents were household decision-makers aged between18 and 65 and had used digital platforms at least once within three to six months prior to being surveyed. These digital platforms include e-commerce apps/websites, payment/ digital wallet apps, health-tracking apps, connected commuter platforms, among others.

“Health and safety measures intended for curbing the spread of COVID-19 have now driven a clear paradigm shift towards digitalisation in the post-virus era,” said Hadi Riachi, Market Head, Swiss Re India, adding, “With an increasing number of digital platforms extending their business reach into financial services, insurers need to adapt their business models to become more relevant and responsive to the latest customer needs.”

“There is also an opportunity to reduce the digital divide by adding more 3G, 4G and even 5G connectivity across India to change consumer behaviour, and this includes how they purchase insurance. Three quarters of rural India have mobile phone connectivity, according to an Indian government survey last year,” said Hadi. “We have the opportunity to leverage technology to make insurance more accessible to those underserved in our society, helping them and their families to reduce their health protection gap.”

Increasing receptiveness to buy insurance digitally

The survey results indicate that digital platforms have high penetration rate in India, with an average of 90% using these channels at least once a week.

Among them, digital payment apps such as Paytm are most popular, used by 85% of Indian respondents at least once a week, closely followed by health-tracking apps (84%), e-commerce apps and websites (76%) and connected commuter platforms (69%).

Digital wallet and e-commerce apps are most suitable for online insurance distribution

There is also a growing trend in seeking insurance information and buying insurance digitally. Traditional channels, such as agents, brokers or insurance aggregators are still the primary channels for insurance-related information searches in India. However, 65% of respondents in India expressed interest in using online channels to purchase insurance.

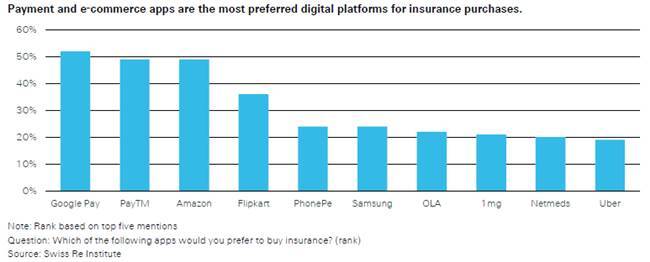

Among the different types of digital platforms, consumers in India indicated a stronger preference towards purchasing insurance through payment/digital wallet and e-commerce platforms. This preference is driven by the respondents’ trust in the platforms where payment/digital wallet apps were rated as most credible, followed by bank and insurer website or apps, and e-commerce platforms.

Combining online and offline customer support will be key

When respondents were asked why they want to purchase insurance digitally, ease of application and getting the best premium rates are the top reasons across three markets. However, respondents also expressed various concerns when buying insurance online. 45% of Indian respondents find it hard to decide on the best product while 37% said there is no agent to help explain the terms.

“Our survey results reveal that while digital insurance is becoming more popular, offline support is still necessary due to the need for guidance and assistance for certain products. It is important for insurers to adopt an omni-channel approach to complement online customer journey with personal assistance to address consumer concerns.” said Hadi.

Strong preference for simpler critical illness and medical reimbursement insurance on digital platforms

The survey tested six hypothetical life and health products to gauge consumer interest in insurance offered through different digital channels. They include medical reimbursement insurance, cancer reimbursement insurance (to cover cancer-related medical expenses), critical illness pay-per-use insurance, cancer insurance (pays a lump sum upon cancer diagnosis), hospitalisation cash – parametric haze/ smog protection and income protection for gig workers.

The results show that Indian consumers (nearly 80%) are strongly inclined to purchase hospitalisation cash and critical illness pay-per-use insurance through digital platforms, but the other four products also have relatively high levels (over 70%) of interest.

Opportunities for insurers and digital platforms to leverage insurance solutions

The survey illustrates partnership opportunities between insurers and digital platforms that will benefit the entire insurance value chain and unlock demand from new insurable risk pools.

Partnering and working with digital platforms and ecosystems will give insurers access to millions of consumers that are often under-protected. Insurers should leverage data collected from the platforms, such as health tracking apps, for personalised wellness programmes and a more holistic risk assessment by incorporating lifestyle factors like physical activity and sleep. This could transform life and health insurance, where risks evolve over time and individual behaviours influence health outcomes.

Meanwhile, digital platforms can benefit from business diversification and stronger customer loyalty by offering financial services online. Partnerships across industries can also offer digital platform expertise in different domains at low cost of failure and minimal risk to their mainstream offerings

Source: Financial Express