21-01-2021

21-01-2021

Global reinsurance outlook to remain negative

Insurance Alertss

Insurance AlertssGlobal reinsurance outlook to remain negative

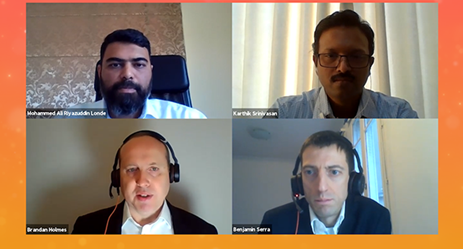

A panel discussion chaired by Moody's Investors Service senior vice president, financial institutions group Benjamin Serra looked at insurance/reinsurance credit trends and rating outlooks for the industry.

Indian market growth to remain flattish

The discussion focused on the operating challenges faced by the industry as a result of the COVID-19 pandemic and its adverse impact on profitability and rating.

ICRA senior vice president and group head – financial sector ratings Karthik Srinivasan said that the pandemic has brought to the fore the importance of health and protection in the Indian market and with the introduction of a standard health insurance policy in the market last year will help increase insurance penetration.

“India doesn’t have a social security mechanism and so low-ticket products backed by the regulator will help the industry grow in the long run,” he said. He expects industry growth to remain flat over the short term but predicts that with economic activity picking up the market will once again regain its double-digit growth momentum.

Indian regulator’s proactive steps during pandemic

Moody’s Investors Service vice president – senior analyst, financial institutions group Mohammed Ali Londe said that the Indian insurance regulator has been very active in the pandemic and took a number of steps for the development of the industry and also for the benefit of consumers. This, he said, has helped create demand for insurance products in the Indian market.

“Insurance penetration in the Indian market is growing, albeit slower than other markets, but the COVID-19 pandemic has helped the market grow, especially health insurance,” he said. Speaking of the health insurance industry in the Middle East region, which he said was not impacted by the COVID-19 pandemic, as governments undertook the cost of treatment for the virus.

Highlighting some of the social risks companies had to face during the pandemic, Mr Londe said some governments in the region have asked insurers to offer motor insurance cover free for two months and that insurers have gained from the low claims’ ratio in the pandemic. “In some jurisdictions where there was no government pressure, insurers have otherwise felt the need to offer discounts to their renewing customers when there were no claims on top of what they were already providing,” he said. In this situation, insurers have become more vocal on their CSR policies by showing that they are giving back to society from what they have gained during the pandemic, he said.

COVID-19 created awareness of insurance

Moody’s Investors Service vice president - senior credit officer, financial institutions group Brandan Holmes said that insurers globally have noticed an increase in demand for protection plans along with consumer awareness on life and health products. He said that there has been an accelerated shift to digital distribution during the pandemic and said that insurers with these capabilities were able to soften the impact of lower sales.

BI has been a huge challenge for insurers in many jurisdictions. “There has been a huge mismatch in what the policy holders thought they were getting and what insurers were intending to put in the wording,” he said. This, he said, has led to a lot of uncertainty for insurers with the courts having to get involved in some countries. He believes that this will have a significant impact on both commercial P&C and reinsurance pricing.

“Price rises are happening globally and even in countries where there has not been any significant BI impact, insurers are also feeling the pressure of rising prices,” he said. He predicted that the global reinsurance outlook would remain negative as COVID related claims pile up with reinsurers and believes that there needs to be an adequate increase in prices for the industry to sustain in the long term.

Less impact on life insurance

Mr Holmes said that globally the life insurance industry was not impacted as severely as expected. The virus impacted older people who did not have life insurance cover and on the other hand there was the socio-economic angle where life insurance policy holders are wealthier and healthier people who are able to shield themselves from the virus.

Source: Asia insurance review