01-02-2021

01-02-2021

IRDAI chief cautions India Inc on Cyber Risks, 14 general insurers issue 38,000 individual cyber covers

Insurance Alertss

Insurance AlertssIRDAI chief cautions India Inc on Cyber Risks, 14 general insurers issue 38,000 individual cyber covers

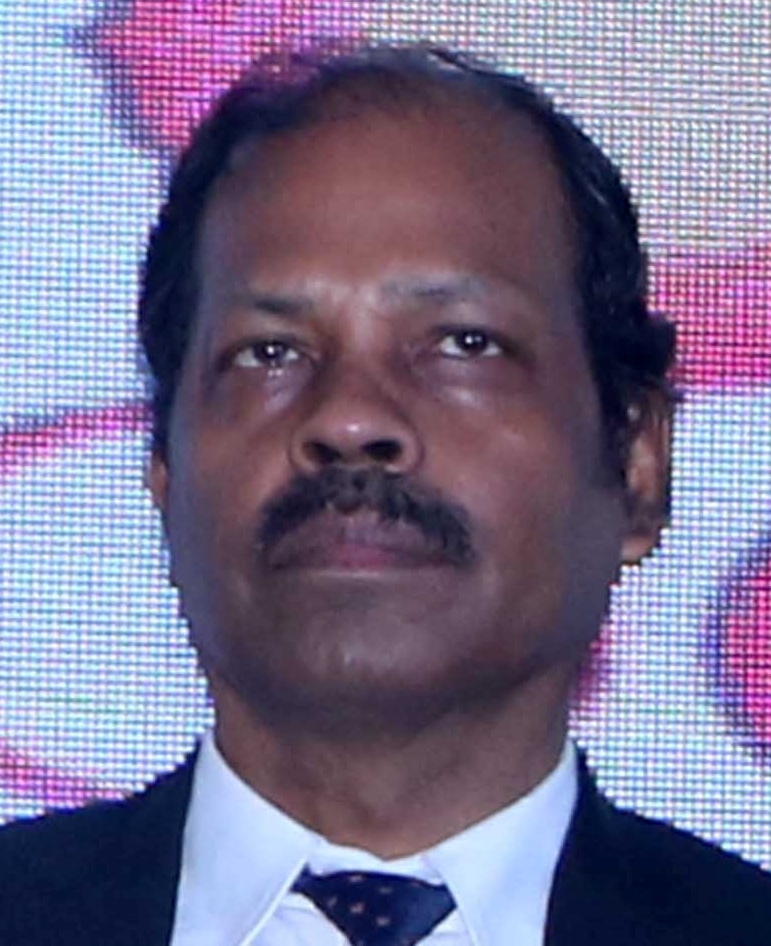

Mumbai: Despite cyber risks looming large in the Indian economy, only 14 Indian general insurers have issued 38,000 individual cyber covers,said Subhash Chandra Khuntia, chairman, IRDAI

Khuntia was addressing `` The Global Cyber Insurance Summit 2021'',the first -ever such international event organised virtually, on Friday, by GIC Re, Data Security Council of India and City of London Corporation, to identify and discuss leading cyber risks faced by corporates and deliberate over robust cyber insurance policies that businesses must adopt to respond to a constantly evolving cyber threat environment.

According to a senior Marsh India official,, not more than 400 to 500 Indian corporates have bought cyber policies. The average policy size of a cyber insurance policy, in the BFSI segment, ranges from $ 1-$ 50 million while a few have taken covers for about $ 300 million and the largest policy size in this segment is at $ 400 million, said the official. .

Indian market has also seen a few claims in the current year and total claims paid by the Indian general insurers will be around $ 10 million,

``Thanks to Covid-19 Pandemic situation, all the claims have been efficiently settled by the insurers. The cyber policy size has remained small in India despite having high awareness on the risk, he said.

``When a great deal of economic activities have turned digital during Covid-19 pandemic,the insurance companies are hesitating to provide cyber covers and there are constraints and challenges in terms of capacity, pricing(in absence of historical data), underwriting for the insurers while dealing with the cyber risks, said Khuntia

Reinsurance capacity in the cyber risks are also limited,’ he added.

``There are new technologies in the economy and also new ways to assess risks that are part of these technologies.There is a lot of information asymmetry. We must be aware that any kind of cyber incident will have impact on other segments of the economy and the other branches of insurance also will be affected,’’ he explained.

``We have made audit cyber risks compulsory for the Indian insurance companies. So, we need to develop a strategy how to develop this segment in a robust manner for the future kind of attacks,” Khuntia pointed out..

Devesh Srivastava CMD, GIC Re said,“Cyber is the final frontier. So clandestinely go where the access window is the easiest, is the maxim of the new cyber criminals. Awareness is half the battle won.’’

Catherine McGuinness, Policy Chair at the City of London Corporation said,``:The City of London is already a world leader in both the insurance and cybersecurity sectors, so it is well-placed to take a leading role in the cyber insurance space. Today's Cyber Insurance Summit in association with GIC Re and Data Security Council of India demonstrates that cyber insurance is a great opportunity to deepen the already close ties between India and the UK."

Global Case Study presented by Shay Simkin, global cyber Head at Howden and who is known for issuing the first -ever cyber policy in the world in the late 1990s,highlighted that globally,the Cyber Risk is the No.1 Risk among the ``Top 10 Business Risks in 2020.’’

Demands for Cyber coverage will continue to grow by 26.3 per cent CAGR between 2020 and 2030, he said..

The insurance industry is under pressure and , structure of the cyber products needs to change. Cyber education is the key, whilst cyber risk can be managed, it cannot be eliminated, he explained. Rama Vedashree, CEO, Data Security Council of India said that post pandemic, India witnessed an accelerated drive towards digitalization and cyber risk and attack increased manifold with targeted phishing, ransomware and social engineering attacks, and a new league of threat actors (state & non-state) emerging.

``There is an imminent need for a holistic risk assessment of the digitization drive at a country, sector, and company levels both from a security and privacy standpoint. The cyber Insurance industry needs to step-up to evolve more nuanced policies aligned to the digital risk quotient of a sector and a company, ” he said.

Sriram, CEO, Cybersecurity Centre of Excellence, DSCI said that the ``Cybersecurity Centre of Excellence’’ is a global hub that is committed to creating a safe, secure and trusted cyberspace, and also in growing the cybersecurity market.

Cyber Insurance is an essential part of the cyber Response strategy in the event of a breach. ``The Cybersecurity Centre of Excellence’’ is committed to collaborating with all the industry stakeholders to increase cyber insurance penetration in India.

``We’re working with technology companies, insurance providers, industry bodies, startups, user enterprises, governments, academia and R&D institutes to help drive deeper engagement in Cyber insurance and associated areas,” he said.

Source: Asia Insurance Post