11-02-2021

11-02-2021

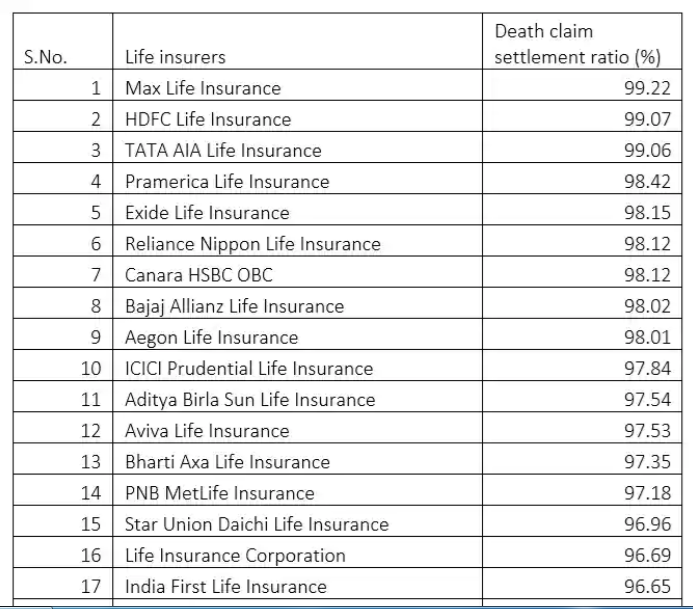

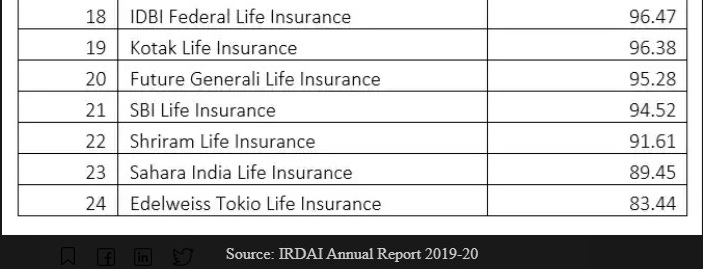

Irdai death claim settlement ratio of life insurers for 2019-20

-2021-2-11-52-687.jpg)

Insurance Alertss

Insurance AlertssIrdai death claim settlement ratio of life insurers for 2019-20

When you buy a life insurance policy, you always think that your beneficiaries should get the sum assured after your demise. This is because, in the event of your death, the payment (sum insured) from the insurer will ensure that your dependants have enough funds to fulfil their future financial goals.

But what if the insurer doesn't settle the beneficiary's claim? It is therefore important for you to understand which insurer has maintained a good track record in settling death claims.

On 10 February 2021, the Insurance Regulatory and Development Authority of India (Irdai) has published the latest 'Death Claim Settlement Ratio' in its 2019-20 annual report.

The death claim settlement ratio is defined as the percentage of insurance claims settled by an insurer compared to the total number of claims received. For instance, if the death claim settlement ratio of an insurer is 96%, it means that the insurer has settled (paid sum assured to the beneficiary) 96 death insurance claims out of every 100 insurance death claims received. This way the death claim settlement ratio is said to be 96% as the remaining 4% insurance claims were rejected by the insurer on certain grounds. One may even check the reasons for rejection with the insurer while buying a life insurance policy.

The below table shows the regulator's latest death claim settlement ratio of life insurers for the year 2019-20:

The death claim settlement ratio mentioned above are published annually by Irdai, that is, published for the previous year in the annual report.

Source: Live Mint