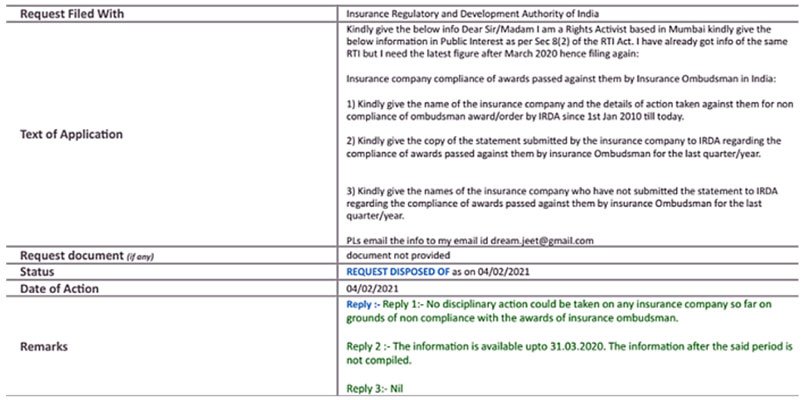

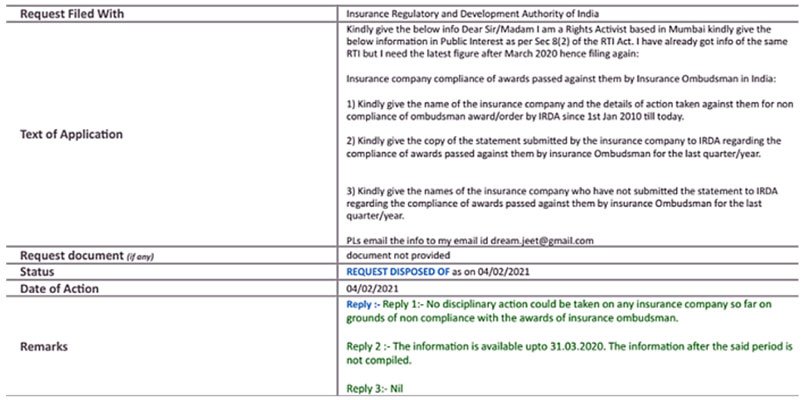

The Insurance Regulatory and Development Authority of India (IRDAI) has admitted, shockingly enough, that in over 10 years, it has not taken any action against a single insurance company for non-compliance with awards or orders issued by the insurance ombudsman. This admission was made in response to a Right to Information (RTI) query filed by Mumbai-based RTI activist Jeetendra Ghadge. The activist had filed an application with IRDAI seeking details about the insurance ombudsman scheme and action taken. Replying to his query on action taken against insurance companies for not-complying with the award or orders of the insurance ombudsman, the IRDAI says, "No disciplinary action could be taken on any insurance company so far on grounds of non-compliance with the awards of insurance ombudsman."

This shows that when it comes to providing relief to consumers, IRDAI, like most other regulators curl up in a shell. Even after the office of insurance ombudsman passed orders and gave awards, there is zero action by the insurance regulator against any insurer for not complying with it. This highlights how much importance is given to consumer grievance redressal by the regulator.

Just in 2019-20, around 1,864 awards are pending with the private and public insurance companies for implementation. As per the reply received under RTI by Mr Ghadge during 2019-20, the offices of the insurance ombudsman passed awards or issued orders in 9,528 cases against insurers in the public as well as privatesectors. Of these, in 7,664 cases the insurance companies complied with the award or orders. However, there still are 1,864 cases pending with the insurers for compliance with the decision of the insurance ombudsman.

Among all the insurance companies with whom awards are pending, the public sector companies are at the forefront. The Oriental Insurance company has a maximum of 480 awards pending with them, the New India Assurance has 303 and the National Insurance Company has 289 awards pending. In the private sector Bharti Axa Life Insurance has 198 awards pending without any action from the ombudsman against these companies.

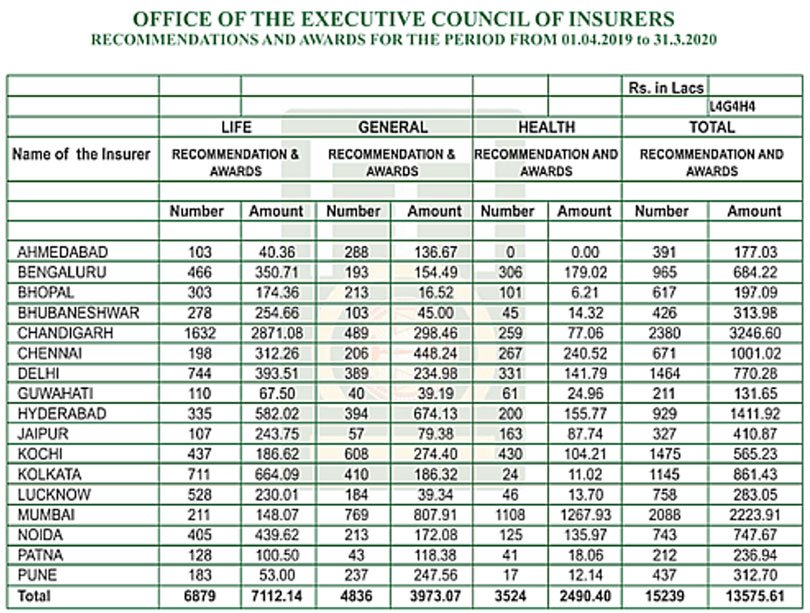

The Executive Council of Insurers (ECI), previously known as Governing Body of Insurance Council (GBIC) established under the Insurance Ombudsman Rules, 2017, facilitates the institution of insurance ombudsman in India. As the information displayed by the ECI on its website, there are 17 offices of insurance ombudsman across India.

Insurance ombudsmen are appointed by the ECI and are empowered to entertain complaints against insurance companies and their agents and intermediaries in respect of personal life insurances, group insurance policies, policies issued to sole proprietorship and micro enterprises.

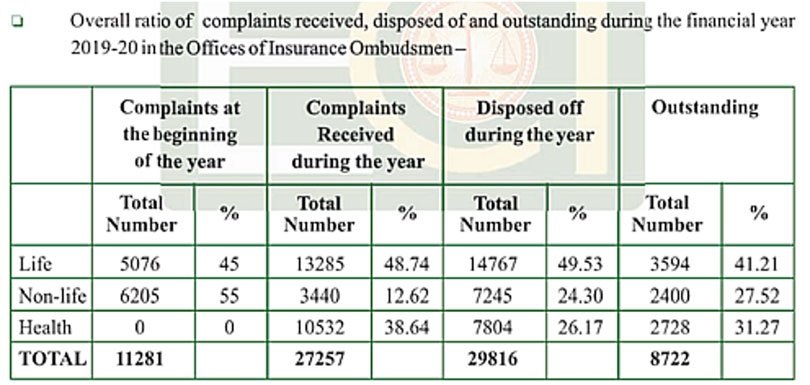

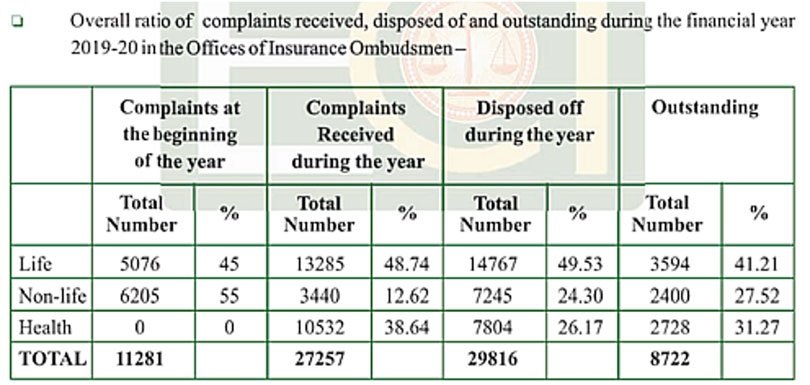

As per the annual report of ECI, at the beginning of FY2019-20, there were 11,281 complaints, including life, non-life and health insurance, pending with the offices of the insurance ombudsman across the county. During the year, it received 27,257 complaints, taking the total number of complaints to 38,538. Out of this, it disposed of 29,816 complaints leaving 8,722 complaints as outstanding.

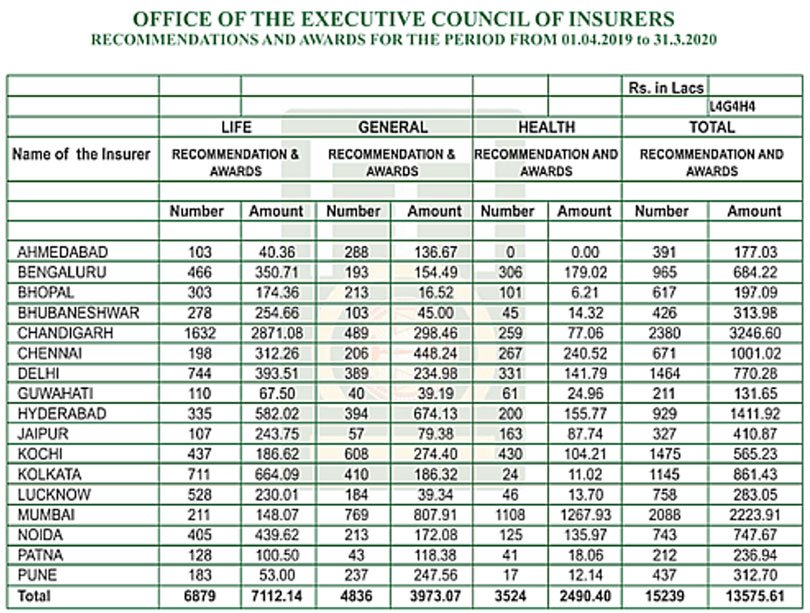

From 1 April 2019 to 31 March 2020, the 17 offices of the insurance ombudsman issued recommendations and awards in 15,239 cases, amounting to Rs13575.61 lakh.

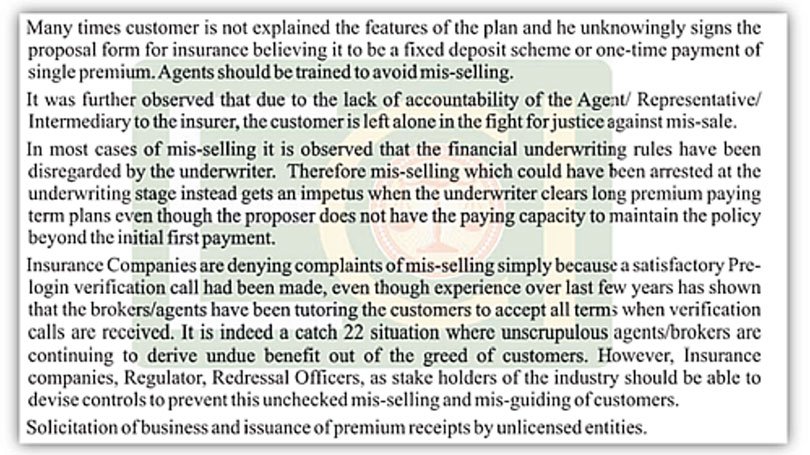

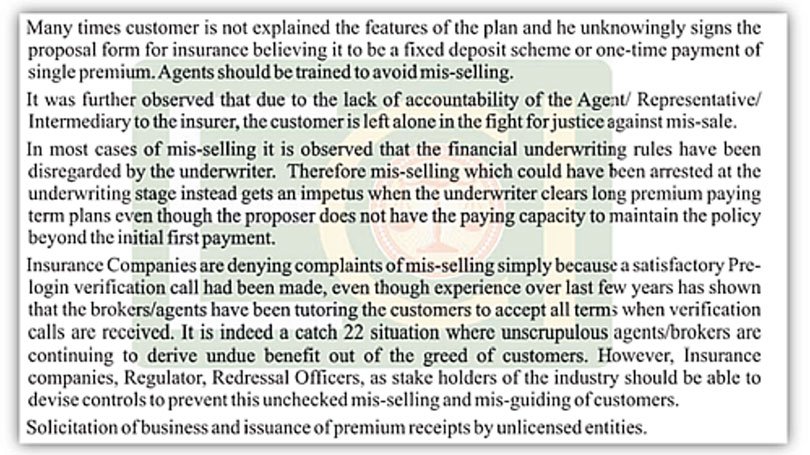

The ECI report highlights that in life insurance, maximum complaints received are related with mis-selling and maximum the number of complaints are against private insurers. "The other major chunk pertains to partial or total repudiation of death claim and the remaining pertains to non-receipt of policy bond, dispute regarding premium paid or payable in terms of the policy and other policy servicing related grievances," it says.

The number of cases of mis-selling are generally based on fraud and forged signatures of policy holder or life assured on the proposal form and benefit or sales illustration, the ECI report says, adding, "Mis-selling can be reduced by making consumers aware of insurance especially in the rural areas. The companies, IRDAI and the office of the insurance ombudsman should hold meetings involving panchayats, local administrators and non-government organisations (NGOs) to spread awareness about insurance."

In general insurance, many complaints are about motor and health insurance, which occur mainly due to reasonable and customary exclusion clauses. ECI says, "Third Party Administrators (TPAs’) decision on the settlement of claims should not be final and the matter should be reviewed by the insurer to arrive at a judicious decision. Most general insurers do not have any established system for review of the claims rejected by their TPAs. Even when the complainant approached the grievance cell after repudiation of the claim by the TPA, the insurer seldom examined the claim dispassionately. In some cases, the insurer depends upon the TPA to represent cases before the ombudsman."

As mentioned above, even the ECI had expressed concern over insurance companies not complying with its awards and orders. "Insurance ombudsman orders are binding on the insurers," it says, "But it is seen that the insurers sometimes do not implement the orders or implementation is not done on time. This is a concern now, which might eventually lead to loss of faith in the system."

"...IRDAI has taken note of such lapses and has advised the insurers for timely compliance failing which will attract stern action. The insurers must honour the decision of the insurance ombudsman and must necessarily comply with the orders fully and on time. This is the need of the hour," the ECI says in its annual report.

However, as the reply received under the RTI Act shows, insurers are not too prrticular about following orders passed by the insurance ombudsman. In such a case, IRDAI must step in and take strict action against the insurers, who are not complying with the orders passed by ombudsman.

"The IRDAI should shut down the Ombudsman if the awards are thrown in the trash by the insurance companies, why waste time of poor victims having insurance-related grievances? Let them approach the consumer courts or civil courts instead. If IRDAI really intends to help citizens, action must be taken against insurance companies who do not comply with the awards," says an agitated Mr Ghadge, who is also part of a non-government organisation (NGO) The Young Whistelblowers.

Source: Moneylife News & Views

02-03-2021

02-03-2021

Insurance Alertss

Insurance Alertss