12-03-2021

12-03-2021

Term life covers set to become pricier in FY22

Insurance Alertss

Insurance AlertssTerm life covers set to become pricier in FY22

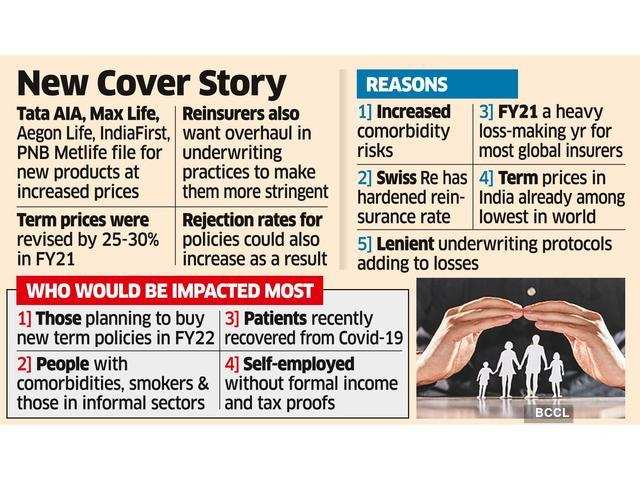

Insuring life is set to get more expensive and harder in the fiscal year starting April. Increased comorbidity risks due to the pandemic and the adverse loss experiences of global reinsurers are set to weigh on how life covers are priced.

Over the coming months, the premium on term covers is set to be raised at least 10-15% by most private sector insurance companies amid a hardening of rates by at least one large foreign reinsurer–Swiss Re — to curtail losses, according to industry executives and experts.

At least five private insurers – Tata AIA, Aegon Life, Max Life, PNB Metlife and IndiaFirst Life – have already filed for new term products with the insurance regulator at increased prices for the new fiscal year. Other life insurers may soon follow.

ET couldn’t independently verify whether state-owned Life Insurance Corp of India (LIC) — the largest life insurer in the country—would also increase prices of protection products. Swiss Re, Tata AIA and Aegon Life didn’t respond to queries. Max Life and PNB Metlife declined to comment. “Reinsurance contracts will set in from April 1,” said a person aware of the matter.

Rejection Rates may Increase

“There is a view that reinsurers can’t support term prices in India, which they feel don’t adequately capture the risks," said the person. "Across the world, disproportionately, FY21 for most global insurance companies was one of the heaviest loss-making years in history. The decision to harden the rates is seen as an attempt to recoup some of these losses."

Moreover, reinsurers also want Indian life insurers to overhaul underwriting practices to make them more stringent and standardised. Therefore, rejection rates for insurance policies, especially for those prone to comorbid risks, could also increase. Stricter protocols for telemedicine-based underwriting may also be enforced, a second person said. "Insurers may only issue policies to those that can refurbish income and medical proofs," the person said.

According to Vishakha RM, chief executive of IndiaFirst Life, the decision to increase the term price was taken in view of an increase in claims. "Term insurance as a business is capital intensive and rise in claims inadvertently reflects in loss ratios," she said. "Now, there are two schools of thought: one is that you either write off these losses, which puts pressure on other portfolios. Or you increase the prices to support these risks."

Companies may differ in approaches to pricing risk depending on portfolios and their existing product range, Vishakha said. The upcoming revision in term prices is on top of a 25-30% hike in premiums by life insurers in FY21—a large reinsurer had cited "adverse claims experience" as a reason to harden rates. Experts pointed out that India has among the lowest term prices in the world. For a 30-year-old, non-smoking Indian with a Rs 1 crore cover, the annual premium typically ranges between Rs 10,000 and Rs 20,000.

India’s life insurance penetration – the premium accrued as a ratio of GDP — at just 2.94% in 2019 is significantly low compared with Asian economies such as China (4.3%) and Malaysia (4.7%). A rise in term prices and stringent underwriting protocols, especially for the less affluent sections of society, could hamper penetration even further, one industry insider pointed out.

The coronavirus pandemic merely advanced the price hike as the country’s life insurance industry was already of the view that the prices were too low to stand the scrutiny of market principles, said Institute of Actuaries of India (IAI) president Subhendu Bal. "The pandemic is a trigger for insurers to readjust the rates, which most insurers and reinsurers already felt was too low," said Bal, who is also chief risk officer at SBI Life Insurance. "Some players that had priced their products too low to gain competitive advantage will have to make more stark adjustments to prevent losses. It’s about achieving the correct balance between pricing and risk."

According to the chief executive of a leading private insurer, the price rise of term products could be in tranches and in the form of new products as the Insurance Regulatory and Development Authority doesn’t allow any sudden revision in term rates. "Insurance is a heavily regulated industry and any proposal to revise term rates incurs regulatory scrutiny on various counts," the executive said. "We may see several new products getting filed in FY22 which would reflect higher risk pricing."