18-03-2021

18-03-2021

Covid-19 insurance claims spike as infection cases surge in March

Insurance Alertss

Insurance AlertssCovid-19 insurance claims spike as infection cases surge in March

With new cases of Covid infections on the rise in the past few weeks, hospital admissions, too, have gone up, resulting in a spike in the number of claims general and health insurance companies are receiving.

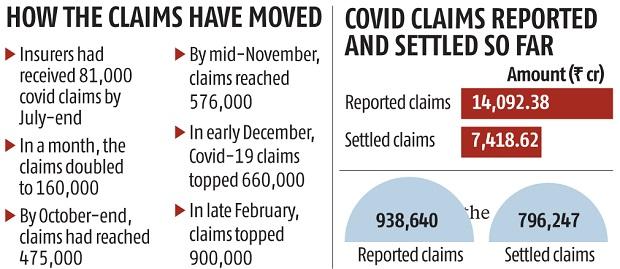

As of March 15, general and health insurers received 938,640 claims related to Covid, amounting to Rs 14,092 crore. Insurers have settled 796,247 claims, amounting to Rs 7,418.62 crore, thereby settling almost 85 per cent of the claims reported. But there is a disconnect between the amount claimed and the amount settled by insurers. The average Covid claim received by insurers is around Rs 1.5 lakh, but the average claim settled is Rs 93,170.

“We are seeing region-wise rise in Covid claims. Areas seeing a surge in Covid infections are seeing a rise in claims. This trend will continue,” said Sanjay Datta, chief-underwriting, reinsurance & claims, ICICI Lombard General Insurance. Bhabatosh Mishra, director, underwriting, products & claims, Max Bupa Health Insurance, said, “We have noted an increase in Covid claims in the past four weeks. But it is nowhere close to the peak levels witnessed between September and December 2020.”

“We are keeping a close eye from an analytics point of view, correlating the rise in cases across India and in specific geographies to the insured population. We do notice a marginally lower rate of admission, compared to the caseload, and lower fatality currently as opposed to last year,” added Mishra. At the end of July 2020, only 81,000 Covid claims were filed with insurers. That number doubled in a month’s time to 160,000 and breached 475,000 by end-October. By mid-November, the figure had surpassed 576,000, reaching 664,488 by early December, amounting to Rs 9,989.89 crore.

Since December, the pace of rise in Covid claims had slowed, in sync with the decline in the number of fresh cases. By end-February this year, the number of claims reported to general and health insurers had breached the 900,000-mark. The extent of the drop in incoming claims was not as enormous as was the case with the number of Covid infections because a large number of claims were coming in the form of reimbursements. Insurers were seeing more reimbursement claims than cashless ones. It was one of the reasons why there was a gap in the number of claims reported and ones settled by insurers so far.

According to the claims data, Maharashtra has the highest number of reported claims, followed by Gujarat, Karnataka, and Tamil Nadu. “There is a resurgence in Covid claims. India is getting close to 25,000 cases in a day. In the first quarter, there were fewer claims for the industry. In the second quarter (Q2), we saw a surge in Covid cashless claims. In the third quarter, there was an unprecedented rise in Covid claims because we not only paid for the treatment that happened during the quarter, but also for the treatment that took place in Q2 through reimbursement claims,” said Dr S Prakash, managing director, Star Health and Allied Insurance.

“In the fourth quarter, we are seeing a continuing increase in our claims outgo as non-Covid claims have also increased. Also, the current impact of the increase in cases may not be fully felt by insurers during this quarter because there is a lag in the claims reported,” added Prakash.