25-03-2021

25-03-2021

LIC Bachat Plus – Positives and Negative / Hidden Factors

Insurance Alertss

Insurance AlertssLIC Bachat Plus – Positives and Negative / Hidden Factors

Recently, LIC has launched Bachat Plus, an insurance plan which is a non-linked, participating life insurance savings plan. LIC launches such schemes to target employees in search of last-minute tax savings. There are a few interesting features in this plan along with several hidden factors that one should know before investing in such plans. What are the Positive Factors in LIC Bachat Plus? Are there any negative or hidden factors in Bachat Plus LIC Plan?

Quick summary about LIC Bachat Plus

You can skip this section if you are already aware of the key features in LIC Bachat Plan. This is a life insurance savings plan which is non-linked and participating.

One can opt for a single premium or limited premium payment of 5 years. One can take this plan online or go offline mode, i.e. visit LIC branch or approach LIC agent.

This plan is available for 180 days only, i.e. 6 months from the date of launch (15-March-2021 + 180 days) This plan is available for 10 years to 25 years tenure.

Minimum age of entry is 18 years and maximum age of entry is between 44 to 70 years depending on the sub option chosen. The minimum sum assured is Rs 1 Lakh and maximum no limit.

Now let us get into Pros and Cons of LIC Bachat Plus Insurance Plan.

LIC Bachat Plus – Positive Factors in this insurance plan

Let us check the positive factors in this insurance plan.

1) Death Benefit

Death benefit is classified as before the commencement of risk and after commencement of risk. Commencement of risk would start immediately if the policy holder is 8 years and above. If the policy holder is < 8 years, it would start as soon as the policy holder attains 8 years or 2 years after policy date, whichever is earlier.

i) Death during first 5 years of policy: In case death happens before commencement of risk, LIC would refund the premiums paid excluding taxes. In case death happens after commencement of risk, LIC would pay the Sum Assured on Death.

ii) Death after 5 years from policy date: In this case, the sum assured on death along with loyalty additions (if any) would be paid to the nominee.

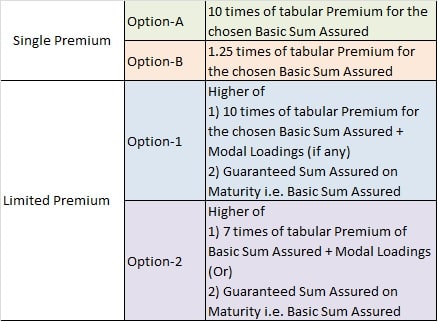

This sum assured on death would depend on whether the policy holder paid a single premium or limited premium payment term as well as the options under it. Below table provides Death Benefit details in LIC Bachat Plus.

2) Maturity Benefit in LIC Bachat Plus

If the policyholder survives till the end of the policy term, they would get the maturity benefit. LIC Bachat Plus Maturity Calculator would be based on Sum Assured on Maturity (equal to the Basic Sum Assured) + Loyalty Additions.

3) Optional Riders in LIC Bachat Plus

LIC offers two optional riders in this insurance plan. One can consider based on their need.

a) LIC’s Accidental Death and Disability Benefit Rider

b) LIC’s New Term Assurance Rider

5) Loyalty addition

This is the important benefit in LIC Bachat Plus. LIC would pay a loyalty addition in this insurance plan which would be from profits / surplus of the company. Here are T&C to pay loyalty addition to the policy holder

i) One would be eligible for Loyalty additions only after 5 years full premiums are paid

ii) Loyalty additions are paid at the end of the policy period based on the surplus / profits for LIC Corporation

iii) LIC Loyalty Addition Rates for FY2020 per Rs 1,000 sum assured are between Rs 1,000 to Rs 1,100 for 20 to 25 years policy term. One can assume that for Rs 1,000 sum assured, Loyalty addition would be Rs 1,000 which his 100% of the sum assured for simple computation.

6) Surrendering this policy

If a policyholder is not happy after taking this policy, they can surrender this policy. Again the T&C would depend on single premium or limited period premium

i) For single premium, one can surrender at any time

ii) For limited premium payment plan, one can surrender after 2 full years premiums are paid

7) Loan Available

This policy provides loans to policyholders if they want to avail in case of any emergency.

i) In single premium, loan can be availed after 3 months from a policy and the eligible amount would be 90% of the surrender value

ii) In case of limited premium payment term plan policy, the eligible amount would be 90% of the surrender value.

iii) In case paid-up policies, it would be 80% of the surrender value.

8) Death Benefit in installments

LIC Bachat Plus provides another good feature in this plan. In case of death of the policy holder, the nominee can avail the death benefit in installments either monthly, quarterly, half year and yearly (Minimum of 5K, 15K, 25K and 50K respectively).

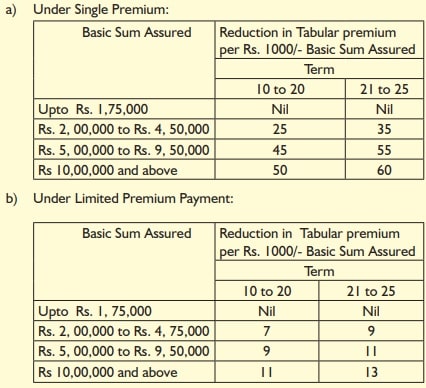

9) High Sum Assured Rebate

LIC provides rebates on high sum assured which would depend on single premium and limited premium payment term and options chosen. Here is the High Sum Assured Rebate on Bachat Plus Plan for these options.

10) Rebate for Online Purchase

This plan is available offline and online. In case of offline, one can approach LIC branch or LIC agent. However, if one wants to sit at home/office and do it on their own, they can go for online mode. LIC offers rebate for online purchases for 2% on single premium and 7% for limited premium payment plans on the tabular premium rates.

11) Income tax exemption u/s 80c

Premiums paid under this plan are eligible for income tax exemption u/s 80c up to Rs 1.5 Lakhs during the financial year.

12) Maturity / Death benefit exemption u/s 10 (10d)

Maturity benefit and death benefits are exempted from income tax u/s 10 (10d).

13) LIC, a trusted brand

LIC is a trusted brand and many believe taking an insurance plan from them would be safe.

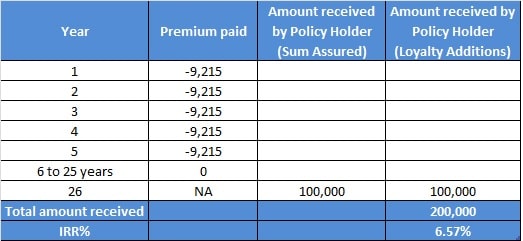

14) LIC Bachat Plus – Maturity Calculator – 6.5% returns

If you are taking this plan, your main objective might be to check how much returns you would be getting. Below illustration would help you to know how much returns you can expect. Assuming 100% loyalty addition (Rs 1,000 Loyalty addition on Rs 1,000 sum assured in 25 years), one can expect 6.5% IRR / returns. These are tax free and beyond the life risk coverage what LIC provides. Here is the illustration / example that shows approx returns.

Negative or Hidden Factors in LIC Bachat Plus

Now, let us look at some of the negative or hidden factors in this plan.

1) Loyalty Additions are not guaranteed

While LIC has paid Loyalty Additions in the past, these are not guaranteed. These rates could even fluctuate. Hence, in the long term of say 25 years, one would not know how LIC Loyalty Addition rates would be. It would be riskier to believe that a corporation would get such surplus / profits and policy holders would get a loyalty addition in the long term of say 20 to 25 years.

2) T&C for Loan

LIC Bachat Plus provides loans to the policy holders, however it comes with several terms and conditions. There are some extreme T&C where if loan repayment EMIs are not delayed, LIC can foreclose the policy.

3) LIC Bachat Plus riders is good but comes with Additional Premiums

This life insurance plan offers riders, however such riders would come with additional premiums. If considered, your returns would be very low.

4) No Bonus

LIC generally offer bonuses in their policies. This insurance plan does not offer any bonuses

5) Suicide < 1 year clause

This policy indicates that in case of suicide of policy holder within 1 year, LIC would refund to nominee only the premiums paid before that period.

Source: Myinvestmentideas.com