25-03-2021

25-03-2021

More takers for ₹1 crore health plans

Insurance Alertss

Insurance AlertssMore takers for ₹1 crore health plans

Driven by spiraling healthcare costs, especially in the wake of covid and new plan launches with higher coverage, the demand for high sum insured health insurance has jump manifold in the past year.

From 2% at the end of 2019, the proportion of policies bought with ₹1 crore sum insured grew to 35% till the end of February, data from Policybazaar showed. Those aged 30-40 had the most share (55%) of high sum insured policies. Of the total health policies sold on Policybazaar, 35% were for a sum insured of ₹5 lakh and 11% for a ₹10 lakh cover.

“Demand for high sum insured plans has been good since their launch in 2019 end. We expect the same demand after the pandemic as well because of rising medical costs. The premiums at which ₹1 crore plans are available have become nominal. You can get a family floater plan at around ₹1,500-3,000 per month," said Amit Chhabra, head-health insurance, Policybazaar.

Policies with ₹1 crore cover that saw traction were from Max Bupa Health Insurance, Care Health Insurance and Aditya Birla Capital Health Insurance.

Analysts said covid has changed the earlier mindset that ₹5-10 lakh cover is sufficient for a family. “Medical inflation is at 8%, which will further add to hospital bills. There can be a situation when more than one family member can get hospitalized the same year. In this case, a low sum insured cover won’t help and you will have to shell out money from your pocket," Chhabra added.

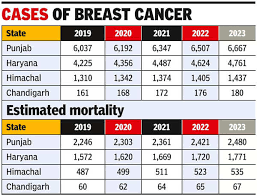

Moreover, critical illnesses are also on the rise. According to a report by the World Health Organization in February 2020, one in 10 Indians will develop cancer and one in 15 will die of the disease. There are an estimated 1.16 million new cancer cases registered each year in India and around 784,800 people die from it each year.

Policybazaar data showed that of all the policies sold, only 13% buyers had pre-existing diseases

Source: Live Mint