31-03-2021

31-03-2021

Health insurance in India: sector overview.

-2021-3-31-36-406.jpg)

Insurance Alertss

Insurance AlertssHealth insurance in India: sector overview.

Health insurance in India: sector overview. In our first health insurance sector report, we analyze long-term trends in healthcare spends and the future scope of health insurance in India. Standalone health players seem best placed to capitalize on the profitable individual health opportunity through aggressive agency distribution, bancassurance arbitrage and focus on product innovation, even as private players try to catch up. It’s still early to forecast claims ratio and profitability, with soaring growth and rapidly evolving trends.

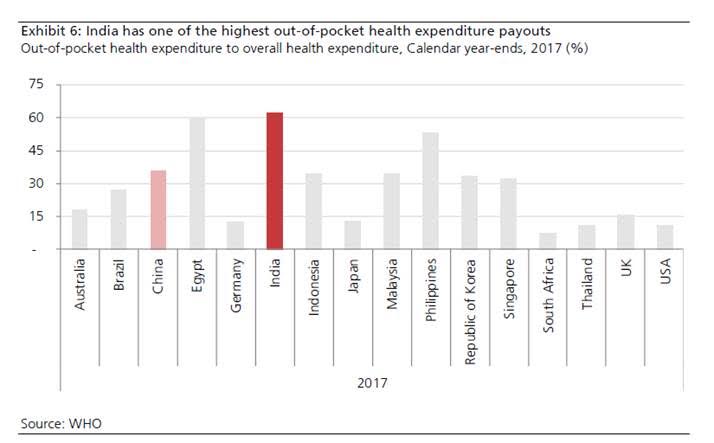

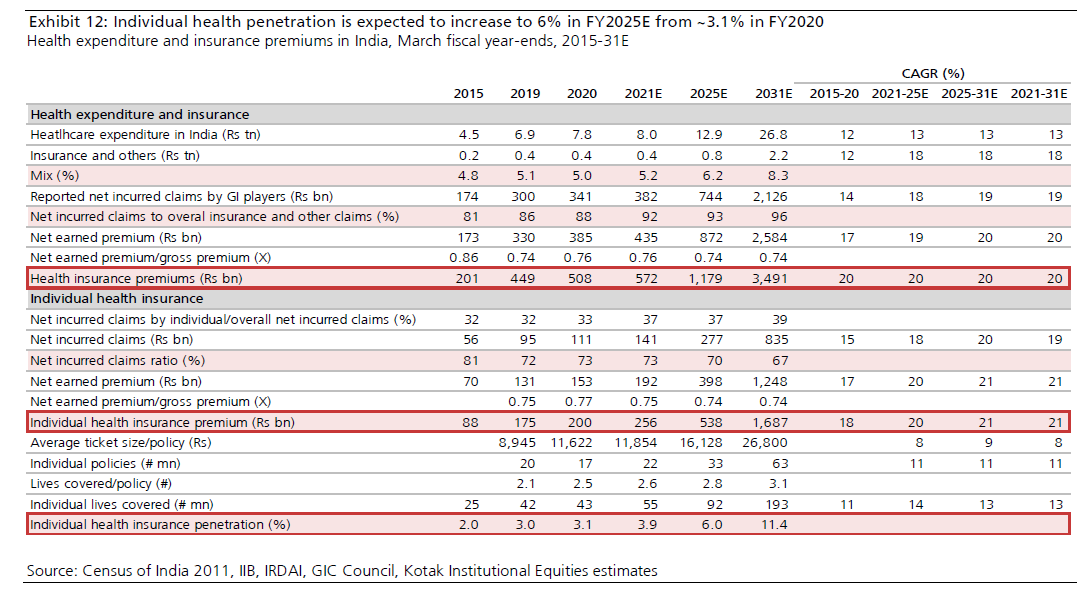

Health insurance: an under-penetrated market segment

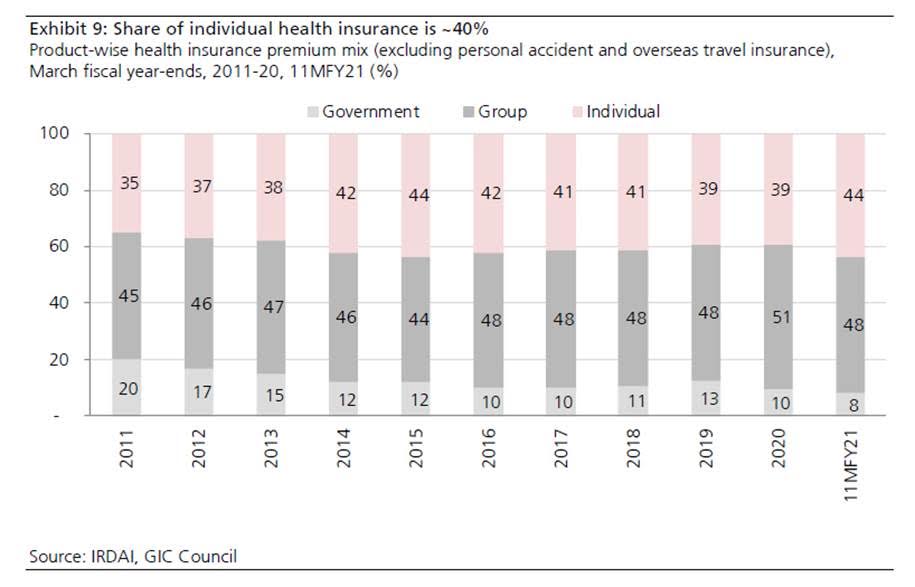

Healthcare expenditure in India increased at a fast clip (12% CAGR) over FY2015-20 to ~Rs8 tn. We expect ~13% CAGR in health expenditure during FY2021-31E aided by increasing urbanization, improving affordability, high medical inflation (around 8-10%), availability of better medical infrastructure coupled with the rise of non-communicable diseases. In India the share of out-of-pocket expenditure to overall healthcare expenditure is higher than that of most countries at >60%. However, we believe the increasing penetration of individual health insurance policies and government financing will likely lower out-of-pocket expenses though it will likely remain high at >50%. Increasing awareness about underinsurance, product diversification and innovation, and strong distribution push by private/standalone health insurance players drives ~21% CAGR in individual health insurance.

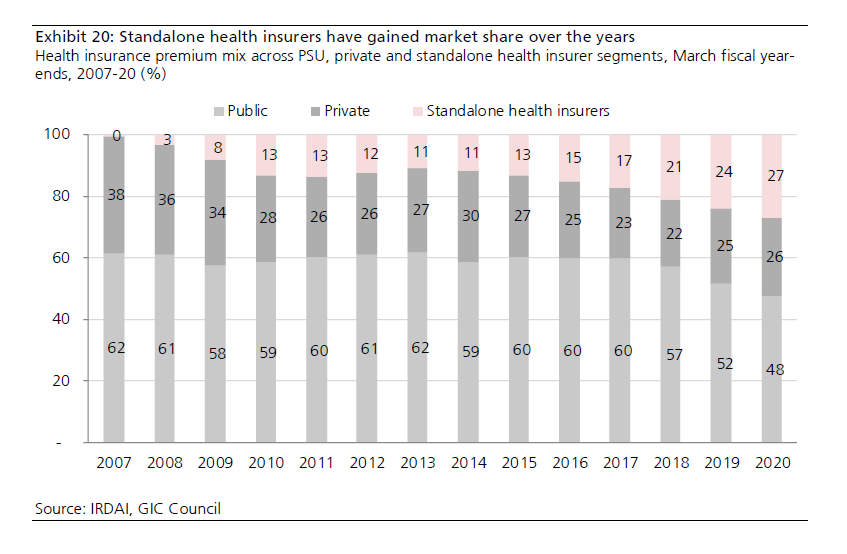

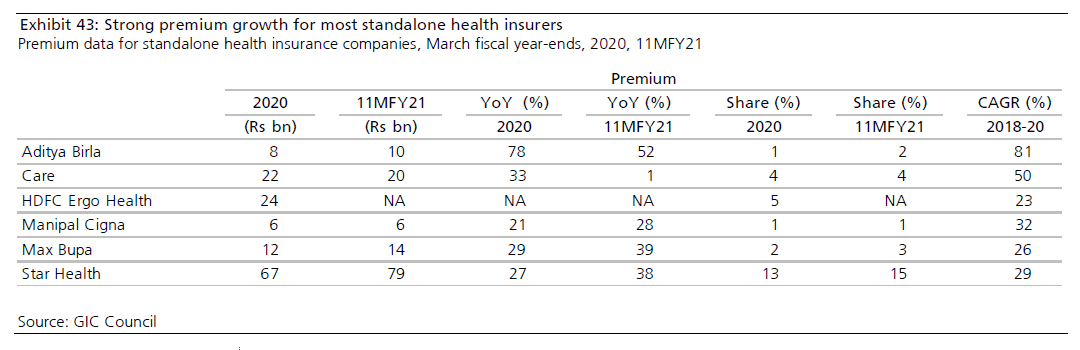

Standalone health insurers gain market share

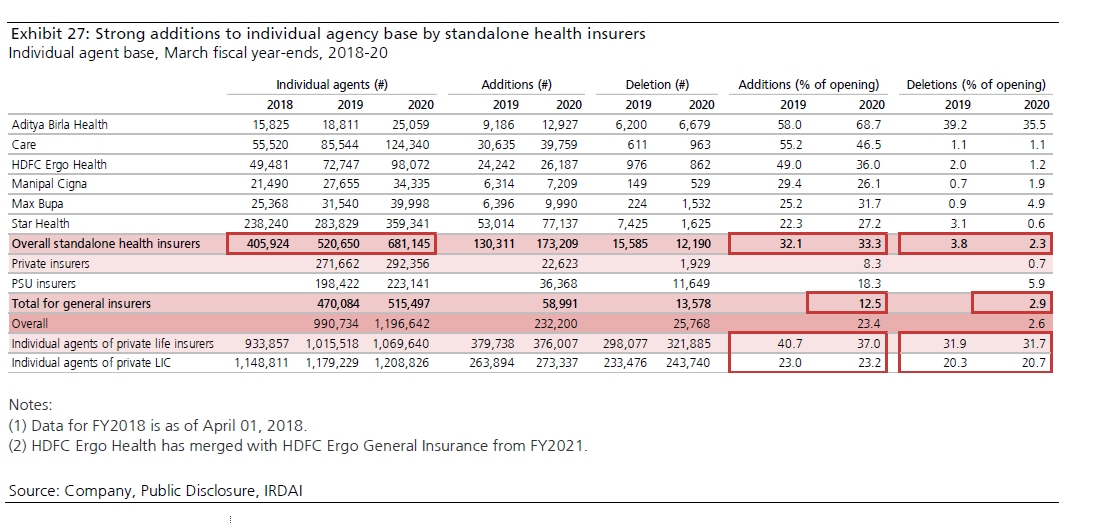

Market share of standalone health insurers in the individual segment increased to 51% in FY2020 from 28% over FY2014-20. This was led by penetration into smaller cities, product innovation, strong addition to the individual agency base (up 30% CAGR over FY2018-20 to >0.6 mn individual agents) and increasing tie-ups with hospitals. Private players gained market share in the group-business segment, however, pricing pressure in this segment resulted in an adverse claim ratio for most players in the large corporate segment.

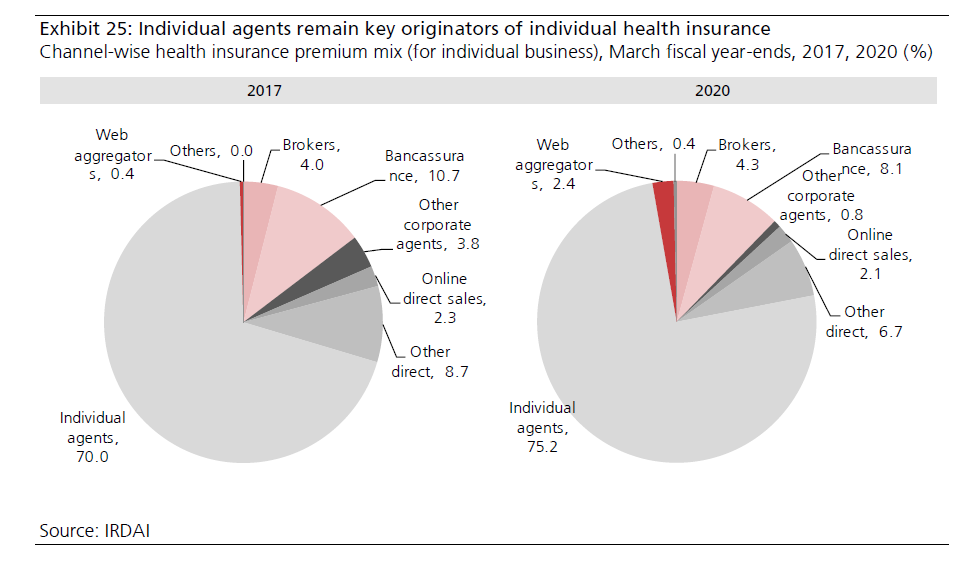

Individual agents dominate distribution mix

Individual agents originate ~75% of overall individual health insurance while the share of bancassurance is low at <10%. The wide range of products, different offerings, features and value added benefits necessitate assisted sales. Bancassurance remains low but presents a huge opportunity as most banks are yet to opt for open architecture. Web-aggregators occupy a small share of 2.4% (FY2020); up from 0.4% in FY2017. However, the ease of comparing products and policies and purchasing them via aggregator portals presents a strong case for the growth of this channel among tech savvy customers. The individual agency channel will likely remain important to drive growth in smaller cities. Most health insurance companies continue to widen their agent network even with commission rates steadily increasing over the past few years; the commission rates for this channel are higher than that of others.

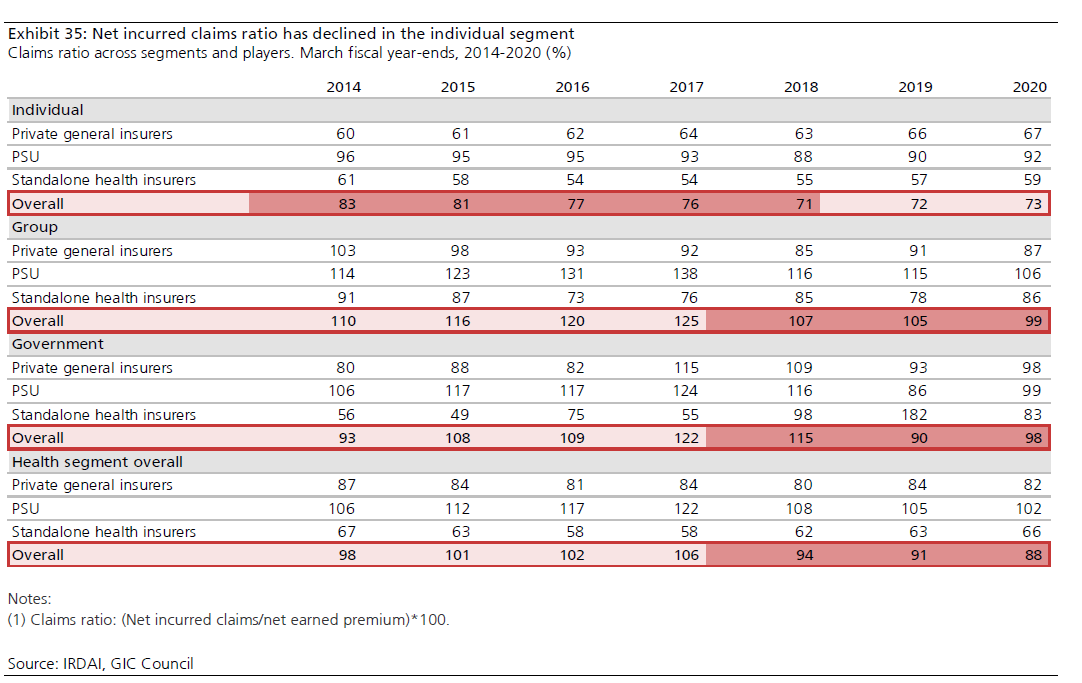

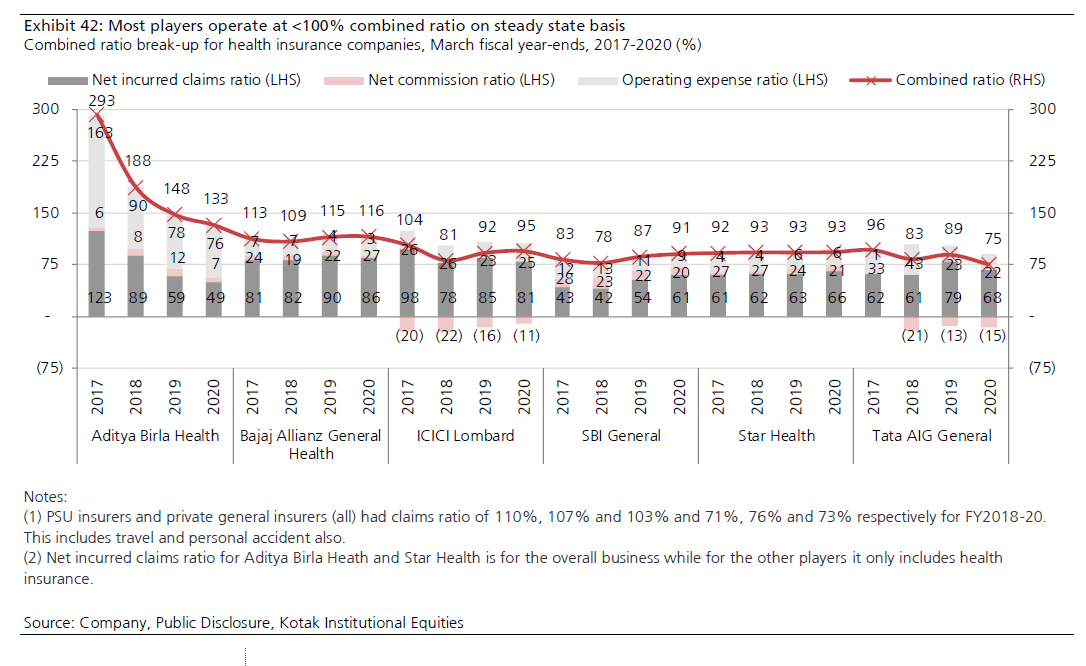

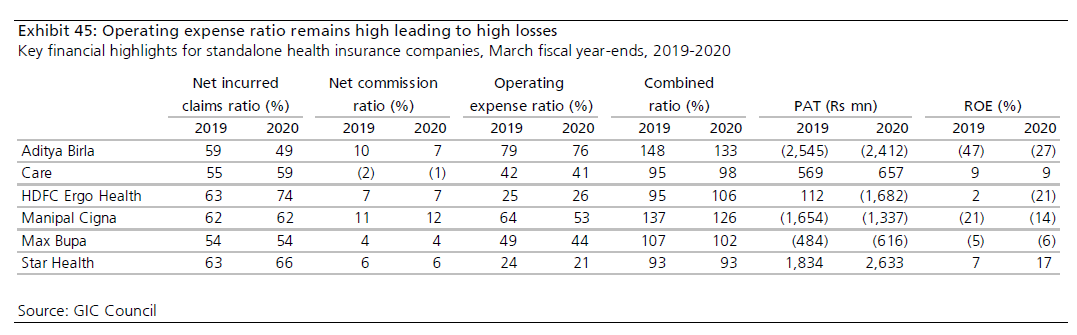

Wide variation in claims ratios; profitability trends yet to evolve

Claims ratio for health insurance segment is around 90% though it differs across players depending on (1) customer type (individual versus group), (2) product type (indemnity, defined benefit, etc.), (3) age profile of target customers, (4) geography, (5) share of renewal premiums in overall gross premiums, (6) channel mix and other factors. Standalone health insurers operate at a low net incurred claims ratio of ~65% likely due to higher individual business followed by private general insurers at ~80%, while the ratio is the highest at ~100% for PSUs. Pricing pressure in larger corporates drives up the claims ratio for group policies (~100%). In the absence of long-tailed products and high float income, maintaining a combined ratio of <100% remains crucial. High operating expense ratio for new-age players dampens the combined ratio but the gradual rise in operating leverage provides support. Sub-scale operations currently drive high losses for most players.

Source:Kotak institutional equities research