01-04-2021

01-04-2021

Standalone health insurers best placed to capitalise on individual medical business: Kotak report

Insurance Alertss

Insurance AlertssStandalone health insurers best placed to capitalise on individual medical business: Kotak report

Standalone health insurance companies are best placed to capitalise on the individual health business, according to a report by Kotak Institutional Equities.

Kotak pointed out that these insurers can play a bigger role in this space through aggressive agency distribution, bancassurance arbitrage and focus on product innovation, even as private players try to catch up.

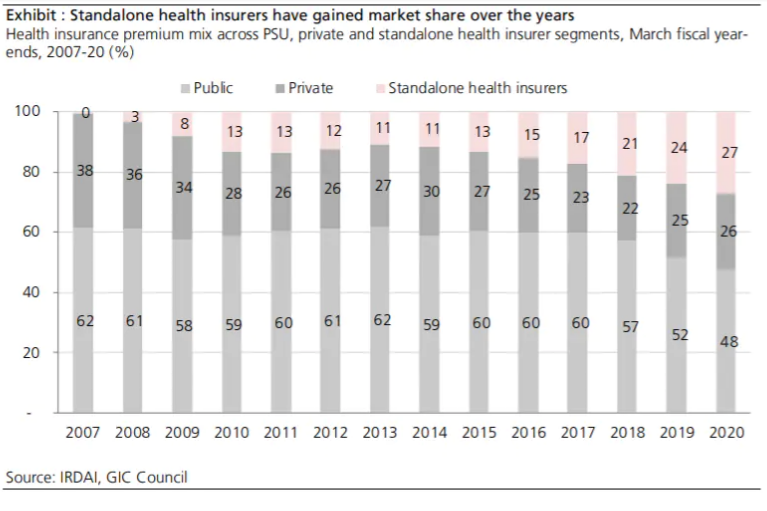

The market share of standalone health insurers in the individual segment increased to 51 percent in FY20 from 28 percent in FY14, as per the report, and with the pandemic continuing it is expected to have grown further in FY21. "Rise in market share was led by penetration into smaller cities, product innovation, strong addition to the individual agency base and increasing tie-ups with hospitals," the report stated.

While private players gained market share in the group-business segment, there was pricing pressure leading to high claims.

Group health is an aggressive segment where insurers offer low prices to retain large corporate clients. The discounts are offered despite any large claims in the previous year.

Out-of-pocket expenses remain high

Out-of-pocket expenses for health are still high, according to Kotak. These expenses refer to the costs incurred for healthcare over and above medical insurance and are caused due to inadequate covers or an absence of health insurance.

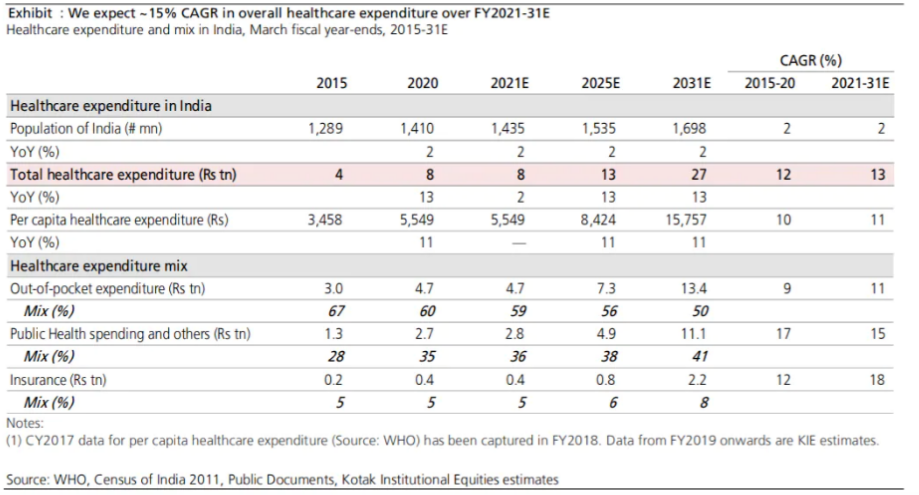

"We peg overall consumer healthcare expenditure at ~Rs 8 lakh crore (excluding medical devices industry, health insurance premiums collected) as of FY20. Our estimates suggest ~12 percent CAGR in healthcare expenditure over FY15 to FY20. A significant portion of this expenditure was funded by out-of-pocket expenses (~60 percent in FY20)," said the report.