06-04-2021

06-04-2021

PFRDA notifies revised pension fund managers charge in NPS. Check details

-2021-4-6-33-361.jpg)

Insurance Alertss

Insurance AlertssPFRDA notifies revised pension fund managers charge in NPS. Check details

The pension regulator has revised the existing Investment Management Fees (IMF) charged by the pension funds in the National Pension System (NPS). The charges have been increased by the Pension Fund Regulatory and Development Authority (PFRDA) from 1 April.

The fees which were 0.01% of the asset have now been increased and capped at 0.09%, depending on the total asset under management (AUM) of the pension fund.

According to the PFRDA circular, "The Investment Management Fees (IMF) to be charged by the Pension Fund will be on the aggregate AUM of the Pension Fund under all schemes managed by Pension Funds. Also, the Pension Fund will continue to load their charges (investment management fees) onto the net asset value on daily basis."

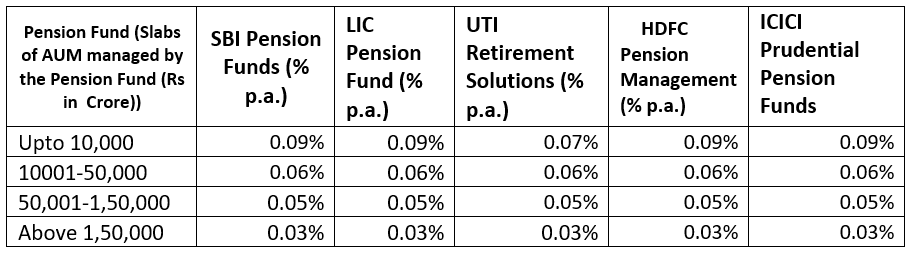

The following slab-wise fee structure is applicable for Pension Funds to whom fresh Certificate of Registration (CoR) have been issued by PFRDA on 30 March.

According to these slabs, for AUMs up to ₹10,000 crore, the maximum charges will be 0.09%. From ₹10,001 to ₹50,000 crore, the fee has been capped at 0.06%; from ₹50,001 to ₹1,50,000 crore at 0.05%, and for AUMs above ₹1,50,000 crore, the charges will be 0.03%.

SBI Pension Funds

For AUMs up to ₹10,000 crore, the charges will be 0.09%. From ₹10,001 to ₹50,000 crore, the fee has been capped at 0.06%; from ₹50,001 to ₹1,50,000 crore at 0.05%, and for AUMs above ₹1,50,000 crore, the charges will be 0.03%.

LIC Pension Funds

For AUMs up to ₹10,000 crore, the charges will be 0.09%. From ₹10,001 to ₹50,000 crore, the fee has been capped at 0.06%; from ₹50,001 to ₹1,50,000 crore at 0.05%, and for AUMs above ₹1,50,000 crore, the charges will be 0.03%.

UTI Retirement Solutions

For AUMs up to ₹10,000 crore, the charges will be 0.07%. From ₹10,001 to ₹50,000 crore, the fee has been capped at 0.06%; from ₹50,001 to ₹1,50,000 crore at 0.05%, and for AUMs above ₹1,50,000 crore, the charges will be 0.03%.

HDFC Pension Management

For AUMs up to ₹10,000 crore, the charges will be 0.09%. From ₹10,001 to ₹50,000 crore, the fee has been capped at 0.06%; from ₹50,001 to ₹1,50,000 crore at 0.05%, and for AUMs above ₹1,50,000 crore, the charges will be 0.03%.

ICICI Prudential Pension Funds

For AUMs up to ₹10,000 crore, the charges will be 0.09%. From ₹10,001 to ₹50,000 crore, the fee has been capped at 0.06%; from ₹50,001 to ₹1,50,000 crore at 0.05%, and for AUMs above ₹1,50,000 crore, the charges will be 0.03%.

Source: Live Mint