14-05-2021

14-05-2021

Two new product structures for title insurance likely: Here're the details

Insurance Alertss

Insurance AlertssTwo new product structures for title insurance likely: Here're the details

A working group of the Insurance Regulatory and Development Authority of India (Irdai), formed to revisit the product structure of “title insurance”, has suggested two new product structures apart from a comprehensive cover for all promoters, allottees, and successors.

The working group, in its report, said, there is a need to expand “title insurance” products to improve the marketability of this specialised category. The product has to be necessarily aligned with the requirements of developers and customised to the needs of individual buyers. These can spur the demand for products in the segment.

Title insurance is a form of indemnity insurance that insures against financial loss from defects in title to real property. Title insurance will defend against a lawsuit attaching the title or reimburse the insured for the actual monetary loss incurred up to the limit prescribed in the policy.

In India, the Real Estate (Regulation and Development) (RERA) Act, 2016, for the first time, gave statutory recognition to the concept of ‘Title Insurance’. The regulator has now asked for inputs from stakeholders on recommendations of the working group by May 31, 2021.

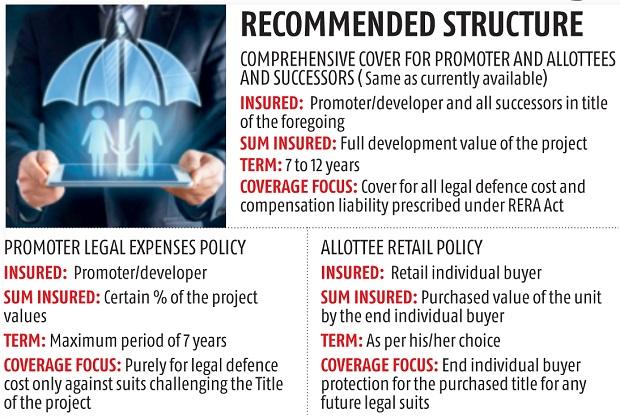

Currently, a comprehensive cover for all promoters, allottees, and successors exists in the market. As far as the two new product structures are concerned, the working group has suggested a legal expense policy for land title owners and developers or promoters. It also suggested a retail policy for allottees, individual customers, and financiers who purchase units in RERA projects.

Promoters or developers can opt for the full comprehensive product which is already available with insurance companies. Or, under the legal expense policy, they can opt for a minimum legal defence cost liability policy such as 10 per cent of project value up to Rs 25 crore sum insured while in process for registration and approval with RERA authorities.

And, retail buyers may buy an “Allottee Retail Policy” at the time of getting handover of the property or giving the last installment or during the registration of title rights of the property. The sum insured for such policies will be the purchased value of the unit by the individual buyer. According to recommendations of the working group, tenure of the product will be in accordance with the individual’s choice.

The working group has also said that increased reinsurance capacity within the country through GIC Re, FRBs, and Lloyd’s will help improve the underwriting capacity of insurers and increase retention in this area.

Source: Business Standard