26-05-2021

26-05-2021

States seek ‘Beed formula’ to cut costs for upcoming kharif season

Insurance Alertss

Insurance AlertssStates seek ‘Beed formula’ to cut costs for upcoming kharif season

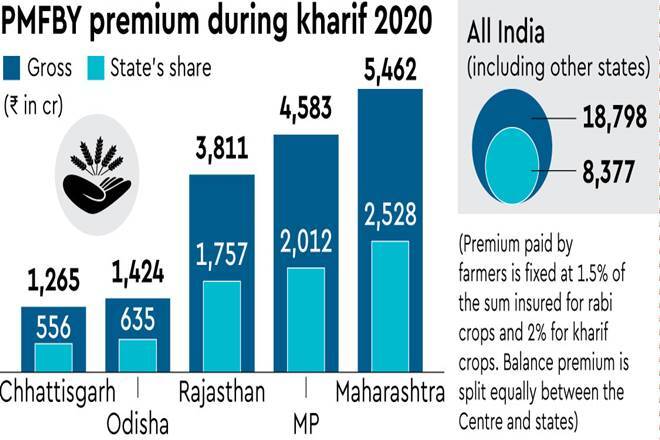

Fiscally-stressed states have over the years turned averse to footing the premium bill for the Pradhan Mantri Fasal Bima Yojana (PMFBY), resulting in insurers not honouring the farmers’ claims on time – as last reported, claims worth over Rs 1,800 crore were yet to be settled. But at least two states – Maharashtra and Rajasthan – have now written to the Centre seeking the ‘Beed district formula’ to run the crop insurance scheme for the upcoming kharif season. The reason: The states reckon that given the normal monsoon predicted for this year, there could be a ‘surplus’ in gross premiums to be collected by insurers and the Beed formula, also called the ’80-110 Plan’, would in such case ensure that premium above a threshold is refunded to the state government.

Under the 80-110 plan, the insurer’s potential losses are circumscribed – the firm won’t have to entertain claims above 110% of the gross premium. The state government has to bear the cost of any claims above 110% of the premium collected to insulate the insurer from losses. The premium surplus (gross premium minus claims) exceeding 20% of gross premium is refunded by insurer to the state government.

Last year, two far-below-normal monsoon rainfalls in central Maharashtra’s Beed district dissuaded insurers from covering farmers in the district under the PMFBY for kharif 2020, and the Centre then asked public sector Agriculture Insurance Company of India (AIC) to oblige. AIC was assured that it won’t have to entertain claims above 110% of the gross premium. It was also told that the state government could bear the cost of any claims above the premium collected to insulate the insurer from losses. The scheme ran successfully.

According to sources, the Centre is not averse to the idea; it has, however, asked the two states to wait as the ’80-110 Plan” needed detailed evaluation and probably Cabinet clearance. “Since it (80-110 Plan) was implemented in Beed district and also in Madhya Pradesh as special cases last year, the outcome has to be analysed on premiums collected by insurer and claims made by farmers,” said a source.

For instance, under the ’80-110 Plan’, in case the claims reach 60% of premium collected, the insurance company will have to refund 20% to the state government and if the claims are 70%, the refund to state will be 10%. In case of claims above 80%, the state will not get any refund. Under PMFBY, premium to be paid by farmers is fixed at 1.5% of the sum insured for rabi crops and 2% for kharif crops, while it is 5% for cash crops. The balance premium is split equally between the Centre and states. Many states have demanded their share of the government-paid premium be capped at 30%, with the balance 70% borne by the Centre.

“Many states are not too eager to run PMFBY due to financial constraints, particularly after the Covid pandemic. Besides, since India Meteorological department (IMD) has predicted a normal monsoon, the states do not expect claims to soar during this kharif season unless there is an unforeseen natural calamity. Chances of crop failure due to less rainfall this year are very low,” said an insurance company official requesting anonymity.

With the view to reduce expenditure on crop insurance, the Maharashtra government has cancelled its 3-year contract with insurance companies approved last year, while Rajasthan is also mulling a similar action, sources said. As many states were complaining about the “ever-increasing premium”, the Centre in February last year had changed the guidelines and allowed them the option of three-year contract with insurers on the premium charged in crop insurance. States also can continue with the existing system of inviting bids for premium every year, as per the guidelines.

The Centre foots the PMFBY subsidy bill to the extent of its formulaic share so long as gross premium level is up to 30% of the sum assured in non-irrigated areas and 25% in irrigated areas. The onus is on the states if they want to implement the scheme even if insurers quote any premium above 25-30%.

Source: Financial Express