09-06-2021

09-06-2021

New business premium of life insurance firms declines 5.5% in May

-2021-6-9-53-447.jpg)

Insurance Alertss

Insurance AlertssNew business premium of life insurance firms declines 5.5% in May

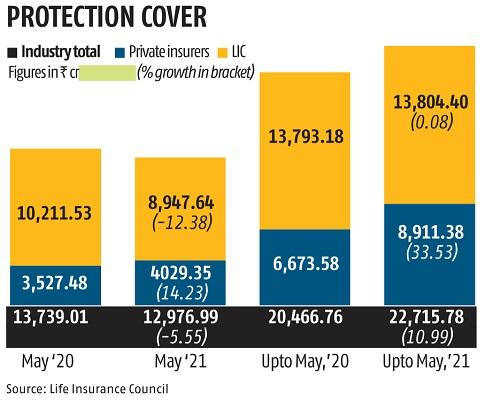

Life insurers have reported a 5.5 per cent decline in new business premium (NBP) in May 2021, compared to the same period last year.

In May, life insurers — 24 in all — amassed NBP worth Rs 12,976.99 crore compared to Rs 13,739 crore in May last year.

The drop in NBP in May comes after a stellar increase of 44.76 per cent in April, albeit due to the low base last year. NBP is the premium acquired from new policies for a particular year.

While the private insurers’ NBP saw a 14 per cent jump in NBP in May, state insurance behemoth — Life Insurance Corporation (LIC) — saw its NBP decline 12.3 per cent on a year-on-year (YoY) basis.

The jump seen by private insurers in their NBP in May 2021, despite lockdown in most parts of the country, could be because of the low base. NBP of 23 private life insurers in May 2021 totalled Rs 4,029.35 crore, as compared to Rs 3,527.48 crore in May 2020, when the entire country was under a strict lockdown to check the spread of the virus. In May 2019, the NBP of private insurers was Rs 4,917.34 crore.

LIC’s NBP, on the other hand, was even lower than what it had amassed last year, during a nationwide lockdown. In May 2021, LIC’s NBP totalled Rs 8,947.64 crore compared to Rs 10,211.53 crore in May 2020. In May 2019, LIC had collected NBP worth Rs 13,496.68 crore.

Among top private life insurers, HDFC Life, Max Life, and Bajaj Life have reported high double-digit YoY growth in NBP in May 2021, while SBI Life saw a marginal YoY rise in NBP, but ICICI Prudential Life Insurance saw its NBP decline 3.92 per cent YoY.

In annualised premium equivalent (APE) terms, private life insurers reported weak individual growth at 5 per cent YoY in May 2021, on a low base of 31 per cent YoY decline in May 2020. APE is the sum of the regular annualized premium from the new business plus 10% of the first single premium in a given period.

So far in FY22, private insurers’ NBP saw a 33.53 per cent YoY growth to Rs 8,911.38 crore, compared to Rs 6,673.58 crore in the same period last year. LIC, on the other hand, saw its NBP rise only 0.08 per cent to Rs 13,804.4 crore. Overall, the industry saw an 11 per cent YoY growth in NBP to Rs 22,715.78 crore.

Source: Business Standard